The post Fintech 100: The most promising fintech startups of 2024 appeared first on CB Insights Research.

]]>For companies interested in the future of fintech, these startups — working on everything from deploying novel AI solutions across the landscape to expanding access to financial services — should be on your radar for partnership and investment opportunities.

The list primarily includes early- and mid-stage startups driving innovation across fintech. Our research team picked winning companies based on CB Insights datasets, including deal activity, industry partnerships, team strength, investor strength, employee headcount, and proprietary Commercial Maturity and Mosaic scores. We also dug into Analyst Briefings submitted directly to us by startups.

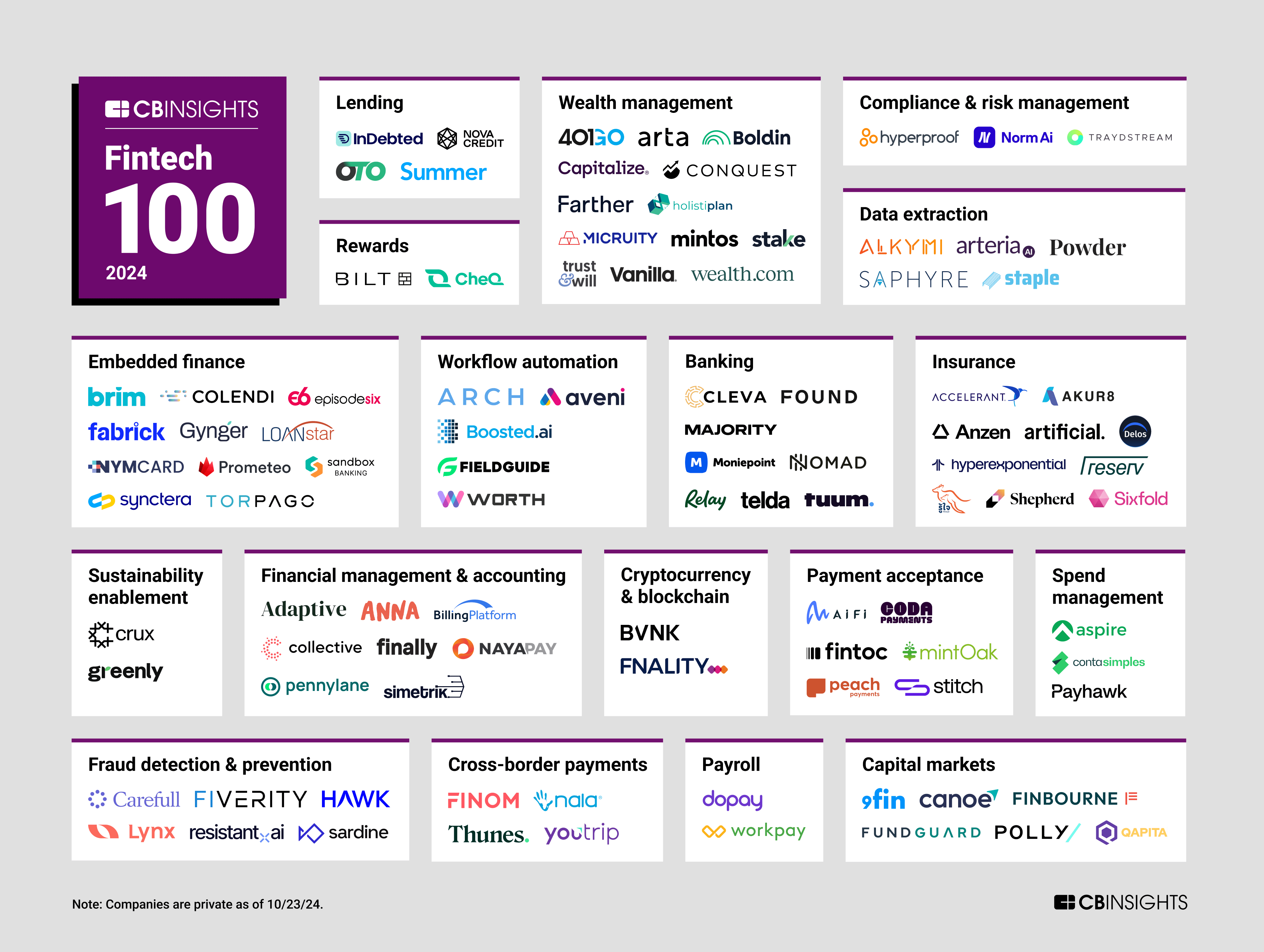

Please click to enlarge.

Here is a summary of the 2024 Fintech 100 cohort highlights:

- The 100 winners include 13 wealth management companies, 11 in embedded finance, and 10 in insurance.

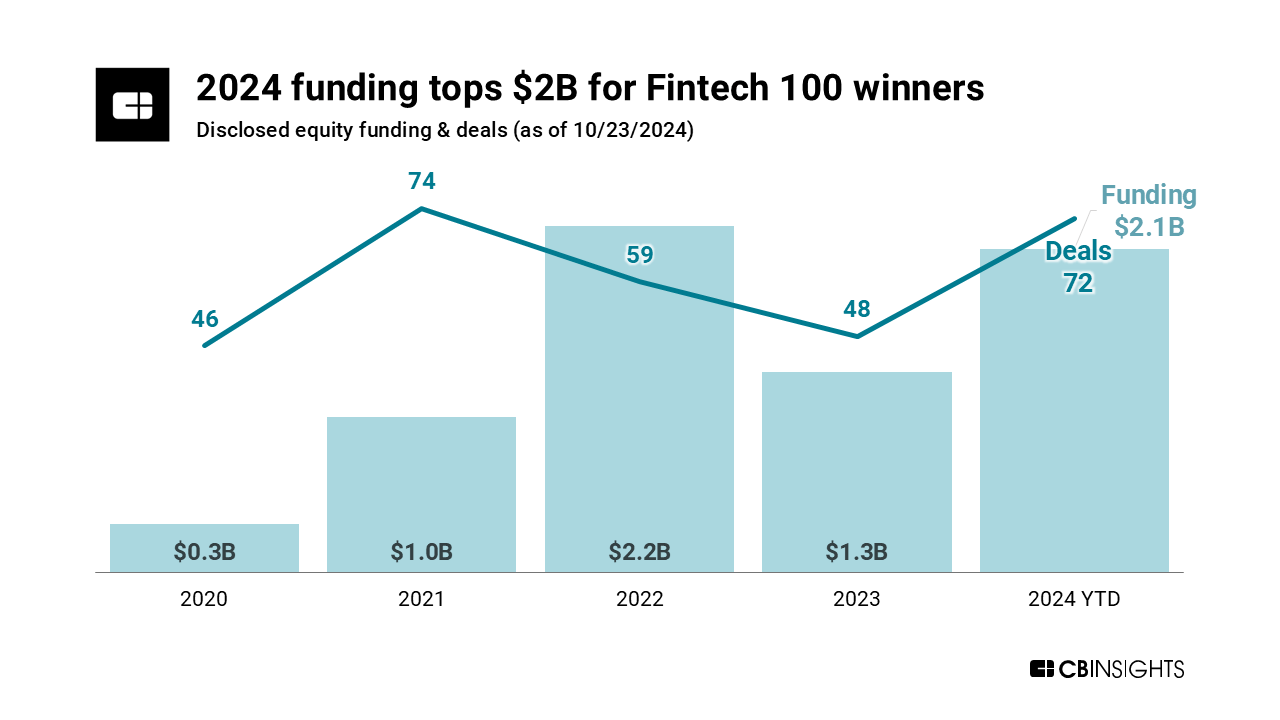

- $7.2B in equity funding raised over time, including more than $2B in 2024 so far (as of 10/23/2024).

- Nearly 50% are early-stage companies (primarily seed/angel or Series A).

- 52 companies from outside the United States, across 23 countries on 6 continents. This includes 17 companies from 11 emerging and developing economies.

- 850+ business relationships since 2022, including with industry leaders like Mastercard, State Street, and Flipkart.

Companies are categorized by their primary focus area and client base. Categories in the market map are not mutually exclusive.

CB Insights customers can interact with the entire Fintech 100 list here and view a detailed category breakdown using the Expert Collection.

2024 FINTECH 100 COHORT HIGHLIGHTS

Funding and valuations

The 2024 Fintech 100 winners have raised $7.2B across 370+ disclosed equity deals to date (as of 10/23/2024).

Gaming payments company Coda Payments and rent rewards company Bilt Rewards lead all winners in disclosed equity funding (with $715M and $560M in funding, respectively).

In 2024 so far, this year’s winners have raised just over $2B across 72 disclosed equity deals.

Three winners have raised mega-rounds ($100M+ deals) in 2024 so far:

- Bilt Rewards — $200M Series C, $150M Series C – II

- Akur8 — $120M Series C

- FundGuard — $100M Series C

Just 5 companies on this year’s list have reached unicorn status (a $1B+ valuation). Amid the broader venture slowdown, just one winner has hit unicorn status in 2024 so far: Pennylane, a France-based financial management and accounting platform for businesses.

Stage breakdown and commercial maturity

Nearly half — 48 — of this year’s Fintech 100 winners are early-stage companies (primarily seed/angel or Series A).

More than 60% of the companies on the list (62) have a CB Insights Commercial Maturity score — which measures a private company’s current ability to compete for customers or serve as a partner — of 4, or Scaling. This indicates they are gaining market traction and growing clients, partners, headcount, and revenue.

Twenty-six winners have a score of 3, or Deploying, which means they have validated ideas and are beginning commercial distribution.

Top investors

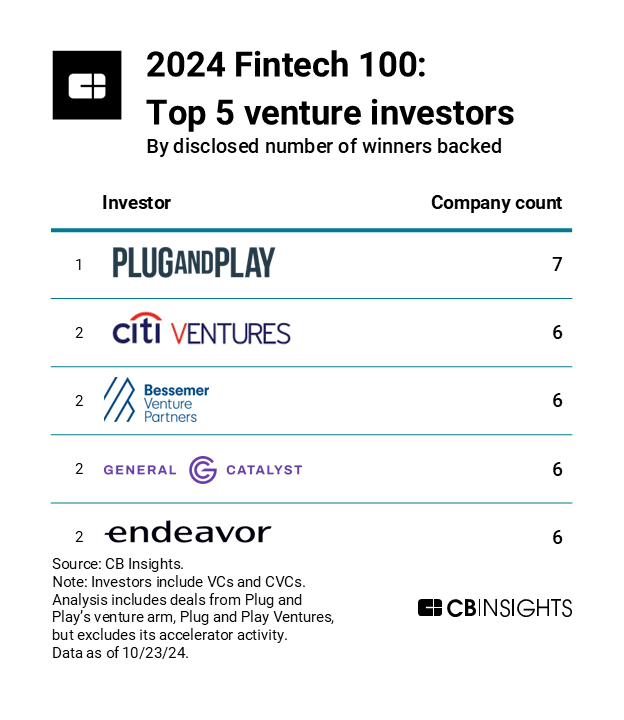

Plug and Play Ventures leads all venture capital (VC) firms, including CVC firms, in the number of winners backed. The 2024 Fintech 100 companies in its portfolio operate across financial management and accounting (Finally), capital markets (FundGuard), payment acceptance (AiFi, Fintoc), banking (Tuum), wealth management (Boldin), and payroll (WorkPay).

Meanwhile, General Catalyst leads in the total number of investments in the 2024 Fintech 100, as it has invested 13 times across 6 companies. It has invested in Bilt Rewards, financial management & accounting firm Collective, alternative credit scoring company Nova Credit, cross-border payments platform Finom, student loan management platform Summer, and AI agent Powder.

Geographic distribution

Just over half (52) of this year’s Fintech 100 winners are based outside of the United States. The United Kingdom leads all non-US countries with 12 winners, and Canada and Singapore are tied for second with 6 companies each.

Seventeen companies on this year’s list come from 11 emerging and developing economies (Brazil, Chile, Colombia, Egypt, India, Kenya, Pakistan, United Arab Emirates, South Africa, Thailand, and Uruguay). Many of these winners are focused on solutions driving financial inclusion and accessibility for groups like small businesses and consumers building their credit.

Headcount growth

This year’s Fintech 100 winners collectively employ more than 18,000 people. Median year-over-year headcount growth is more than 30%.

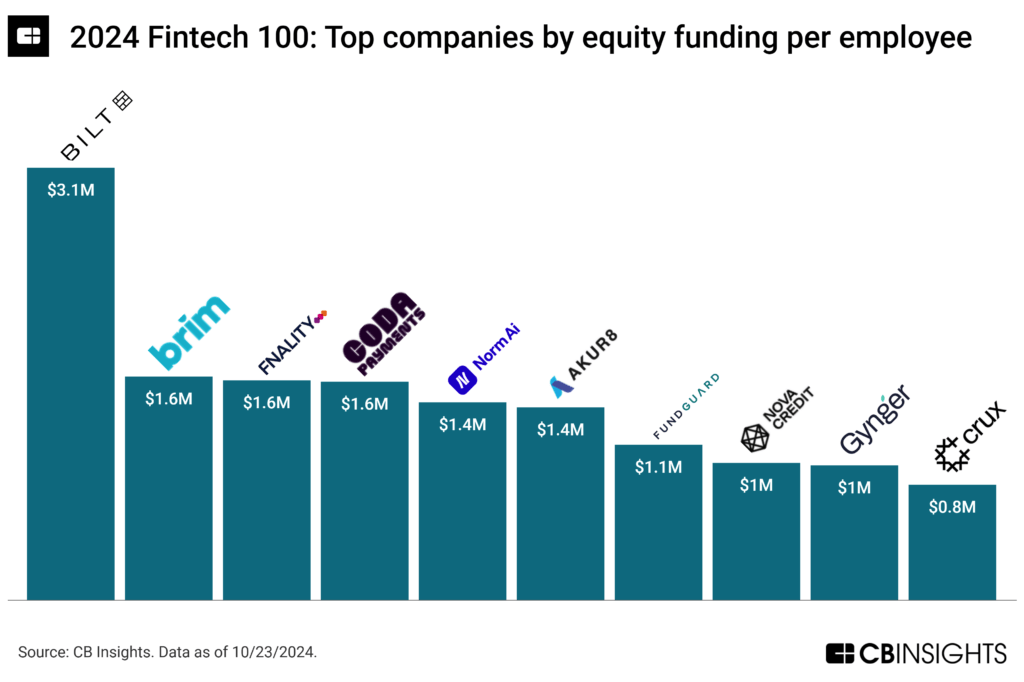

Bilt leads all winners with $3.1M in equity funding per employee. Embedded finance company Brim Financial, blockchain company Fnality, and Coda Payments are tied for second with $1.6M per employee.

