Instacart

Founded Year

2012Stage

IPO | IPOTotal Raised

$2.861BDate of IPO

9/19/2023Market Cap

11.34BStock Price

44.78Revenue

$0000About Instacart

Instacart is a grocery technology company that operates an online marketplace for grocery delivery and pickup services. The company provides a platform where customers can order groceries, alcohol, and home essentials from various retailers and have them delivered or prepared for curbside pickup by personal shoppers. Instacart's services cater to individual consumers and businesses, offering technology products to fulfill orders and provide digital advertising services. It was founded in 2012 and is based in San Francisco, California.

Loading...

ESPs containing Instacart

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The on-demand grocery delivery market caters to the busy lifestyles of modern consumers looking to purchase groceries without leaving their home. Platforms in this market offer convenience and prompt services, delivering everything customers need within a short timeframe. They bring local sellers online, provide a larger choice of products at competitive prices, and can offer discounts that are ex…

Instacart named as Leader among 15 other companies, including Amazon, DoorDash, and Deliveroo.

Loading...

Research containing Instacart

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Instacart in 22 CB Insights research briefs, most recently on Jan 25, 2024.

Jan 4, 2024 report

State of Venture 2023 Report

Nov 21, 2023

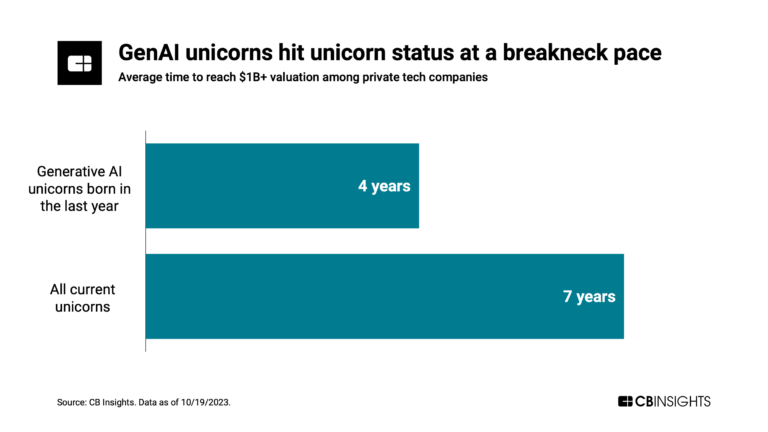

Has the global unicorn club reached its peak?

Nov 20, 2023 report

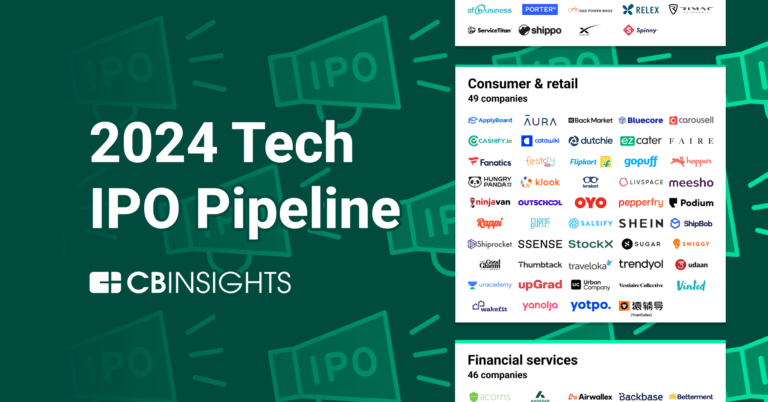

The 2024 Tech IPO Pipeline

Oct 12, 2023 report

State of Venture Q3’23 ReportExpert Collections containing Instacart

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Instacart is included in 7 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

5,634 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Grocery Retail Tech

648 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

On-Demand

1,244 items

Tech IPO Pipeline

568 items

Food & Meal Delivery

1,531 items

Startups and tech companies offering online grocery, food, beverage, and meal delivery services.

