Payhawk

Founded Year

2018Stage

Series B - II | AliveTotal Raised

$236.5MValuation

$0000Last Raised

$100M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-56 points in the past 30 days

About Payhawk

Payhawk is a spend management platform that operates in the financial technology sector. The company offers a suite of tools for managing corporate expenses, including issuance of corporate cards, automation of expense management, and comprehensive accounts payable software. Payhawk's solutions are designed to provide real-time visibility and control over business spending, streamline financial operations, and integrate with existing ERP and accounting systems. It was founded in 2018 and is based in London, England.

Loading...

Payhawk's Product Videos

ESPs containing Payhawk

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The spend management market enable businesses to efficiently manage and control their expenditures through a suite of integrated software solutions, including virtual corporate cards, expense management systems, procurement software, budget tracking tools, and supplier management platforms. Vendors use APIs and cloud-based platforms to integrate these solutions into existing financial and operatio…

Payhawk named as Outperformer among 15 other companies, including Coupa, Ramp, and Brex.

Payhawk's Products & Differentiators

Payhawk

• Integrated global solution for managing company spending • Corporate bank accounts in multiple currencies with dedicated IBANs • Global company cards • Mobile app for employees • Powerful and flexible software for the finance accounting team • Best-in-class direct integrations with ERP mean no manual data transfer (especially Xero and Oracle NetSuite)

Loading...

Research containing Payhawk

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Payhawk in 13 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