Company health

Eighty-three of this year’s winning companies have a CB Insights Mosaic score — a proprietary measure of private company health and growth potential — of at least 700 out of 1,000 (as of 10/23/24). Compared to all private companies — fintechs or otherwise — with Mosaic scores, these 83 winners rank in the top 4% by Mosaic score.

Bilt Rewards leads the cohort with a score of 952. Nova Credit and Arta are tied for second with 883.

Winners deploy AI across a variety of use cases

AI’s dominance in the venture market and broader tech conversations is reflected in this year’s Fintech 100 cohort.

Several winners have developed AI solutions to automate financial services operations. For example, Alkymi and Saphyre are among the handful of companies using AI to analyze and extract data from financial documents.

But winners are also deploying AI within specific financial services sectors, including embedded finance, compliance, and insurance.

For instance, Gynger uses AI and data analytics to quickly approve and underwrite financing. The company is backed by PayPal Ventures and Google’s AI-focused venture arm Gradient Ventures.

Meanwhile, Norm Ai offers AI agents for compliance teams, enabling them to assess content or actions against regulatory requirements. The company raised a $27M Series A round in June 2024 from investors including Bain Capital Ventures and Citi Ventures.

Delos Insurance Solutions, on the other hand, issues property insurance and analyzes satellite data using AI to identify areas with greater wildfire risk. Its founders’ backgrounds in the space industry inform their approach to data gathering via satellite.

Fintechs gear solutions toward financial inclusion and accessibility

Many of this year’s winners are focused on making financial services and technology more accessible to growing customer segments.

Small businesses are a focus worldwide. This year’s list includes solutions like Sequoia Capital– and Founders Fund-backed Found, which offers banking for self-employed people and small business owners. Meanwhile, Pakistan-based NayaPay offers financial management for consumers as well as small businesses. Singapore-based YouTrip also has both B2C and B2B platforms for cross-border payments, focusing its B2B services on small businesses in southeast Asia.

Companies in this year’s cohort are also targeting consumers building their financial profiles and wealth. US-based MAJORITY allows individuals to get banked in the US without social security numbers. OTO, meanwhile, offers loans for electric bike and scooter purchases in India. Banks are hesitant to finance the purchases despite strong government support for the vehicles, so the massive consumer market is turning to fintechs.

Meanwhile, companies like Bilt Rewards and CheQ are helping consumers manage their credit and build toward major purchases in different ways. Bilt converts rent payments into points that can be redeemed toward a down payment on a home, and it can also send renters’ on-time payment reports to credit bureaus.

In India, where credit cards have lower penetration but are growing quickly, CheQ helps consumers pay off all of their credit cards and earn rewards on one digital platform. It aims to support users who are new to the credit system and offers free credit reports and tips on managing credit. The company recently announced a partnership with India’s e-commerce giant Flipkart to enable consumers to earn extra points on purchases during Flipkart’s sale event.

The post Fintech 100: The most promising fintech startups of 2024 appeared first on CB Insights Research.

]]>The post Future Tech Hotshots: 52 emerging tech startups that will have big, successful exits appeared first on CB Insights Research.

]]>The question is certainly top of mind for corporations getting to grips with emerging technology like generative AI — the answer could help identify future competitors, partners, new markets, or acquisition targets.

Using CB Insights’ proprietary data and metrics — including Exit Probability, Commercial Maturity, Mosaic, headcount, patents, and funding — we identified the 52 emerging players our data says are most likely to have an outsized influence in the next 5–10 years and have a strong exit.

Download the report to see:

- The full list of Future Tech Hotshots

- Key themes and industry analysis

- Methodology

MORE TOP COMPANY LISTS FROM CB INSIGHTS:

- Insurtech 50: The most promising insurtech startups of 2024

- AI 100: The most promising artificial intelligence startups of 2024

- The Digital Health 50: The most promising digital health companies of 2023

- Fintech 100: The most promising fintech startups of 2023

The post Future Tech Hotshots: 52 emerging tech startups that will have big, successful exits appeared first on CB Insights Research.

]]>The post Insurtech 50: The most promising insurtech startups of 2024 appeared first on CB Insights Research.

]]>Highlights from the 2024 cohort include:

- The 50 winners include 23 tech vendors and 27 insurers and intermediaries.

- $5.6B in equity funding raised over time, including $1B in 2024 so far (as of 8/19/24).

- Forty percent of winners are early-stage insurtechs addressing everything from wildfire risk to genAI-powered workflow automation.

- More than a dozen countries represented, spanning Asia, Australia, Europe, and North America.

- 500+ business relationships since 2020, including with industry leaders like Swiss Re and Tokio Marine.

Our research team picked winning companies based on CB Insights datasets, including deal activity, industry partnerships, team strength, investor strength, patent activity, employee headcount, and proprietary Commercial Maturity and Mosaic scores. We also dug into Analyst Briefings submitted directly to us by startups.

Please click to enlarge.

CB Insights customers can interact with the entire Insurtech 50 list here and view a detailed category breakdown using the Expert Collection.

2024 INSURTECH 50 COHORT HIGHLIGHTS

Funding and valuations

The cohort has raised $5.6B across 210+ disclosed equity deals to date (as of 8/19/24). Next Insurance and Coalition lead in disclosed equity funding among the cohort ($1.1B and $770M, respectively).

In 2024 so far, this year’s winners have raised $1B across 38 disclosed equity deals. Just 5 deals account for more than half of this funding total:

- Altana AI — $200M Series C

- ICEYE — $93M Series D

- Vitesse — $93M Series C

- Cover Genius — $80M Series E

- Hyperexponential — $73M Series B

Altana AI reached a $1B valuation following its Series C round in July 2024. This earned it a spot in the unicorn club alongside the other unicorns in this year’s Insurtech 50 cohort: Accelerant, Coalition, and Next Insurance.

Stage breakdown

Forty percent of this year’s Insurtech 50 winners are early-stage companies (i.e., primarily seed or Series A). These companies are the fastest-growing among those analyzed, with a median 12-month headcount growth rate of 45% — 23 points higher than the median for the rest of the cohort.

Comparatively, 46% of winners are mid-stage (i.e., Series B or C), and 14% are late-stage (i.e., primarily Series D+).

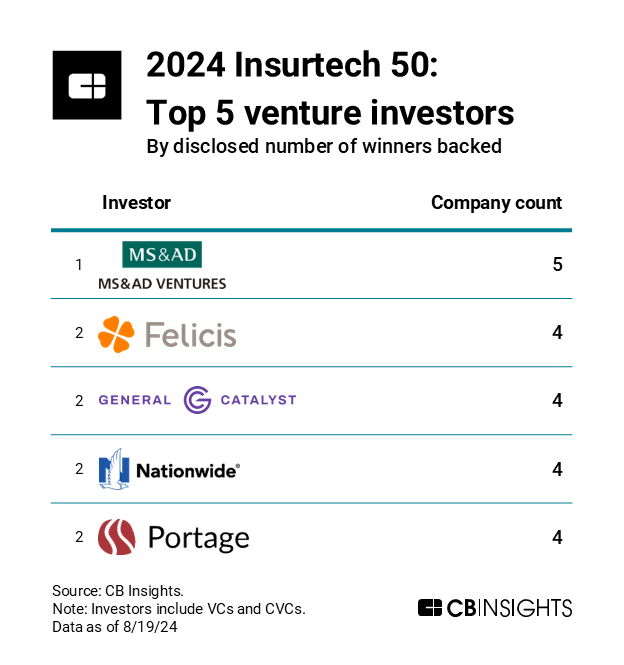

Top investors

MS&AD Ventures has invested in 5 of this year’s winners, leading among venture capital (VC) firms, including corporate venture capital firms. The investor has backed 4 insurance providers — Accelerant, Anzen, Next Insurance, and Wagmo — and 1 tech vendor, Artificial Labs.

Following MS&AD Ventures are Felicis, General Catalyst, Nationwide Ventures, and Portage — each of these investors has backed 4 winners.

When it comes to investment activity in 2024, Portage leads in the number of winners backed. So far this year, it has backed 3 insurance providers: CoverTree, Faye, and Hellas Direct.

Geographic distribution

This year’s Insurtech 50 winners are collectively headquartered across more than a dozen different countries.

The majority of these companies (30) are based in the United States. Among US metro areas, New York and Silicon Valley lead the pack, as they are both home to 10 of the winners. These metro areas are followed by Boston (4 winners) and Atlanta (2 winners).

The UK follows the US with 8 winners — 6 based in London and 2 near Birmingham.

Headcount growth

Over 7,700 people are employed by the 2024 Insurtech 50 winners, with 4 companies employing about a third of the cohort’s workers: Next Insurance, Coalition, ICEYE, and Cover Genius.

From July 2023 to July 2024, this year’s winners created more than 1,400 jobs. One winner more than tripled its headcount over the period: Sixfold (+267% YoY).

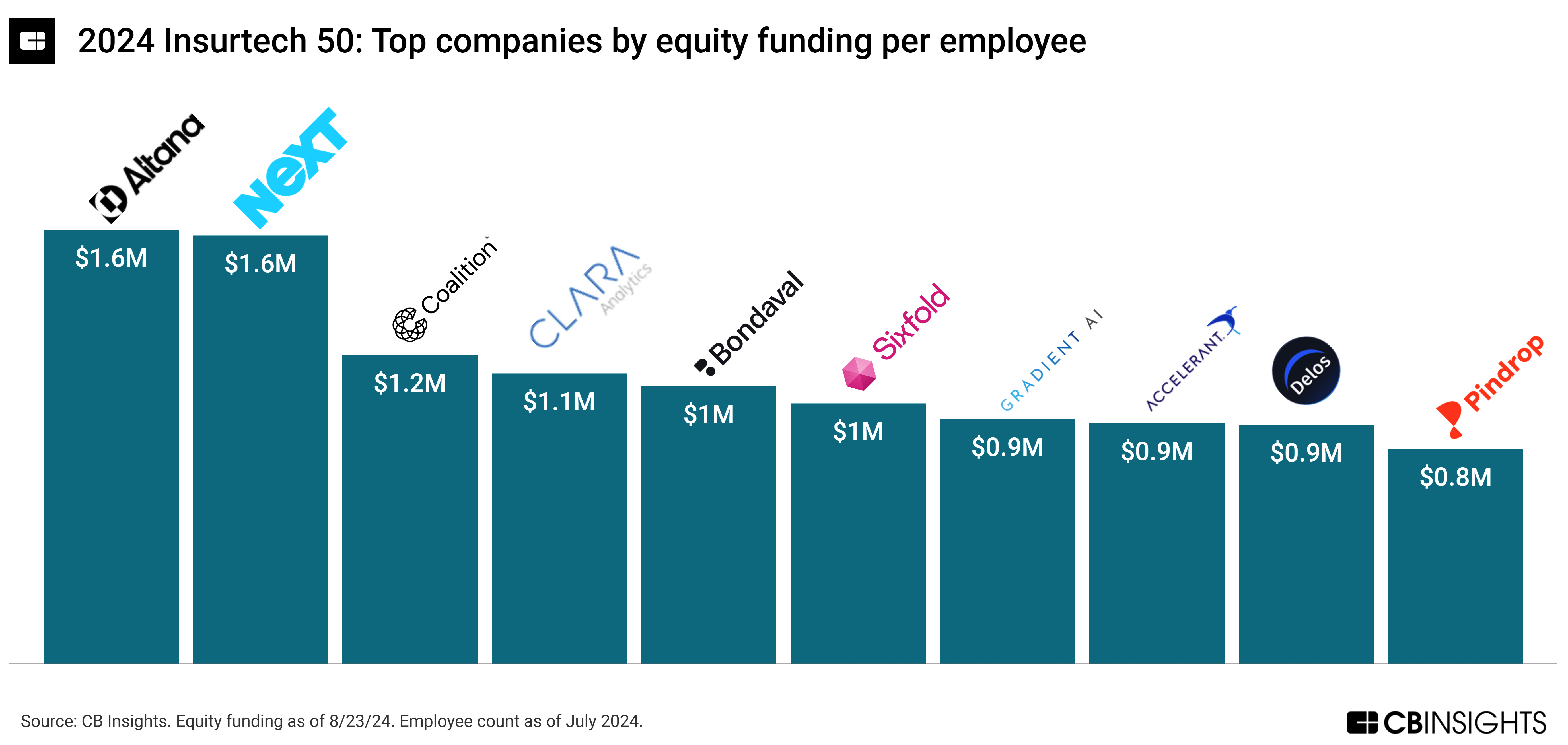

The median 2024 Insurtech 50 winner has raised $0.6M in equity funding per employee. Altana AI and Next Insurance lead among the winners, each having raised $1.6M in equity funding per employee.

Company health

Forty-one of the 50 winners have a CB Insights Mosaic score — a proprietary measure of private company health and growth potential — of at least 700 out of 1,000 (as of 8/26/24). Compared to all private companies — insurtechs or otherwise — with Mosaic scores, these 41 winners rank in the top 3% by Mosaic score.

Next Insurance and Coalition — with Mosaic scores of 898 and 881, respectively — hold the highest scores among this year’s winners.

AI threads the tech vendor landscape

Most of the winning tech vendors offer AI products, which aligns with the broader momentum toward AI (and generative AI) adoption across the insurance industry. Applications often center on prioritization use cases, like risk ranking for underwriters and claims triage for adjusters.