Conference Exhibitors

5,302 items

Latest Instacart News

Nov 3, 2024

Maplebear Inc. (NASDAQ:CART) CEO Fidji Simo Sells 20,750 Shares Posted by MarketBeat News on Nov 3rd, 2024 Maplebear Inc. ( NASDAQ:CART – Get Free Report ) CEO Fidji Simo sold 20,750 shares of the company’s stock in a transaction on Tuesday, October 29th. The shares were sold at an average price of $44.39, for a total value of $921,092.50. Following the completion of the transaction, the chief executive officer now directly owns 1,803,278 shares in the company, valued at $80,047,510.42. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this link . Fidji Simo also recently made the following trade(s): Get Maplebear alerts: On Wednesday, August 28th, Fidji Simo sold 33,000 shares of Maplebear stock. The stock was sold at an average price of $35.27, for a total value of $1,163,910.00. Maplebear Trading Up 1.5 % Shares of CART opened at $44.78 on Friday. Maplebear Inc. has a 12 month low of $22.13 and a 12 month high of $45.75. The stock has a fifty day moving average price of $40.04 and a 200-day moving average price of $35.86. The firm has a market cap of $11.68 billion and a PE ratio of -2.26. Want More Great Investing Ideas? Maplebear ( NASDAQ:CART – Get Free Report ) last announced its earnings results on Tuesday, August 6th. The company reported $0.20 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.13 by $0.07. Maplebear had a negative return on equity of 49.98% and a negative net margin of 52.21%. The company had revenue of $823.00 million for the quarter, compared to analyst estimates of $806.35 million. The firm’s quarterly revenue was up 14.9% compared to the same quarter last year. As a group, research analysts forecast that Maplebear Inc. will post 1.17 EPS for the current year. Analyst Upgrades and Downgrades Several research analysts recently commented on the stock. Piper Sandler raised their price target on shares of Maplebear from $47.00 to $50.00 and gave the stock an “overweight” rating in a research note on Wednesday, August 7th. Jefferies Financial Group assumed coverage on shares of Maplebear in a research report on Wednesday, October 16th. They set a “hold” rating and a $43.00 target price on the stock. Raymond James initiated coverage on Maplebear in a report on Tuesday, September 24th. They issued a “market perform” rating for the company. BMO Capital Markets raised their price objective on Maplebear from $36.00 to $39.00 and gave the stock a “market perform” rating in a report on Wednesday, August 7th. Finally, Wolfe Research assumed coverage on Maplebear in a report on Tuesday, July 16th. They issued a “peer perform” rating for the company. Twelve investment analysts have rated the stock with a hold rating and thirteen have issued a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of “Moderate Buy” and a consensus price target of $43.57.

Instacart Frequently Asked Questions (FAQ)

When was Instacart founded?

Instacart was founded in 2012.

Where is Instacart's headquarters?

Instacart's headquarters is located at 50 Beale Street, San Francisco.

What is Instacart's latest funding round?

Instacart's latest funding round is IPO.

How much did Instacart raise?

Instacart raised a total of $2.861B.

Who are the investors of Instacart?

Investors of Instacart include PepsiCo, Sequoia Capital, D1 Capital Partners, Andreessen Horowitz, T. Rowe Price and 32 more.

Who are Instacart's competitors?

Competitors of Instacart include Roadie, Ninja Van, Good Eggs, Gopuff, Thirstie and 7 more.

Loading...

Compare Instacart to Competitors

Shadowfax caters logistics platform that operates in the hyper-local, on-demand delivery sector. The company provides a range of services including delivery, retail deliveries, and e-commerce solutions such as forward and reverse shipments. It primarily serves sectors such as e-commerce, food, pharma, and groceries. It was founded in 2015 and is based in Bengaluru, India.

Roadie provides logistics management and crowdsourced delivery solutions within the logistics and transportation industry. The company offers local same-day delivery, delivery from warehouse with in-house sortation, oversized delivery, and returns services. Its services are utilized in various sectors including electronic commerce, healthcare, and construction supplies. It was founded in 2014 and is based in Atlanta, Georgia. In September 2021, Roadie was acquired by United Parcel Service.

Huolala is an internet logistics platform. It provides same-city and cross-city freight transportation, enterprise logistics services, less-than-truckload (LTL) transportation, car rental and after-sales services, and more. It was formerly known as EasyVan. The company was founded in 2013 and is based in Guangzhou, China.

Ninja Van is a tech-enabled logistics company specializing in e-commerce express logistics. The company offers a suite of solutions for parcel delivery, including digital and full-funnel marketing services to enhance shippers' sales. Ninja Van's network extends to various sectors, including e-commerce and business-to-business inventory restocking. It was founded in 2014 and is based in Singapore.

Rappi operates as a tech company that focuses on digital commerce and delivery services. The company offers a platform for ordering food, supermarket goods, and pharmacy products online, with a delivery service to customers' locations. Rappi partners with restaurants and stores to facilitate their access to a wider customer base through its app. It was founded in 2015 and is based in Mexico City, Mexico.

Gopuff operates an instant commerce delivery platform for foods and beverages. The company also provides an application that allows customers to choose from the products such as alcohol delivery service, over-the-counter medications, groceries, snacks, drinks, and more. It was founded in 2013 and is based in Philadelphia, Pennsylvania.

Loading...