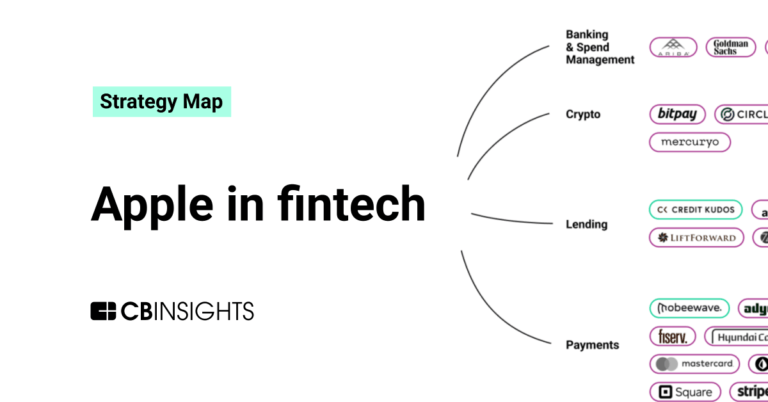

The B2B payments tech market map

Oct 11, 2022

The Transcript from Yardstiq: Klarna vs. Afterpay

Oct 4, 2022

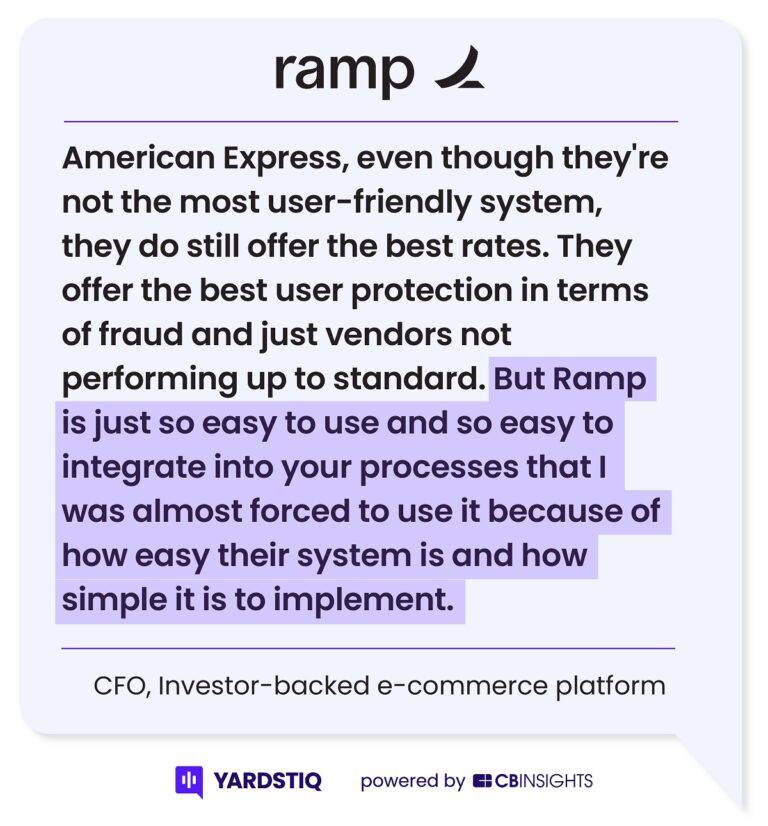

The Transcript from Yardstiq: Ramp vs. BrexExpert Collections containing Payhawk

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

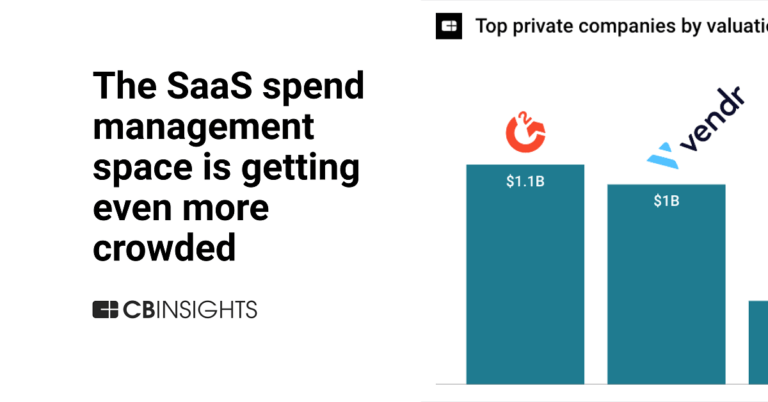

Payhawk is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,249 items

SMB Fintech

1,648 items

Payments

3,034 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,413 items

Excludes US-based companies

Fintech 100

449 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech 100 (2024)

100 items

Latest Payhawk News

Oct 31, 2024

Block's business-focused payments arm, Square, told CNBC it has rolled out it's Square Card product in Britain. It marks the first time Block has expanded its business card offering outside North America, where it first launched in 2019. The firm will come up against local banking giants like Lloyds and NatWest, as well as fintech players including Pleo, Payhawk and Spendesk. Marco Bello | AFP | Getty Images LONDON — Block, the payments company owned by tech billionaire Jack Dorsey has launched its corporate card service in the U.K. in a bid to deepen its expansion into the country and take on big incumbents like American Express . The firm's business-focused payments arm, Square, told CNBC that it opened registrations for its Square Card product in Britain late Wednesday, marking the first time Block has expanded its business card offering outside North America, where it first launched in 2019. Currently available in the U.S. and Canada, Square Card is a free business spending card that reduces the time between merchants making a sale and having funds available to spend. It competes with offerings from the likes of American Express . Samina Hussain-Letch, executive director of Square U.K., said the launch of the firm's corporate card product in the U.K. would give merchants speedier access to funds and help them more easily manage their daily expenses. "When designing this product we went back to our mission of making commerce easy," Hussain-Letch told CNBC. Based on internal research Square found that small and micro businesses "prefer their funds to be consolidated in one place," she said, adding that real-time access to funds was also an important factor. In the U.K., Square Card will come up against local banking giants like Lloyds . It will also heighten competition for some well-funded European fintech players, including Pleo, Payhawk and Spendesk. Hussain-Letch highlighted The Vinyl Guys as an example of an early adopter of its corporate card offering. The vehicle branding and signage printing shop based in Stafford used the corporate card as part of a testing phase with domestic U.K. customers. "We've had some great feedback about the benefits of having instant access to funds which really helps our small business sellers to run and grow, as we know that the number one reason small businesses fail in the UK is due to problems with cash flow," she added. Merchants can personalize employee spending cards with signatures and business branding. Once an employee is onboarded onto the Square Card program, they can begin using within their own digital wallet apps. The service doesn't charge monthly fees, maintenance fees, or foreign exchange fees. Square is deepening its investment in the U.K. at a time when the country is seeking to be viewed as a destination for global technology businesses. On Wednesday, Finance Minister Rachel Reeves hiked Capital Gains Tax (CGT) — a levy on investment profits. But the news offered some relief for technology entrepreneurs who feared a more intense tax raid on the wealthy. The lower capital gains tax rate will be increased to 18% from 10%, while the higher rate will climb to 24% from 20%, Reeves said. The tax hikes are expected to bring in £2.5 billion. Get a weekly round up of the top tech stories from around the world in your inbox every Friday.