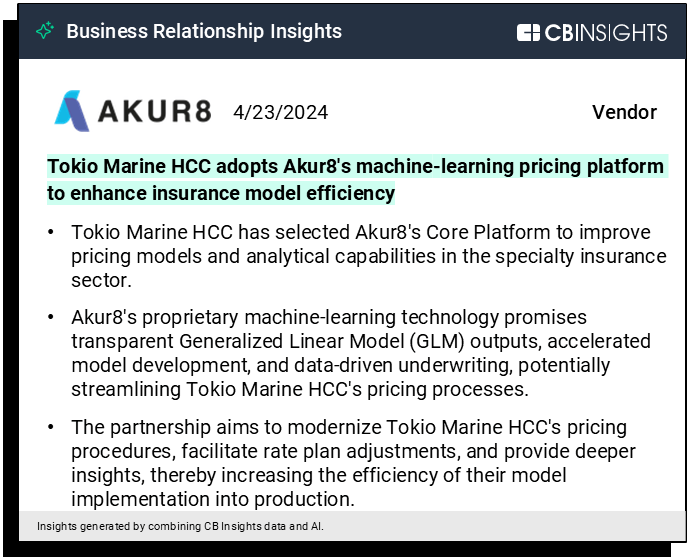

The winners’ business relationships often incorporate the use of AI. Recent examples with industry figures include:

- Reask and AXA Climate — March 2024

- Akur8 and Tokio Marine HCC — April 2024

- Indico Data and Convex — June 2024

Insurtech managing general agents (MGAs) gain ground

MGAs — intermediaries with delegated underwriting authority from one or more insurance carriers as well as related entities like managing general underwriters — represent a sizable portion of the 2024 Insurtech 50 list. Their presence reflects broader industry momentum toward the business model.

Notably, most insurtechs within the commercial category are MGAs that offer property & casualty insurance to businesses. Established insurers have made strategic investments in several of these companies, including:

- American Family Insurance, which led Ledgebrook’s $24M Series A round in April 2024 via its CVC (American Family Ventures)

- Arch Capital Group, which participated in Rainbow’s $12M seed round in January 2024

- Hiscox, which led Coterie Insurance’s Series B round in March 2024

The post Insurtech 50: The most promising insurtech startups of 2024 appeared first on CB Insights Research.

]]>The post AI 100: The most promising artificial intelligence startups of 2024 appeared first on CB Insights Research.

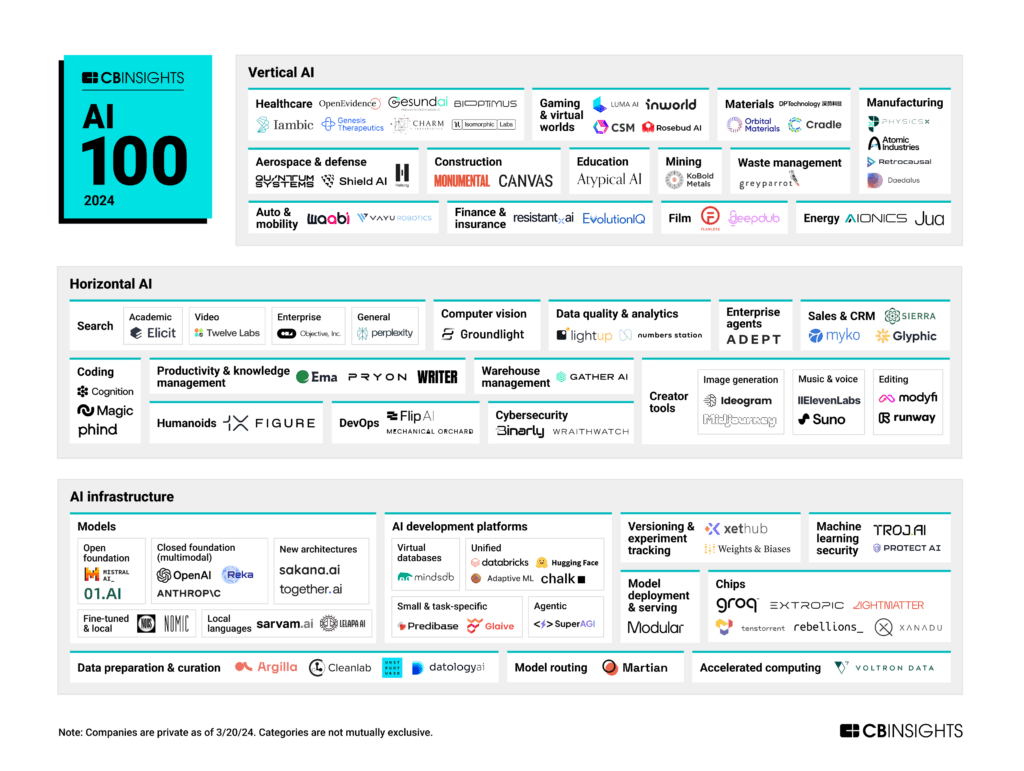

]]>Highlights from the 2024 cohort include:

- 16 countries represented, from the US to France to South Africa

- 30+ categories of solutions, from foundation models to humanoids

- 68% early-stage startups building virtual worlds, autonomous factories, language models for under-represented languages, and more

- 600+ business relationships since 2016 with industry leaders like Toyota, Netflix, and the World Bank

Our research team picked winning companies based on CB Insights datasets including deal activity, industry partnerships, team strength, investor strength, patent activity, and proprietary Mosaic Scores. We also analyzed CB Insights’ exclusive interviews with software buyers and dug into Analyst Briefings submitted directly to us by startups.

Please click to enlarge.

CB Insights customers can interact with the entire AI 100 list here and view a detailed category breakdown using the Expert Collection.

2024 AI 100 COHORT HIGHLIGHTS

Funding distribution

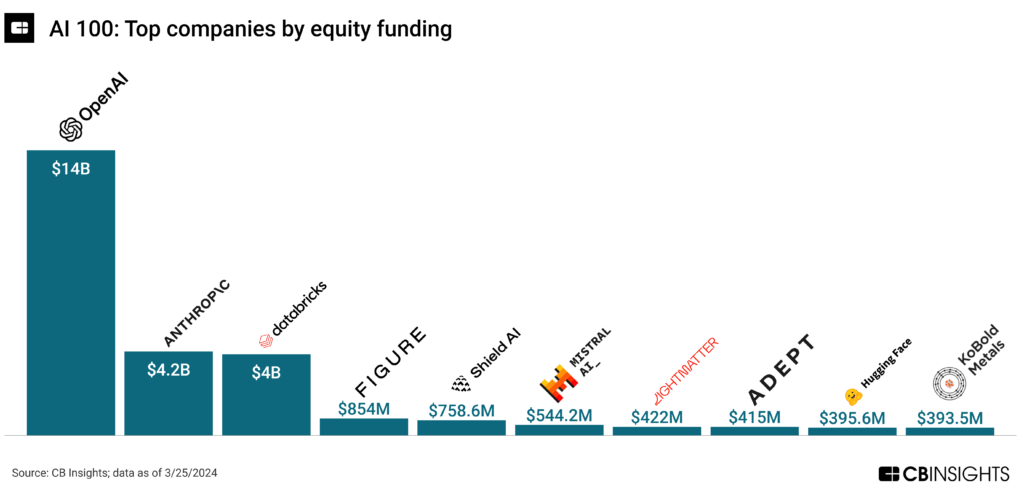

The cohort has raised over $28B across 240+ equity deals since 2020 (as of 3/22/24). OpenAI has raised over 40% of that total, with $12B. Meanwhile, 25% of the winning companies have raised less than $10M, with some not having raised any venture funding.

Just over two-thirds (68%) of winning companies are in the early stages of fundraising (seed/angel and Series A) or have yet to raise outside equity.

Valuation trends

This year’s list includes 19 unicorns with a $1B+ valuation.

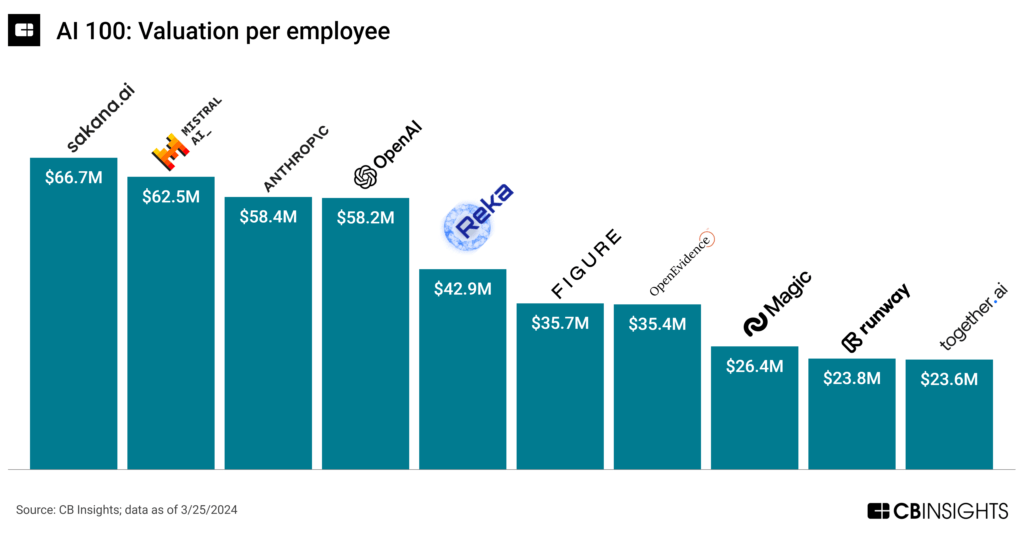

Meanwhile, Sakana AI — founded by one of the authors of the seminal Google research paper on Transformers — has the highest valuation per employee, at $67M. (It had just 3 employees when it earned its $200M valuation in early 2024.) Sakana is working on new “nature-inspired” AI architectures and recently released 3 Japanese-language models.

Revenue generation

The AI 100 includes a mix of companies at different stages of maturity, product development, and revenue.

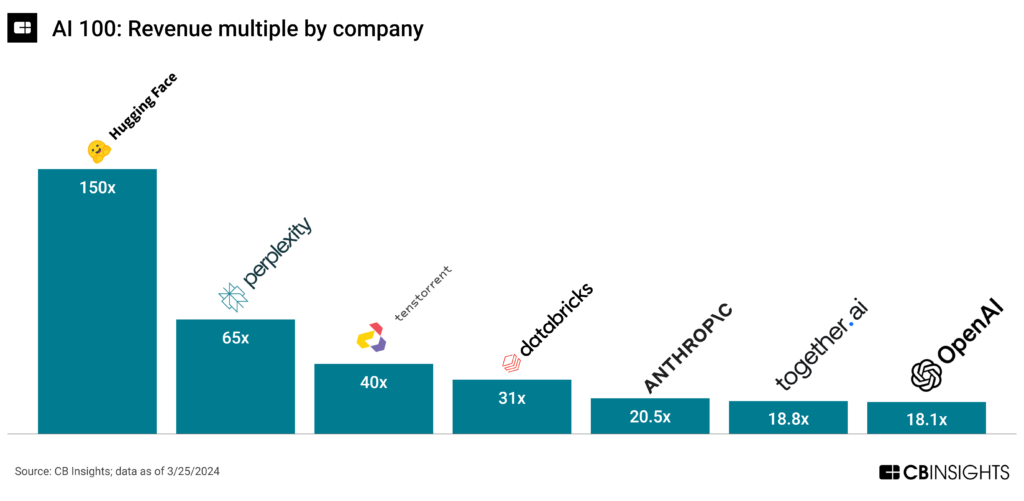

Hugging Face, an AI infrastructure platform focused on open-source development, has one of the highest revenue multiples at 150x ($30M in 2023 revenue at a $4.5B valuation). It’s followed by Perplexity, which is developing an alternative to traditional search engines, at 65x (based on a 2023 valuation of $520M and $8M in 2024 ARR).

Midjourney, an image generation platform that has not raised any outside equity, is one of the leading AI 100 winners by revenue with $200M in ARR.

Global reach

A total of 31 winning companies in this year’s cohort are headquartered outside the United States, across 15 other countries. This includes South Africa-based Lelapa AI — which is developing language processing tools for sub-Saharan African languages like Afrikaans, isiZulu, and Sesotho — and Canada-based Ideogram, which is tackling the problem of generating images with legible text.

Europe-based startups account for 19% of the list, including companies headquartered in the United Kingdom, France, and Germany.

Categories & applications

Over one-third of this year’s winners are focused on building core AI infrastructure, from foundation models to AI chips to AI development platforms.

A total of 30 vendors are focused on horizontal (i.e., cross-industry) solutions like coding automation, creator tools, and search, while 34 companies are specializing in verticals like gaming, healthcare, education, and manufacturing.

A handful of winners are building niche applications where the use of AI is not yet commonplace. These include:

- Atomic Industries, which is developing AI for tool and die making in manufacturing and is backed by the venture arms of Porsche, Yamaha, and Toyota

- Rosebud AI, a text-to-game generation startup backed by OpenAI co-founders Ilya Sutskever and Andrej Karpathy, as well as Khosla Ventures

- Flawless AI, a startup developing lip-synced video dubbing for the film industry

CB Insights customers can get real-time updates on the AI 100 winners using this home feed.

The post AI 100: The most promising artificial intelligence startups of 2024 appeared first on CB Insights Research.

]]>The post The Digital Health 50: The most promising digital health companies of 2023 appeared first on CB Insights Research.

