Jeeves

Founded Year

2019Stage

Line of Credit | AliveTotal Raised

$470.66MLast Raised

$75M | 6 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-74 points in the past 30 days

About Jeeves

Jeeves operates a financial platform providing payment and expense management solutions within the financial services industry. The company offers a suite of tools that streamline global finance operations, including multi-currency accounts, corporate card issuance, cross-border payments, and integrated expense management. Jeeves primarily serves businesses looking to manage their financial operations across multiple countries. It was founded in 2019 and is based in Orlando, Florida.

Loading...

Loading...

Research containing Jeeves

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Jeeves in 6 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

Dec 14, 2023

Cross-border payments market map

Dec 8, 2023 report

The top 25 most successful startup accelerators

Oct 26, 2023

The CFO tech stack market map

Expert Collections containing Jeeves

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Jeeves is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,249 items

Payments

3,034 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,304 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

108 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Fintech 100

349 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Latest Jeeves News

Oct 15, 2024

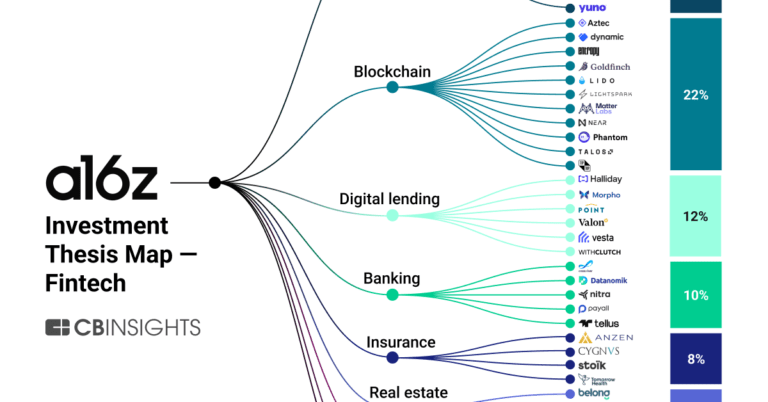

3:00 AM PDT · October 15, 2024 In a typical organization, finance is one of the most important functions. Yet teams are often bogged down by manual workflows. According to a survey by Paylocity, an HR software provider, 38% of finance teams spend more than a fourth of their time on manual jobs, like reviewing invoices. Matthieu Hafemeister, an ex-fintech investor at Andreessen Horowitz, says he’s seen many finance orgs struggle to scale up as a result of all the work they’re doing by hand. “The status quo for finance is countless point solutions that are cobbled together within the finance department,” Hafemeister told TechCrunch. “Excel continues to be the lowest common denominator, limiting the promise of automation.” To Hafemeister’s point, most finance departments are indeed heavily reliant on spreadsheets. One survey found that 82% still use Excel files for budgeting, forecasting, and other core financial planning activities. After experiencing these frustrations firsthand while leading growth at fintech firm Jeeves , Hafemeister decided to team up with Ted Michaels, Jeeves’ previous head of finance and an old friend, to launch a platform to automate financial tasks. Called Concourse , the platform connects to a businesses’ financial systems to let finance teams retrieve and analyze data, generate charts, and ask ad-hoc questions such as “What’s our non-GAAP revenue?” “Concourse can proactively surface insights that allow finance teams to be better prepared by enabling them to stay ahead of trends,” Hafemeister said. “Instead of a tool that tries to improve the speed or efficiency of completing a task, Concourse can be given discrete tasks to do entirely on its own.” Concourse’s back-end dashboard, which shows the status of its various AI integrations and settings to fine-tune them.Image Credits:Concourse Now, finance automation isn’t exactly new technology. Linq recently emerged from stealth with AI to automate aspects of research for financial analysts. Ledge and Doopla are also building a range of finance-specific generative modeling tools. But what makes Concourse different, according to Hafemeister, is its ability to execute financial workflows with “complex, multi-step operations.” For example, the platform can retrieve data from a company’s NetSuite dashboard to download CSV files, then copy that data to an Excel spreadsheet. “We leverage large language models to do what they are best suited for and pair them with more traditional methods of data analysis,” Hafemeister explained. There’s great interest in AI for finance. One poll found that 58% of finance teams are now using some form of AI technology, up 21% from 2023. Grand View Research estimates that the “AI in fintech” segment, worth $9.45 billion three years ago, is growing 16.5% annually. But to stand a chance of making a dent in the market for finance automation tech, Concourse will have to demonstrate its product’s ROI — a challenging feat. Per Gartner, showing or estimating the value of AI is a top barrier to adopting it for close to half of companies. Concourse will also have to assuage potential customers’ fears of AI-introduced errors and hallucinations . In a poll of U.K.-based executives by HR specialist Peninsula, 40% said inaccuracies from AI tools were a key concern, followed by concerns around data confidentiality. Hafemeister said that Concourse employs “a variety of tools and techniques” for fact-checking and validation to try to ensure its AI performs tasks as intended. He added that Concourse doesn’t use companies’ data to train its AI models — at least not without explicit permission — and that the platform only collects data customers share with it. “Data accuracy is paramount in finance, where answers are typically either entirely correct or entirely incorrect,” Hafemeister said. “As such, at Concourse we’ve spent a lot of time and effort on delivering AI that can accurately perform the task it’s been assigned. We also take data privacy and security very seriously, and have built Concourse using industry best practices.” Folks seem willing to be take Hafemeister at his word. Concourse, which is still in beta ahead of a broader launch planned for next year, has several customers, including Instabase and Shef , and $4.7 million in capital. Hafemeister’s ex-employer, a16z, has invested in the startup, along with Y Combinator, CRV, and Box Group. Hafemeister says the focus at the moment is product development and growing New York-based Concourse’s six-person staff. “We raised money to hire more engineers, build out more workflows that our AI can take on, increase coverage on data integrations, and start to scale our go-to-market function,” he said. “The strong focus on engineering recruiting is to hire backend, machine learning, and AI engineers.” Topics