Payhawk Frequently Asked Questions (FAQ)

When was Payhawk founded?

Payhawk was founded in 2018.

Where is Payhawk's headquarters?

Payhawk's headquarters is located at WeWork, 1 Waterhouse Square, London.

What is Payhawk's latest funding round?

Payhawk's latest funding round is Series B - II.

How much did Payhawk raise?

Payhawk raised a total of $236.5M.

Who are the investors of Payhawk?

Investors of Payhawk include Earlybird Venture Capital, QED Investors, Greenoaks Capital Management, Lightspeed Venture Partners, HubSpot Ventures and 12 more.

Who are Payhawk's competitors?

Competitors of Payhawk include Airbase, Moss, Jeeves, Pleo, Ramp and 7 more.

What products does Payhawk offer?

Payhawk's products include Payhawk and 4 more.

Who are Payhawk's customers?

Customers of Payhawk include ATU, Luxair, Heroes, Payflow and Gtmhub.

Loading...

Compare Payhawk to Competitors

Pleo operates as a business spend management platform. It provides virtual cards, expenses, automated expense reports for employees, invoices, and more. It serves industries such as retail, healthcare, technology, and more. It was founded in 2015 and is based in Kobenhavn N, Denmark.

Moss is a spend management platform that operates in the financial technology sector. The company provides solutions for corporate credit card issuance, expense management, and accounts payable automation, designed to streamline financial processes and enhance control over company spending. Moss's platform is tailored to the needs of modern SMB finance teams, offering features such as real-time budget tracking, receipt capture, and seamless integrations with accounting software. Moss was formerly known as Vanta. It was founded in 2019 and is based in Berlin, Germany.

Ramp specializes in spend management solutions within the financial technology sector. The company offers a suite of products that include corporate cards, expense management, and accounts payable automation designed to streamline finance operations and improve efficiency for businesses. Ramp's platform also provides features such as automated procurement, vendor management, and working capital solutions, catering to a diverse range of customer needs from startups to large enterprises. It was founded in 2019 and is based in New York, New York.

Spendesk is a spend management platform that offers a comprehensive solution for modern finance teams in various business sectors. The company provides corporate cards, invoice payments, expense reimbursements, budgets, approvals, reporting, compliance, and pre-accounting in one integrated system. Spendesk's platform is designed to give businesses complete visibility and control over their spending, with features such as built-in automation and an easily adopted approval process. It was founded in 2016 and is based in Paris, France.

Soldo provides spend management solutions within the financial services sector. The company offers a platform that connects with financial systems to manage corporate spending through company cards, a mobile app for tracking expenses, and tools for financial compliance. Soldo serves businesses that need to manage their expense processes and gain insights into their spending. Soldo was formerly known as PX Technology. It was founded in 2014 and is based in London, England.

Fyle focuses on intelligent expense management. Its main services include tracking receipts, reporting expenses, managing credit card reconciliation, and providing analytics on company spending. The company primarily sells to sectors such as construction, non-profit, technology, and legal services. It was founded in 2016 and is based in Bengaluru, India.

Loading...