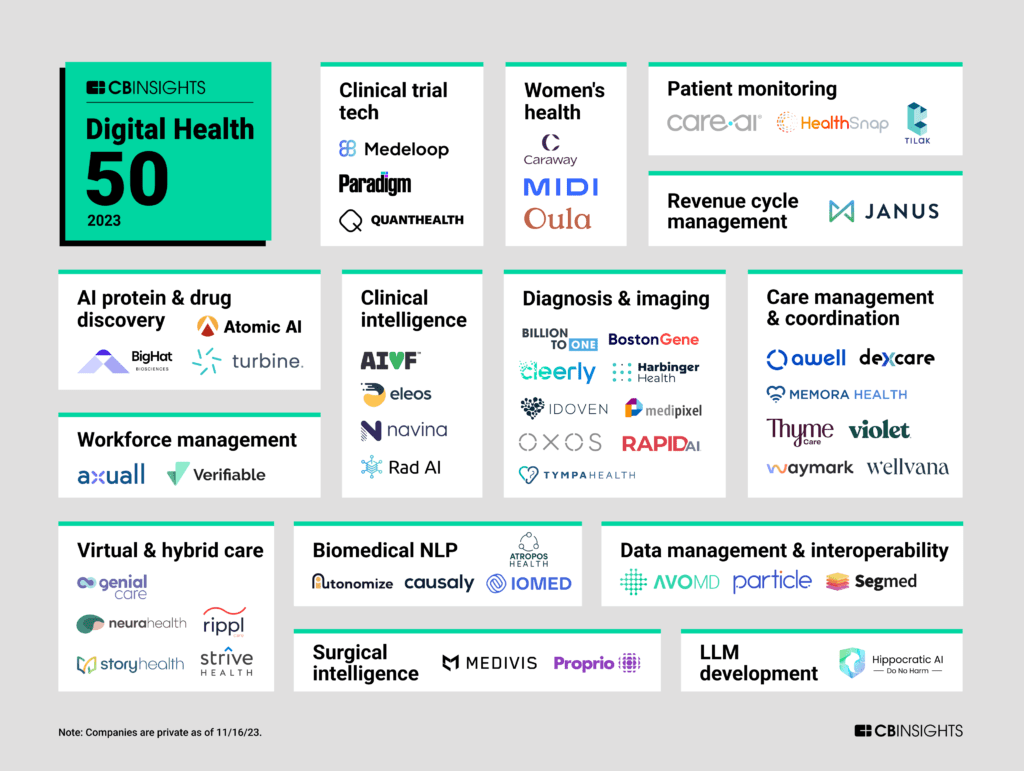

]]>Companies on this list are building tools for clinicians, healthcare organizations, payers, and life sciences companies. Some are building the next generation of drug discovery platforms or re-envisioning how clinical trials are prepared, run, and accessed. Others are focused on tools for transforming surgery and helping patients prepare for procedures. Many are developing new ways to analyze data from monitoring devices or imaging, using AI to make quicker diagnoses and to help clinicians determine the right treatment for each patient.

The 50 winners were selected from a pool of over 10K companies, including applicants and nominees. They were chosen based on several factors, including CB Insights datasets — covering R&D activity, Mosaic scores, business relationships, software buyer transcripts, investor profiles, news sentiment analysis, competitive landscape, and team strength — along with criteria such as tech novelty, market potential, and impact on the industry.

CB Insights customers can access the entire Digital Health 50 list and interactive Expert Collection here.

If you are not already a CB Insights customer, sign up for a free trial to analyze each winner’s funding and valuation history, headcount growth, key competitors, and more.

Want to be considered for future rankings? Fill out this initial application form (it’ll take no more than a few minutes). If selected, you’ll be asked to complete our Analyst Briefing Survey so that our analysts can better understand your products, customers, and market traction.

TOP DIGITAL HEALTH COMPANIES 2023: DIGITAL HEALTH 50 HIGHLIGHTS

Overall funding & valuation trends: The Digital Health 50 contains a mix of early- and mid-stage private companies, at different levels of product development and maturity.

Overall, the cohort has raised $3.2B+ in equity funding across 145 deals since 2018 (as of 11/27/23). In 2023 so far, these companies have secured 41 equity deals that collectively amount to nearly $1.5B. This year’s list includes 1 tech unicorn (a private company with a $1B+ valuation).

Early-stage innovation: Thirty-one winners (62%) are in the early fundraising stages (seed/angel or Series A).

While many of our winners from previous years focus on providing care directly to patients, a growing number of early-stage innovators — companies like Atropos Health, Rad AI, and HealthSnap — are producing tools to assist clinicians and healthcare organizations, giving them access to cutting-edge technology like generative AI.

Most represented categories: Among the categories highlighted on the map, diagnosis & imaging holds the largest share of this year’s winning cohort (18%). The 9 companies in this category are focused on the early detection and diagnosis of serious diseases and conditions, potentially enabling quicker interventions and better patient outcomes.

Companies like Harbinger Health and BillionToOne are creating new ways to detect disease through liquid biopsies and other noninvasive testing methods. Others — including Idoven and RapidAI — leverage AI and advanced analytics to improve the accuracy and diagnostic potential of existing imaging and monitoring tools.

Diagnosis & imaging isn’t the only digital health category being transformed by AI — this year’s winning cohort contains 33 companies with AI-augmented solutions.

Global reach: This year’s winners represent 8 countries across the globe. Twenty-two percent are headquartered outside the US, including 3 from the United Kingdom, 2 from Israel, and 2 from Spain. Other countries represented include South Korea, Belgium, France, and Brazil.

Digital Health 50 (2023)

Track the 50 most promising digital health startups to watch in 2023. Look for Digital Health 50 – 2023 in the Collections tab.

THE DIGITAL HEALTH 150 CLASS OF 2022: WHERE ARE THEY NOW?

The Digital Health 150 2022 cohort has posted several accomplishments in 2023 so far (as of 11/27/23), including:

- One new unicorn with a $1B+ valuation.

- $500M+ in new equity funding across 38 deals.

- 2 exits: Hospital IQ was acquired by 2021 DH 150 winner LeanTaaS, and Nuvo Group has announced plans to go public via SPAC.

The post The Digital Health 50: The most promising digital health companies of 2023 appeared first on CB Insights Research.

]]>The post The 345 most promising startups in the world appeared first on CB Insights Research.

]]>Using CB Insights data, we picked these 300+ private startups from a pool of over 1M companies in our database across:

- Fintech

- Artificial intelligence

- Generative AI

- Insurtech

- Retail tech

Download the data file to get the details on each company. They’re early stage to late stage and from around the world.

If you are not already a CB Insights client, sign up for a free trial to analyze each winner’s customer relationships, read buyer impressions of their product, see their headcount growth, and more.

Our analysts will also be unveiling the most promising digital health startups on December 5. Register for the live briefing here.

The post The 345 most promising startups in the world appeared first on CB Insights Research.

]]>The post Fintech 100: The most promising fintech startups of 2023 appeared first on CB Insights Research.

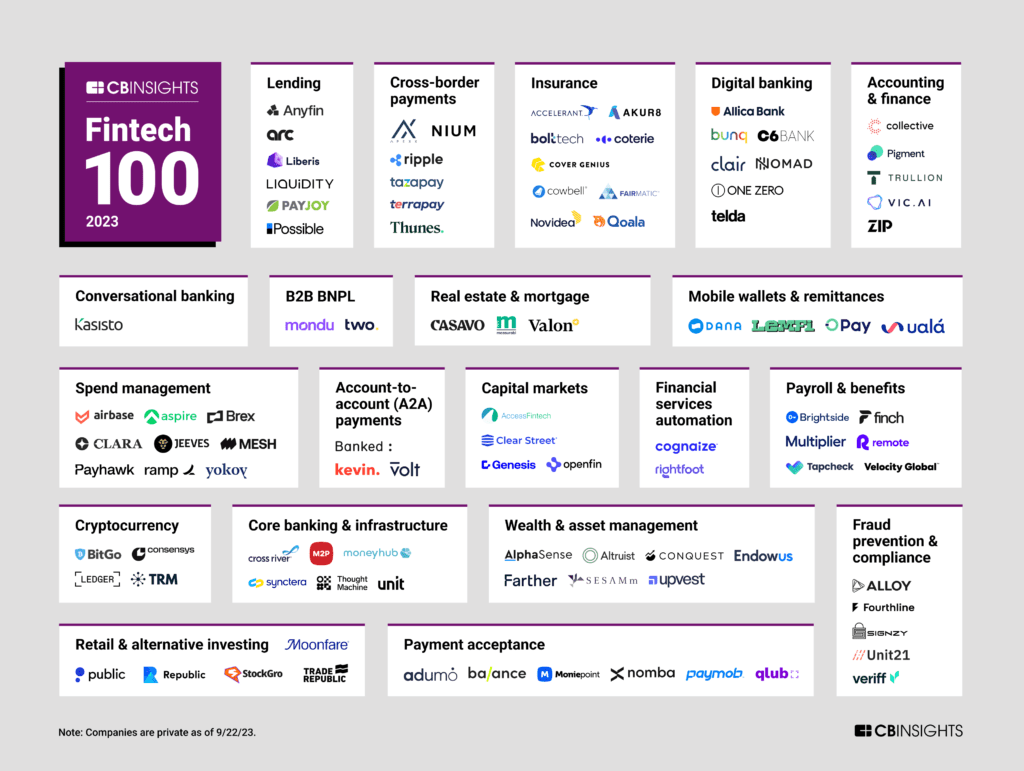

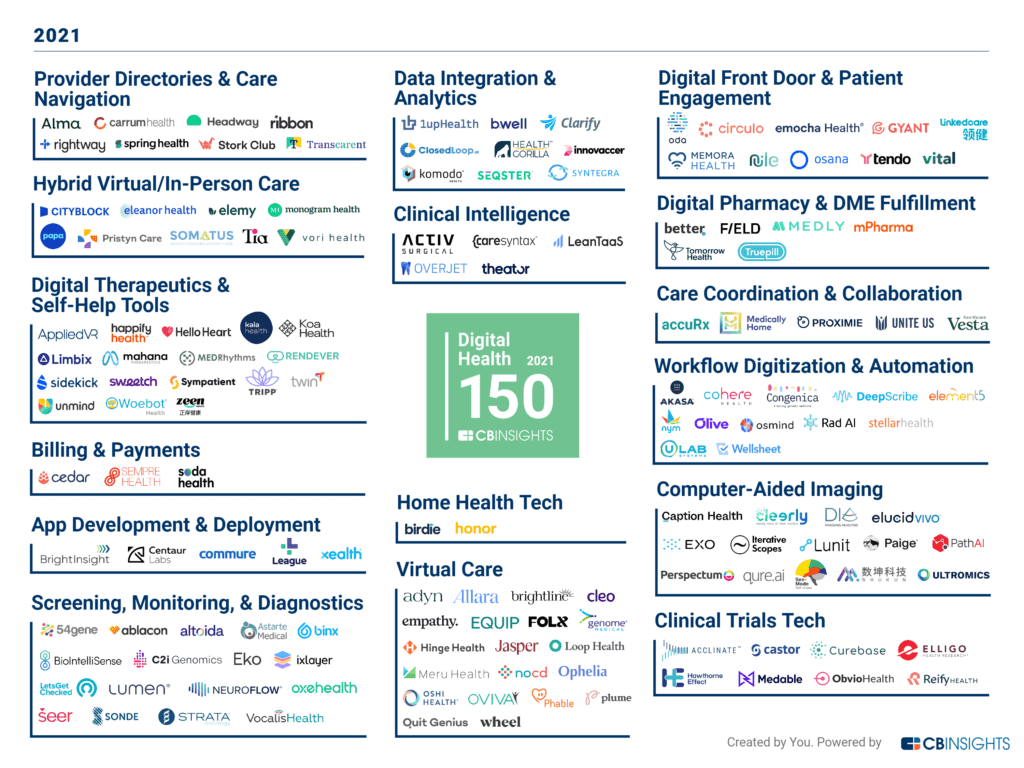

]]>Three-quarters of this year’s winners are B2B fintechs, including business spend management platforms, cross-border and real-time payment providers, and core banking and infrastructure platforms.

Additionally, 24 companies in this year’s cohort are B2C, including challenger banks, mobile wallets, and retail investing platforms.

Using the CB Insights platform, our research team picked these 100 private market companies from a pool of over 19K companies, including applicants and nominees. They were chosen based on CB Insights datasets — including equity funding, investor profiles, business relationships, R&D activity, news sentiment analysis, competitive landscape, proprietary Mosaic scores, and Yardstiq transcripts — and criteria such as tech novelty and market potential. The research team also reviewed thousands of Analyst Briefings submitted by applicants.

CB Insights clients can access the entire Fintech 100 list and interactive Expert Collection here.

If you are not already a CB Insights client, sign up for a free trial to analyze each winner’s funding and valuation history, headcount growth, key competitors, and more.

Want to be considered for future rankings? Fill out this initial application form (it’ll take no more than a few minutes). If selected, you’ll be asked to complete our Analyst Briefing Survey so that our analysts can better understand your products, customers, and market traction.

Companies are categorized by their primary focus area and client base. Categories in the market map are not mutually exclusive.

Please click to enlarge.

TOP FINTECH COMPANIES 2023: FINTECH 100 COHORT HIGHLIGHTS

Overall funding and valuation trends: The Fintech 100 includes a mix of companies at different stages of maturity, product development, and funding. The cohort has raised nearly $22B in equity funding across 381 deals since 2019 (as of 9/22/23). This year’s list includes 31 unicorns (private companies with a $1B+ valuation).

Early-stage innovation: Twenty companies in this year’s winning cohort are in early fundraising stages (seed/angel or Series A). Solutions from early innovators are being developed across categories, including B2B BNPL (Mondu and Two), account-to-account (A2A) payments (Banked and kevin.), and mobile wallets and remittances (DANA and LemFi).

Most represented categories: The cohort is broken down into 20 categories. “Spend management” and “insurance” are tied for the largest portion of this year’s winners (9 companies each).

The spend management category is led by later-stage market leaders Brex and Ramp, which both launched generative AI product features this year. The category also includes two new winners in non-US markets: Singapore-based Aspire and Mexico-based Clara.

Insurance is one of the biggest categories for the second straight year. Eight out of the 9 insurtechs are B2B, including two insurance distribution platforms: repeat winner bolttech and new winner Cover Genius.

Global reach: This year’s winners represent 24 different countries across the globe. Forty-three percent of the selected companies are headquartered in the US — down from 53% last year. The UK comes in second with 12 winners, followed by Singapore with 7.

Additionally, some emerging markets stand out with multiple winners this year. For example, India has 3 winners, while Indonesia and Egypt each have 2.

Novel applications: Two of this year’s winners are developing large language models purpose-built for financial services: conversational AI provider and returning winner Kasisto and financial document processing platform Cognaize.

Two winners in the wealth and asset management category, AlphaSense and SESAMm, have integrated generative AI into their market intelligence platforms for document summarization and extraction.

Finally, within core banking and infrastructure, embedded finance platforms — like repeat winner Unit and an early-stage new winner Synctera — are growing quickly in the United States.

Fintech 100 (2023)

Track the 100 most promising fintech startups to watch in 2023. Look for Fintech 100 (2023) in the Collections tab.

THE FINTECH 250 CLASS OF 2022: WHERE ARE THEY NOW?

The Fintech 250 2022 cohort has posted some notable accomplishments since October 4, 2022. Collectively, this cohort has seen:

- $10B in equity funding across 64 deals — including Stripe’s $6.5B round in March 2023.

- 14 mega-rounds (deals worth $100M+).

- 2 acquisitions: Uplift was acquired by another Fintech 250 winner, Upgrade, for $100M, and PolicyGenius was acquired by Zinnia.