Jeeves Frequently Asked Questions (FAQ)

When was Jeeves founded?

Jeeves was founded in 2019.

Where is Jeeves's headquarters?

Jeeves's headquarters is located at 924 North Magnolia Avenue, Orlando.

What is Jeeves's latest funding round?

Jeeves's latest funding round is Line of Credit.

How much did Jeeves raise?

Jeeves raised a total of $470.66M.

Who are the investors of Jeeves?

Investors of Jeeves include Community Investment Management, Andreessen Horowitz, CRV, Tencent, Clocktower Technology Ventures and 57 more.

Who are Jeeves's competitors?

Competitors of Jeeves include Pluto, Pleo, Ramp, Center, Brex and 7 more.

Loading...

Compare Jeeves to Competitors

Brex is a financial technology company that specializes in AI-powered spend management for businesses. The company offers corporate credit cards, automated expense management, and bill payment software, as well as banking and Treasury services that include high-yield deposits and FDIC-insured accounts. Brex primarily serves startups, mid-size companies, and enterprises and provides them with tools to control and track company spending in real-time. Brex was formerly known as Veyond. It was founded in 2017 and is based in San Francisco, California.

Ramp specializes in spend management solutions within the financial technology sector. The company offers a suite of products that include corporate cards, expense management, and accounts payable automation designed to streamline finance operations and improve efficiency for businesses. Ramp's platform also provides features such as automated procurement, vendor management, and working capital solutions, catering to a diverse range of customer needs from startups to large enterprises. It was founded in 2019 and is based in New York, New York.

Moss is a spend management platform that operates in the financial technology sector. The company provides solutions for corporate credit card issuance, expense management, and accounts payable automation, designed to streamline financial processes and enhance control over company spending. Moss's platform is tailored to the needs of modern SMB finance teams, offering features such as real-time budget tracking, receipt capture, and seamless integrations with accounting software. Moss was formerly known as Vanta. It was founded in 2019 and is based in Berlin, Germany.

Tribal Credit operates as a financial solutions company operating in the business services sector. It provides corporate cards and financial tools designed to manage expenses. Its tools include features for controlling spending, managing international transactions, and handling online advertising and digital subscriptions. It was formerly known as Aingel. The company was founded in 2016 and is based in San Jose, California.

Fyle focuses on intelligent expense management. Its main services include tracking receipts, reporting expenses, managing credit card reconciliation, and providing analytics on company spending. The company primarily sells to sectors such as construction, non-profit, technology, and legal services. It was founded in 2016 and is based in Bengaluru, India.

Pleo operates as a business spend management platform. It provides virtual cards, expenses, automated expense reports for employees, invoices, and more. It serves industries such as retail, healthcare, technology, and more. It was founded in 2015 and is based in Kobenhavn N, Denmark.

Loading...