- 4 new entrants to the unicorn club: eToro, Kin, Liquidity, and Quantexa all hit $1B+ valuations for the first time.

The post Fintech 100: The most promising fintech startups of 2023 appeared first on CB Insights Research.

]]>The post GenAI 50: The most promising generative artificial intelligence startups of 2023 appeared first on CB Insights Research.

]]>Among this year’s winning cohort, 16 winners are focused on industry-specific genAI use cases, such as character animation in media & entertainment or drug discovery in healthcare. A total of 20 vendors are working on cross-industry solutions, like AI assistants & human-machine interfaces (HMIs) as well as code generation tools. The other 14 companies in the GenAI 50 cohort are developing tools like vector database tech and foundation models to support AI development.

Our research team picked these 50 private market vendors using CB Insights datasets — including R&D activity, proprietary Mosaic scores, business relationships, Yardstiq transcripts, investor profiles, news sentiment analysis, competitive landscape, and team strength — and criteria such as tech novelty and market potential. The research team also reviewed Analyst Briefings submitted by applicants.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.

The post GenAI 50: The most promising generative artificial intelligence startups of 2023 appeared first on CB Insights Research.

]]>The post Insurtech 50: The most promising insurtech startups of 2023 appeared first on CB Insights Research.

]]>Among this year’s winners, some are developing new AI tools and infrastructure for insurers to digitize and improve back-office efforts, while others are competing with legacy insurers by building tech-first insurance platforms. A number of winners are digitally linking various stakeholders in the insurance industry, such as by opening new distribution channels or enabling more efficient risk transfer exchanges.

The CB Insights research team picked these 50 vendors from a pool of over 2K companies, including applicants and nominees. They were chosen based on CB Insights datasets — including R&D activity, Mosaic scores, business relationships, Yardstiq transcripts, investor profiles, news sentiment analysis, competitive landscape, and team strength — and criteria such as tech novelty and market potential.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.

The post Insurtech 50: The most promising insurtech startups of 2023 appeared first on CB Insights Research.

]]>The post AI 100: The most promising artificial intelligence startups of 2023 appeared first on CB Insights Research.

]]>Around one-third of this year’s winners are focused on AI applications across specific industries — such as visual dubbing for the media & entertainment sector or textile recycling for fashion & retail. A total of 40 vendors are focused on cross-industry solutions, like AI assistants & human-machine interfaces (HMIs), digital twins, climate tech, and smell tech.

Additionally, 27 companies in this cohort are developing tools like vector database tech and synthetic datasets to support AI development.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.

The post AI 100: The most promising artificial intelligence startups of 2023 appeared first on CB Insights Research.

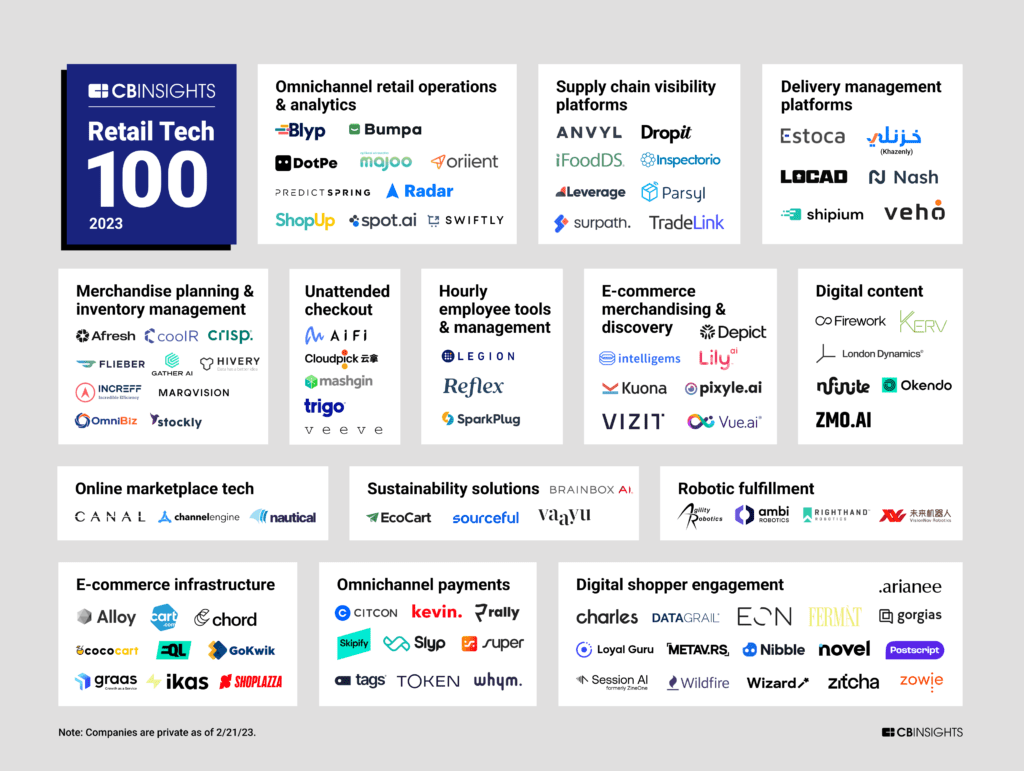

]]>The post Retail Tech 100: The most promising retail tech startups of 2023 appeared first on CB Insights Research.

]]>Many of this year’s winners focus on boosting the efficiency of retail operations across channels. To this end, AI is being deployed by winners across categories, to automate everything from inventory forecasting and management to counterfeit tracking. Additionally, platforms that integrate tech stacks — whether in stores or for digital selling — are gaining traction in developed as well as emerging markets.

Other companies in this year’s winning cohort help retailers create more engaging shopping experiences, via tools like chat commerce, shoppable video, and NFTs. Sustainable shopping solutions for both consumers and retailers make a notable appearance as well.

Using the CB Insights platform, our research team picked these 100 private market vendors from a pool of over 7K companies, including applicants and nominees.

The list includes early- and mid-stage startups driving innovation across store tech, e-commerce, loyalty & rewards, supply chain & logistics, and digital engagement. They were chosen based on factors including funding, proprietary Mosaic scores, market potential, business relationships, investor profile, news sentiment analysis, competitive landscape, team strength, and tech novelty. The research team also reviewed hundreds of Analyst Briefings submitted by applicants.

Clients can access the entire Retail Tech 100 list and interactive Collection here. (If you don’t have a CB Insights login, create one here.)

Companies are categorized by their primary focus area and client base. Categories in the market map are not mutually exclusive. Please click to enlarge.

Want to be considered for future rankings? Fill out this initial application form (it’ll take no more than a few minutes). If selected, you’ll be asked to complete our Analyst Briefing Survey so that our analysts can better understand your products, customers, and market traction.

RETAIL TECH 100 COHORT HIGHLIGHTS

Overall funding & valuation trends: The cohort has raised nearly $5B across more than 250 equity deals since 2019 (as of 3/2/23). In 2022 alone, companies on the list raised more than $3.1B across 106 deals. This year’s list features 3 unicorns: self-checkout company Mashgin, delivery management platform Veho, and omnichannel operations and loyalty tool Swiftly.

Funding leaders: Cart.com, which makes end-to-end e-commerce technology, is the most well-funded company on the list, with $323M in total equity funding. Delivery management unicorn Veho comes in second with $299M in funding. New unicorn Swiftly rounds out the top 3 with $216M in total equity funding.

Global reach: This year’s winners come from 20 different countries. Fifty-six of the selected companies (56%) are headquartered in the US. The United Kingdom comes in second with 6 (6%) and China and Australia are tied for third with 5 companies (5%) each.

Notably, 12 companies on the list (12%) represent emerging market economies. Local companies in these markets are increasingly looking to deploy tech to make fragmented and informal retail processes more efficient and trackable.

Some of the companies in these geographies — like Majoo (Indonesia) and Dot (India) — offer omnichannel retail operations platforms that help retailers digitize operations across in-store and online channels. Other solutions — such as Khazenly (Egypt) — are focused on delivery management.

Top investors: Insight Partners is the top investor in this year’s list. It has invested in 8 of this year’s winners since 2019, including 3D digital content producer and manager nfinite, food traceability solution iFoodDS, and delivery management platform Shipium. Tiger Global is close behind with 7 companies, followed by Accel with 5.

Digital content and engagement rules: The biggest category for this year’s list is digital shopper engagement, which has 16 companies (16%). The companies in this category allow retailers to connect with shoppers across platforms and channels, with a focus on personalization and loyalty.

For instance, Charles and Postscript both make chat commerce platforms that enable marketing and checkout via text. Meanwhile, Arianee, METAV.RS, and Novel help brands develop NFTs and use Web3 tools to boost loyalty and authenticate their products.

Automation is driving efficiency: Automation solutions reach across categories on this year’s list as retailers and brands look for tools to make their operations faster and smarter.

Alloy, for instance, makes a platform to connect e-commerce teams’ apps and automate tasks. Several other companies build supply chain integration platforms that aggregate tools and use AI to optimize decision-making. Meanwhile, Vue.ai, Lily AI, and Pixyle use AI to automate product tagging and broader catalog management online, which can ultimately boost the accuracy of shoppers’ searches and drive more buying.

Early-stage innovation: More than half of the winners in this year’s cohort are early-stage companies (seed/angel or Series A). These companies are developing innovative solutions to promote more specialized and personalized shopping experiences.

For example, EQL’s e-commerce platform is specialized for “hype commerce,” or limited-time drops for hot products. EON creates digital IDs (or digital twins) to make apparel traceable. And Nibble Technology uses AI and chat commerce to inject negotiation into e-commerce shopping.

What we didn’t find: Despite retailers’ acute challenges in a few areas — namely loss prevention and employee empowerment — our research turned up fewer-than-expected earlier-stage companies solving these problems in new ways.

However, a few tools still stood out in these areas. For example, Spot’s AI-powered video intelligence system helps retailers track everything from shoplifting to employee issues. Meanwhile, SparkPlug’s platform helps retailers reward employees in a tough labor market through the gamification of tasks.

Retail Tech 100 (2023)

Track the 100 most promising retail tech innovators to watch in 2023 and beyond. Look for Retail Tech 100 (2023) in the Collections tab.

THE RETAIL TECH 100 CLASS OF 2022: WHERE ARE THEY NOW?

The 2022 Retail Tech 100 winners have accomplished a great deal since March 2022. Together, they have seen:

- Over $2.5B in equity funding across 25+ deals (as of 3/2/23)

- 10 mega-rounds (deals worth $100M+), including a $300M round to cross-border payments company Xendit

- 2 exits: 1 merger and 1 acquisition

- 1 new entrant to the $1B+ unicorn club

If you want to learn more about the Retail Tech 100 Class of 2022, check out the full list of previous winners.

The post Retail Tech 100: The most promising retail tech startups of 2023 appeared first on CB Insights Research.

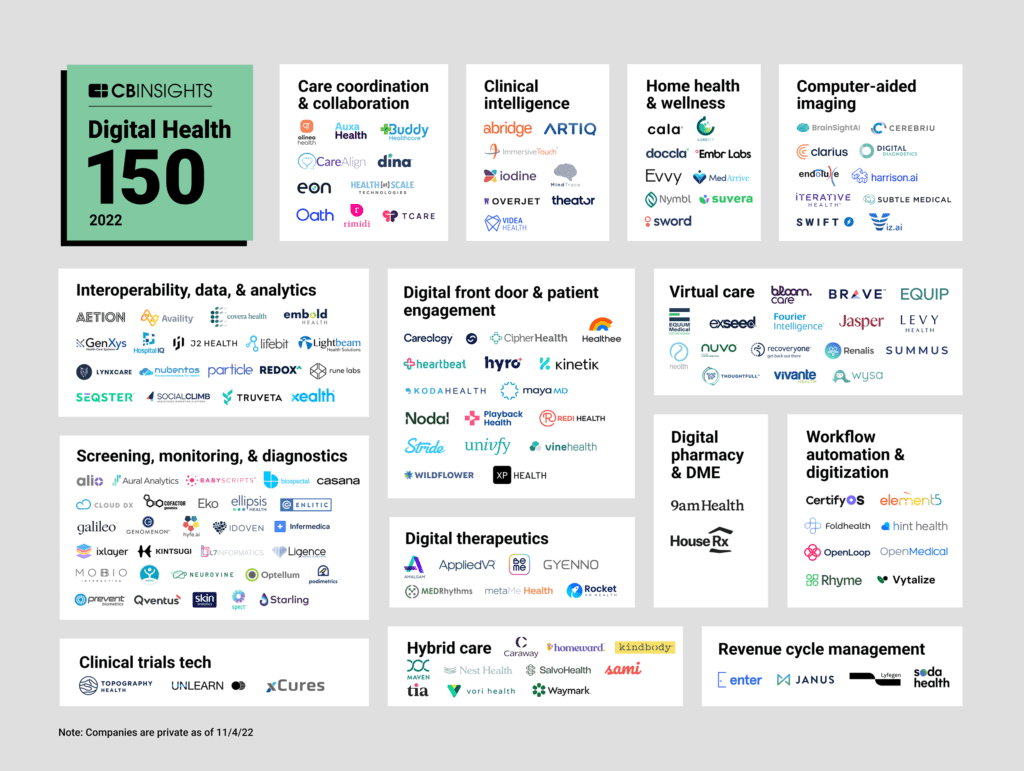

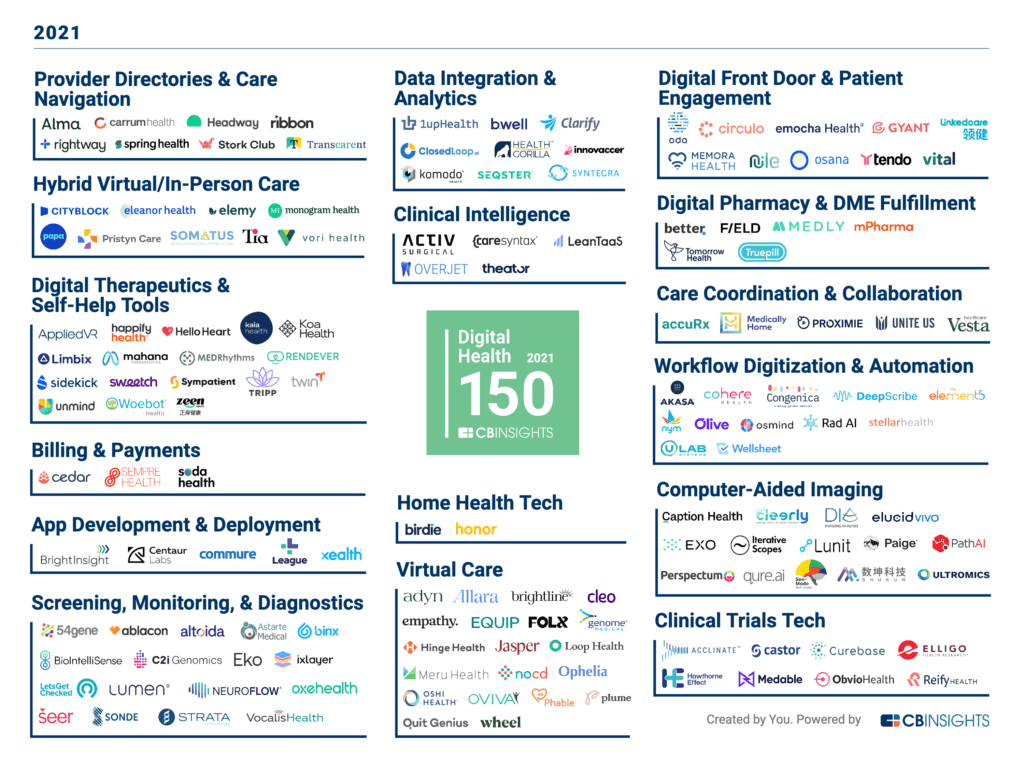

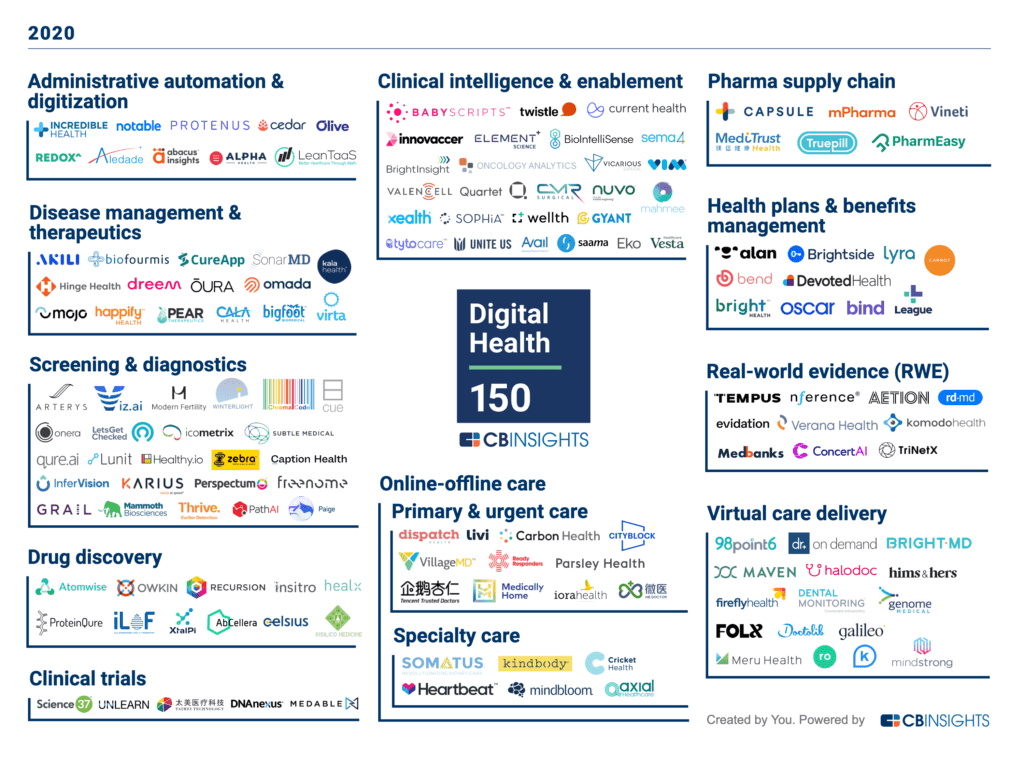

]]>The post The Digital Health 150: The most promising digital health companies of 2022 appeared first on CB Insights Research.

]]>The 2022 Digital Health 150 cohort has raised approximately $5.6B in aggregate funding across 378 deals since 2017 and includes startups at different investment stages of development, from early-stage companies to well-funded unicorns.

Winners are focusing on everything from reimagining clinical care, to making healthcare more accessible for underserved populations, to leveraging tech like AR/VR to improve surgical training.

These 150 winners were selected from a pool of over 13,000 companies, including applicants and nominees.

They were chosen based on several factors, including data submitted by the companies, proprietary Mosaic scores, company business models and momentum in the market, funding, business relationships, investor profiles, competitive positioning, tech novelty, and more. CB Insights’ research team also reviewed over 3,000 Analyst Briefings submitted by applicants.

FREE DOWNLOAD: THE COMPLETE DIGITAL HEALTH 150 LIST

Clients can access the entire Digital Health 150 list and interactive Collection here. (If you don’t have a CB Insights login, create one here.)

Companies are categorized by their primary focus area and client base. Categories in the market map are not mutually exclusive. Please click to enlarge.

Want to be considered for future rankings? Fill out this initial application form (it’ll take no more than a few minutes). If selected, you’ll be asked to complete our Analyst Briefing Survey so that our analysts can better understand your products, customers, and market traction.

DIGITAL HEALTH 150 COHORT HIGHLIGHTS

- Few repeat winners: Around 90% of this year’s winning cohort did not appear on last year’s list. This high proportion of new winners partially stems from a flood of M&A and IPO activity in 2021, which saw record exits in the digital health space. Multi-year winners like Xealth, Redox, and Maven Clinic have contended with economic pressures to earn their place once again.

- Global representation grows: Winners in this year’s Digital Health 150 span 18 countries across 5 continents. A quarter (25%) are headquartered outside of the US — the most in the history of our list. While the US still leads, the UK comes in second with 9 winners, followed by Canada with 5 and Brazil with 3.

- Focus on diagnostics: The screening, monitoring, & diagnostics category leads with 29 companies, accounting for nearly one-fifth of the Digital Health 150. Notable winners here include mobile skin lesion analytics provider Skin Analytics, vocal biomarkers companies Ellipsis Health and Kintsugi, and concussion monitoring solution Prevent Biometrics. This category is followed by interoperability, data, & analytics (12% of the winners), virtual care (11%), and digital front door & patient engagement (11%).

- Funding leaders: Since 2017, this year’s Digital Health 150 winners have raised around $5.6B in equity funding across 378 deals (as of 11/16/22). This includes $1.6B raised across 85 deals in 2022 YTD alone. The top 3 companies by all-time total equity funding raised are SWORD Health, Maven Clinic, and Viz.ai.

- Unicorn slowdown: This year’s list includes only 5 unicorns with a $1B+ valuation, around 3% of the total list. For comparison, last year’s list contained 17. This tracks with a broader drop in new unicorns across sectors in 2022.

- Top investors: General Catalyst is the most active investor in this year’s Digital Health 150 companies, having backed 13 of this year’s winners since 2017, including Homeward, Equip, Casana, and SWORD Health. Insight Partners is next with 10, followed by 7wire Ventures and Plug and Play Ventures with 6 each.

- Early-stage innovation: Nearly half of our winners are companies in earlier stages of development (incubator, angel/seed, or Series A). Players here include Vori Health, which provides hybrid (virtual and in-person) musculoskeletal care, and Janus Health, which provides process analysis, process improvement, and intelligent automation tools for revenue cycle management.

Track all the Digital Health 150 Startups in this report and many more on our platform

The 150 private digital health startups working to recreate how healthcare is delivered. Look for The Digital Health 150 in the Collections tab.

THE DIGITAL HEALTH 150 CLASS OF 2021: WHERE ARE THEY NOW?

Since January 2022, the 2021 Digital Health 150 winners have posted a number of accomplishments, including:

- More than $2.5B in new equity funding (as of 11/16/22).

- 9 new mega-rounds ($100M+), including a $325M round to home kidney care provider Somatus.

- 2 exits: 1 IPO and 1 acquisition.

- 4 new entrants to the $1B+ unicorn club, including Clarify Health and Transcarent.

If you want to learn more about the Digital Health 150 Class of 2021, check out the full list of previous winners.

The post The Digital Health 150: The most promising digital health companies of 2022 appeared first on CB Insights Research.

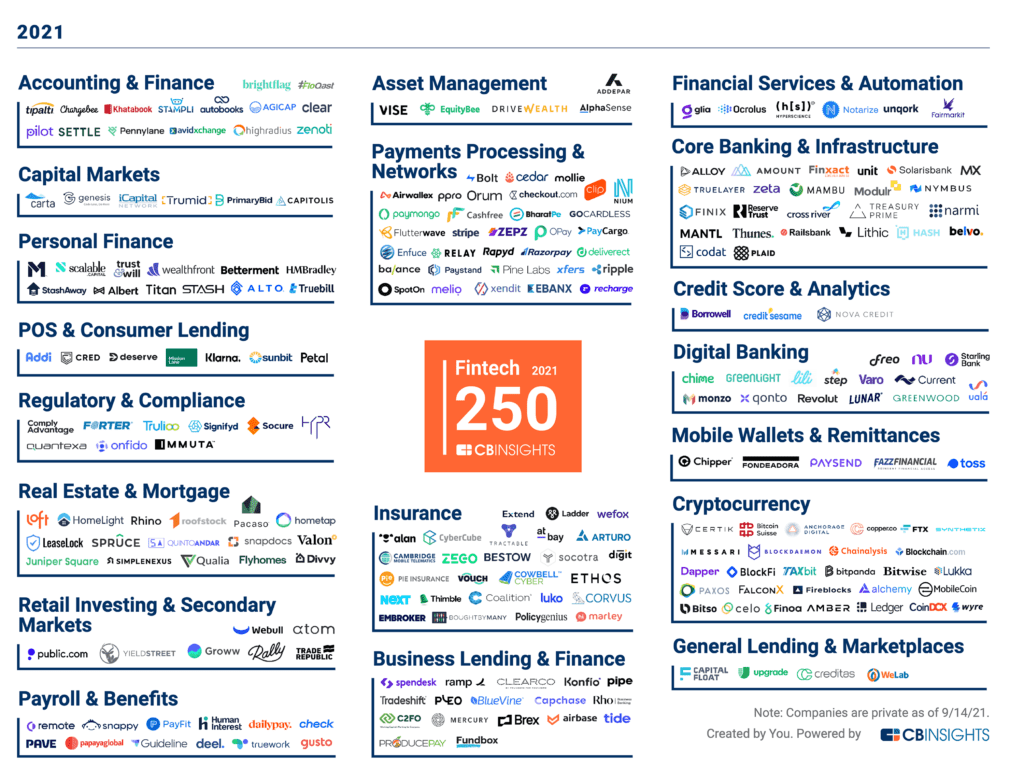

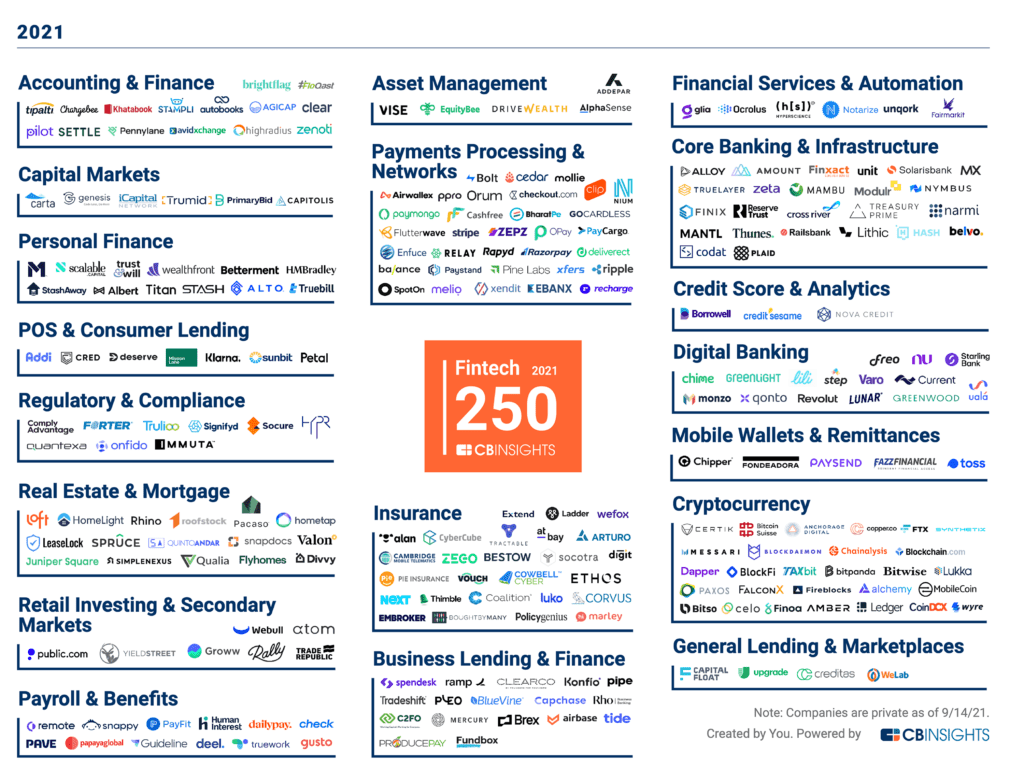

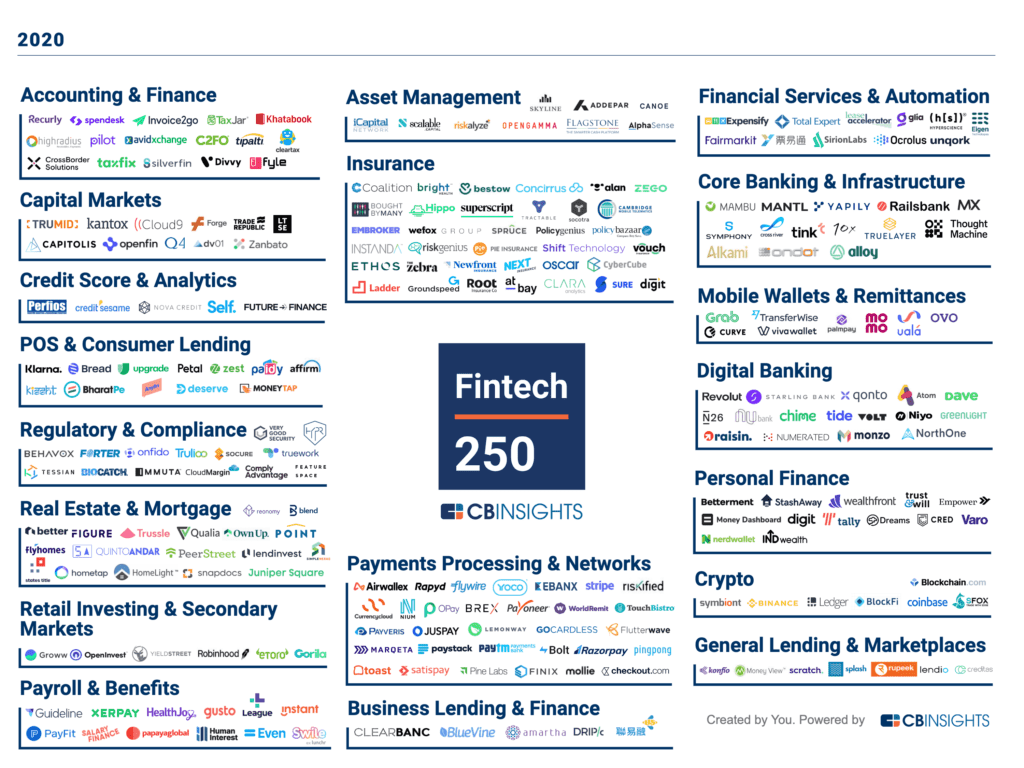

]]>The post The Fintech 250: The most promising fintech companies of 2022 appeared first on CB Insights Research.

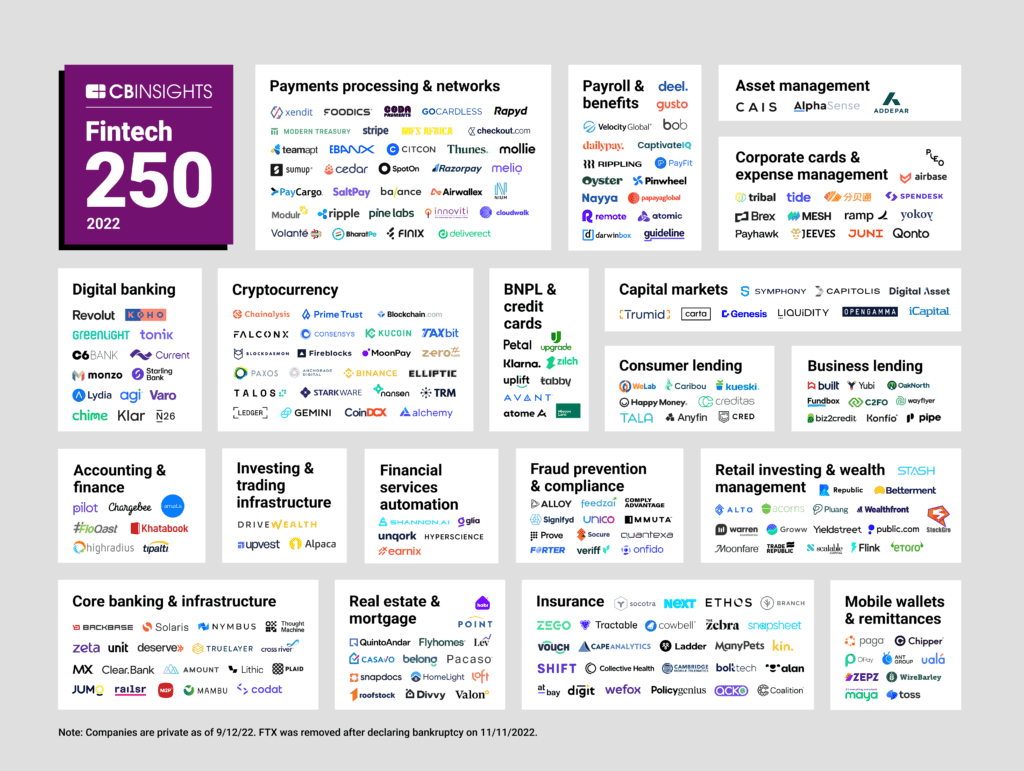

]]>Some of this year’s winners are building safer and more efficient ways to send and receive payments. Others are striving to make banking, loans, mobile wallets, and investing products available to historically underserved populations all over the world.

Using the CB Insights platform, our research team selected these 250 winners from a pool of over 12,500 eligible private companies, including applicants and nominees. They were chosen based on factors including proprietary Mosaic scores, funding, market potential, business relationships, investor profile, news sentiment analysis, competitive landscape, team strength, and tech novelty. The research team also reviewed over 2,000 Analyst Briefings submitted by applicants.

Clients can access the entire Fintech 250 list and interactive Expert Collection here. (If you don’t have a CB Insights login, create one here.)

Companies are categorized by their primary focus area and client base. Categories in the market map are not mutually exclusive. Please click to enlarge.

Want to be considered for future rankings? Fill out this initial application form (it’ll take no more than a few minutes). If selected, you’ll be asked to complete our Analyst Briefing Survey so that our analysts can better understand your products, customers, and market traction.

FINTECH 250 COHORT HIGHLIGHTS

Below are a few highlights from the Fintech 250 Class of 2022.

New vs. repeat winners: Nearly two-thirds (64%) of this year’s cohort are repeat winners: 144 were on last year’s list and 16 have made their way back onto the list after winning in a prior year. That leaves only 90 new winners (36% of the list), the fewest ever since we started the Fintech 250.

Why is the new winner cohort so small? In the past, many winners would exit via IPO or M&A and lose eligibility for the list. Today, fintech leaders are staying private longer, especially amid this year’s market turmoil. This has allowed them to retain their eligibility through multiple list rounds. Additionally, factors such as rising inflation, interest rate hikes, and struggling public tech stocks have made it more difficult for new entrants to make a splash in the already maturing fintech market.

Some of the biggest names in the industry, like Stripe and Klarna, have certainly faced their fair share of obstacles, including layoffs and valuation cuts. But when analyzing the data — including revenue, number of customers and customer growth, partnerships, and equity funding — most of these better-established fintech leaders remain on top.

Global reach: Globalization is a key theme for this year’s Fintech 250. The winners represent 33 different countries (by headquarters location) across the globe — 7 more than last year. Just over half (53%) of the selected companies are headquartered in the US, which is the fewest we’ve seen in the Fintech 250 since 2017. The UK came in second with 31 winners (12%), followed by India with 14 (6%), Brazil with 9 (4%), and Germany with 7 (3%).

Stemming from the broader theme of globalization comes localization — the practice of serving local markets and regions. This is a strong focus for winners in emerging markets like India, South America (11 winners, 4%), and Africa (6 winners, 2%).

For example, 3 of this year’s first-time winners are building payment networks in Africa: MFS Africa, TeamApt, and Paga.

B2B vs. B2C: About two-thirds (64%) of this year’s Fintech 250 are B2B, and 36% are B2C. The B2B-B2C split represents a broader shift in market sentiment away from consumer-facing fintechs. This has been driven in part by reports released this year citing the lack of neobank profitability as well as the visible struggle of public B2C fintech stocks like Robinhood, Coinbase, Affirm, and NuBank.

The largest B2B fintech winners by valuation are Stripe ($74B internal valuation), Checkout.com ($40B), Plaid ($13.5B), and Brex ($12.3B).

Most-represented categories: The fintech categories comprising the most winners are payments processing & networks with 33 (13%), insurance with 25 (10%), cryptocurrency with 24 (10%), core banking & infrastructure with 19 (8%), and retail investing & wealth management with 17 (7%).

This marks payments processing & networks’ second straight year as the top category by number of winners. This category includes B2B providers of e-commerce and point-of-sale (POS) payments processing, APIs, payouts, cross-border payments, and more. It also tied with cryptocurrency for the most new winners at 11. Notable new Fintech 250 champions in the payments processing & networks space include card reader and POS system provider SumUp, gaming payments platform Coda Payments, and Brazil-based CloudWalk (the developer of POS solution InfinitePay).

All but one of this year’s insurance winners were also featured in our inaugural Insurtech 50, published in June 2022. The category includes companies selling insurance products and services directly to customers (i.e., individuals or businesses buying an insurance policy), like Digit Insurance in India and SMB-focused Next Insurance. It also includes companies like Cambridge Mobile Telematics and Shift, which sell technology to reinsurers and insurance brokers.

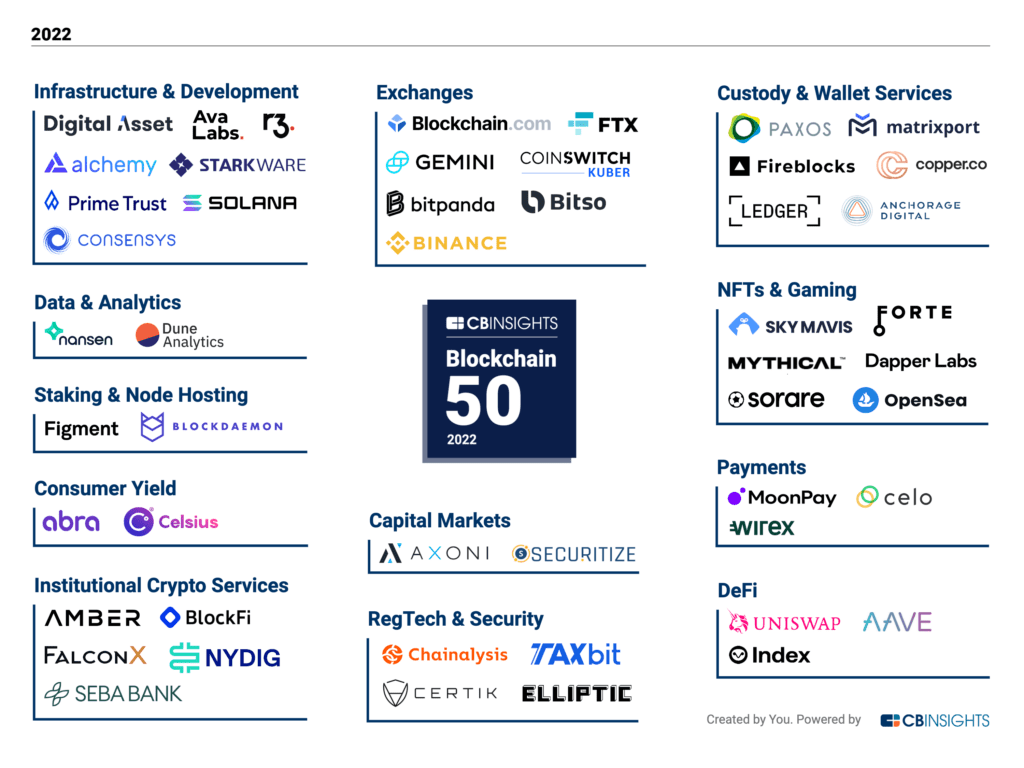

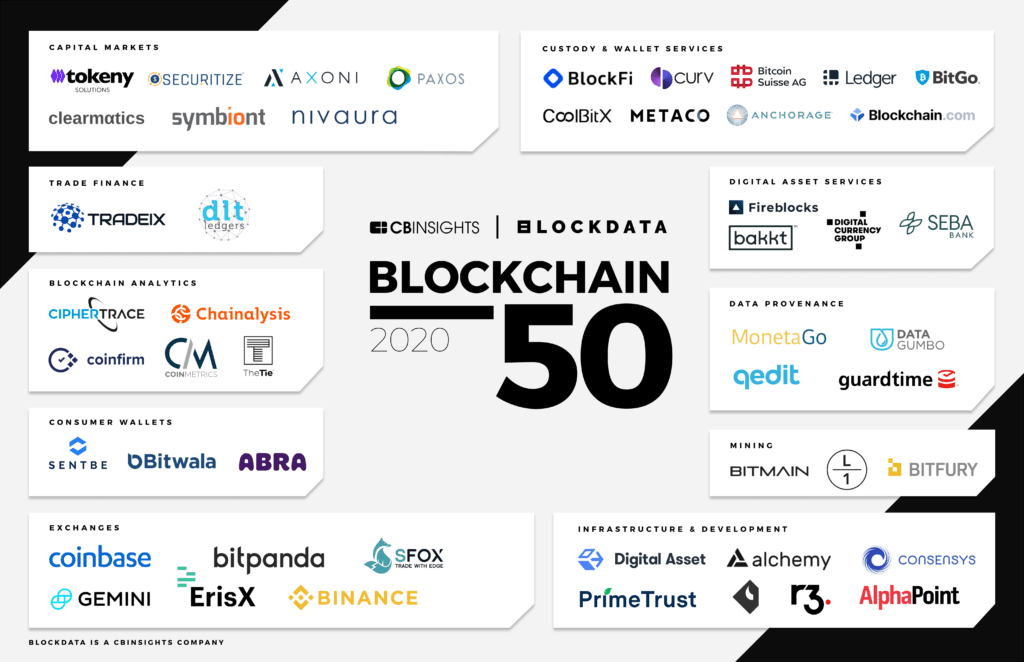

Despite the crypto market downturn this year, startups in the space still account for a significant share of this year’s Fintech 250 list. Data on funding, top investor support, revenue, and business relationships still point to the long-term momentum of these companies. Notable players include crypto exchange Binance as well as Web3 infrastructure providers ConsenSys and Fireblocks.

Overall funding & valuation trends: The Fintech 250 cohort has raised over $115B in equity funding across over 1,100 deals since the start of 2017 (as of 9/20/2022). In 2021 alone, winners raised over $51B across 337 equity deals. That’s an average of more than one funding round per company in a single year.

The top 3 winners by total equity funding raised since 2017 are Ant Group (who’s had to delay an IPO due to Chinese government regulations), Klarna, and Chime.

This year’s list includes 159 unicorns with a $1B+ valuation — almost two-thirds (64%) of the total list. While that stat definitely jumps off the page, it’s a little less shocking when you consider that there were a total of 297 fintech unicorns in the world at the end of Q2’22.

Top investors: Tiger Global is the top investor in this year’s Fintech 250 by a significant margin, having backed equity deals to 45 of the winners, including Stripe, Checkout.com, and Revolut, since 2017. Accel is second with 29 companies in its portfolio, followed by Ribbit Capital with 27.

Innovation at the earlier stages: Thirty-two (13%) of our winners are seed, Series A, or Series B startups.

To highlight a few, MoonPay provides fiat-to-crypto on- and off-ramps for crypto and NFT businesses, enabling them to accept traditional payment methods. International insurtech bolttech is building a global insurance exchange that connects insurers, distribution partners, and customers, to change the way insurance is bought and sold. Finally, StockGro is an India-based social investing app that allows users to invest virtual money to learn about stocks, play games, and win rewards.

Fintech 250 (2022)

Track the 250 most promising fintech startups to watch in 2022. Look for Fintech 250 (2022) in the Collections tab.

THE FINTECH 250 CLASS OF 2021: WHERE ARE THEY NOW?

Since the start of October 2021, the 2021 Fintech 250 winners have posted a number of accomplishments, including:

- Nearly $20B in equity funding raised across 150+ deals (as of 09/20/2022)

- 68 mega-rounds (deals worth $100M+), including a $1B Series D to payments platform Checkout.com

- 5 exits, including 3 acquisitions and 2 IPOs (AvidXchange and Nubank)

- 20 new entrants to the $1B+ unicorn club, including Alchemy, Cross River Bank, and Qonto

If you want to learn more about the Fintech 250 Class of 2021, check out the full list of previous winners.

The post The Fintech 250: The most promising fintech companies of 2022 appeared first on CB Insights Research.

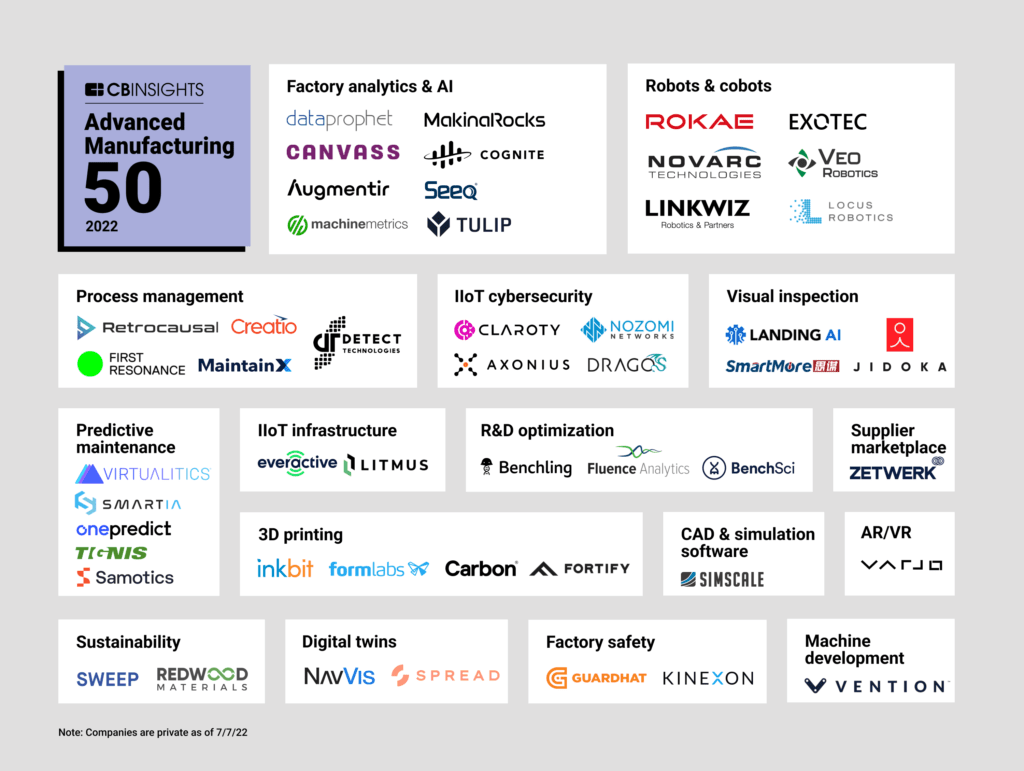

]]>The post Advanced Manufacturing 50: The most promising advanced manufacturing startups of 2022 appeared first on CB Insights Research.

]]>Some of this year’s winners aim to provide robotic systems to help manufacturers increase productivity and reduce labor costs. Others are developing advanced analytics that will allow manufacturers to maximize the efficiency and quality of their processes, systems, equipment, and more.

Using the CB Insights platform, our research team picked these 50 private market vendors from a pool of over 6K companies, including applicants and nominees. They were chosen based on factors including R&D activity, proprietary Mosaic scores, market potential, business relationships, investor profile, news sentiment analysis, competitive landscape, team strength, and tech novelty. The research team also reviewed hundreds of Analyst Briefings submitted by applicants.

Clients can access the entire Advanced Manufacturing 50 list and interactive Expert Collection here. (If you don’t have a CB Insights login, create one here.)

Companies are categorized by their primary focus area and client base. Categories in the market map are not mutually exclusive. Please click to enlarge.

Want to be considered for future rankings? Fill out this initial application form (it’ll take no more than a few minutes). If selected, you’ll be asked to complete our Analyst Briefing Survey so that our analysts can better understand your products, customers, and market traction.

TOP ADVANCED MANUFACTURING COMPANIES 2022: ADVANCED MANUFACTURING 50 COHORT HIGHLIGHTS

Below are a few highlights from the Advanced Manufacturing 50 Class of 2022.

Overall funding & valuation trends: The Advanced Manufacturing 50 includes a wide range of companies at different stages of maturity, product development, and funding.

Overall, the cohort has raised $6.9B+ from 369 disclosed investors, across 177 equity deals since 2017 (as of 7/20/22). In 2021 alone, companies in this cohort raised over $3.7B across 46 deals. This year’s list includes 12 unicorns with a $1B+ valuation.

Global reach: This year’s winners represent 13 different countries across the globe. Twenty-seven of the selected companies (54%) are headquartered in the US. Germany and Canada tied for second, with 4 winners (8%) each.

Other countries home to at least one winner on this year’s list include India, China, France, South Korea, Finland, Japan, the Netherlands, Norway, South Africa, and the United Kingdom. (Note: This geographical breakdown does not account for companies with multiple global headquarters.)

Top investors: The top investor in this year’s cohort is Accel, as it has backed 5 winners since 2017. Insight Partners and next47 tied for second — each has backed 4 winners over the same time period.

Innovation at earlier stages: Nineteen (38%) of our winners are Series A or Series B companies with promising product ideas.

To highlight a couple, Landing AI provides a platform designed to help industrial organizations create and deploy computer vision applications for visual inspection. South Africa-based DataProphet utilizes AI to collect data from across factory floor sources, like production equipment and internet of things (IoT) sensors, in order to find process efficiencies.

Most represented categories: Among the categories highlighted on this map, factory analytics & AI holds the largest share (16%) of our winning cohort. The 8 companies featured in this category are focused on developing analytics solutions that increase production efficiency, output, and quality for manufacturers. Companies like Seeq and MakinaRocks provide data-driven insights to guide process optimization, by leveraging AI and real-time production monitoring to analyze past and present data streams.

Robots & collaborative robots (cobots) came in second with 12% of our winning cohort. The 6 companies featured in this category offer robotic hardware and software solutions that support process automation and maximize worker productivity. Some companies in this space, like Rokae, are developing a cross-industry range of robotic systems, including software, control arms, and cobots. Others maintain a more specific focus — for example, Exotec offers industrial robots for manufacturing logistics and warehousing.

Advanced Manufacturing 50 (2022)

Track the 50 most promising private advanced manufacturing companies to watch in 2022.

The post Advanced Manufacturing 50: The most promising advanced manufacturing startups of 2022 appeared first on CB Insights Research.

]]>The post Insurtech 50: The most promising insurtech startups of 2022 appeared first on CB Insights Research.

]]>Some of this year’s winners are aiming to provide a better digital insurance experience for customers looking to buy life, health, and P&C insurance products. Others are developing technology to help insurers improve their underwriting, claims, distribution, and other internal operations — empowering them to provide a better insurance experience.

Using the CB Insights platform, our research team picked these 50 private market vendors from a pool of over 2K companies, including applicants and nominees. They were chosen based on factors including R&D activity, proprietary Mosaic scores, market potential, business relationships, investor profile, news sentiment analysis, competitive landscape, team strength, and tech novelty. The research team also reviewed hundreds of Analyst Briefings submitted by applicants.

Clients can access the entire Insurtech 50 list and interactive Expert Collection here. (If you don’t have a CB Insights login, create one here.)

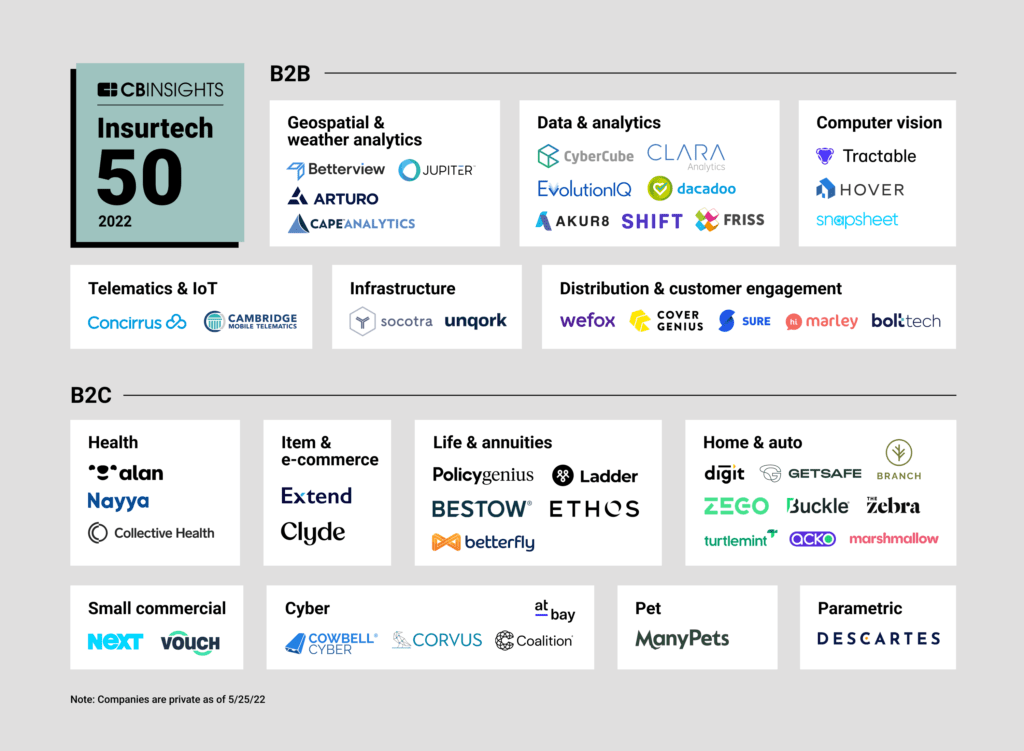

Companies are categorized by their primary focus area and client base. Categories in the market map are not mutually exclusive. Please click to enlarge.

Want to be considered for future rankings? Fill out this initial application form (it’ll take no more than a few minutes). If selected, you’ll be asked to complete our Analyst Briefing Survey so that our analysts can better understand your products, customers, and market traction.

TOP INSURTECH COMPANIES 2022: INSURTECH 50 COHORT HIGHLIGHTS

We split this year’s cohort into 2 broad categories:

- B2B: Twenty-three winners operate in the B2B space, meaning they sell technology to (re)insurers and insurance brokers. Companies in this section are using new data, advanced analytics, and other emerging technologies to drive efficiencies and better customer experiences in insurance and risk management operations.

- B2C: Just over half of the Insurtech 50 cohort are considered B2C companies, meaning they sell insurance products and services directly to customers (i.e., individuals or businesses buying an insurance policy). While business models may differ — as some companies in this group underwrite policies themselves while others act more as agents or lead gen intermediaries on behalf of other insurers — all companies in this section have a customer-facing value proposition.

Below are a few highlights from the Insurtech 50 Class of 2022.

Overall funding & valuation trends: The Insurtech 50 includes a mix of companies at different stages of maturity, product development, and funding.

Overall, the cohort has raised $11B+ from over 400 disclosed investors, across 215 equity deals, since 2017 (as of 6/10/22). In 2021 alone, companies from this cohort raised $5.5B across 55 deals. This year’s list includes 20 unicorns with a $1B+ valuation.

Global reach: This year’s winners represent 10 different countries across the globe. Thirty-one of the selected companies are headquartered in the US. The United Kingdom came in second with 5 winners, followed closely by France with 4 winners and India with 3.

Other countries home to a winner/winners on this year’s list include Germany, the Netherlands, Switzerland, Singapore, Chile, and Australia. (Note: This geographical breakdown does not account for companies with multiple global headquarters.)

Innovation at the earlier stages: Fourteen of our winners are Series A or Series B companies with promising product ideas.

To highlight a couple, EvolutionIQ brings together structured and unstructured internal claims data with external third-party data to enable insurers to handle claims more quickly and accurately. Paris-based Descartes Underwriting collects a variety of data — including satellite images, IoT sensor data, and sonar data — to build parametric insurance products for climate change-related perils.

Most-represented categories: Among the categories highlighted on this map, home & auto holds the largest share of our winning cohort. The 9 companies featured in this category are focused on selling home and/or auto insurance directly to customers. While some offer their own insurance products (e.g., Branch, whose policies are reinsured by SCOR), others like The Zebra enable customers to shop and compare products from a variety of different insurers.

On the B2B side, data & analytics holds the largest share of our winning cohort. The 7 companies featured in this category are focused on obtaining new data and building advanced analytical models to help insurers better understand their customers and the risks they face. Companies in this space like dacadoo are building out health scores enabling life insurers to better underwrite, and some like CLARA Analytics even recommend the right lawyer to minimize workers’ compensation litigation costs.

Insurtech 50 (2022)

Track the 50 most promising private insurtech companies to watch in 2022.

The post Insurtech 50: The most promising insurtech startups of 2022 appeared first on CB Insights Research.

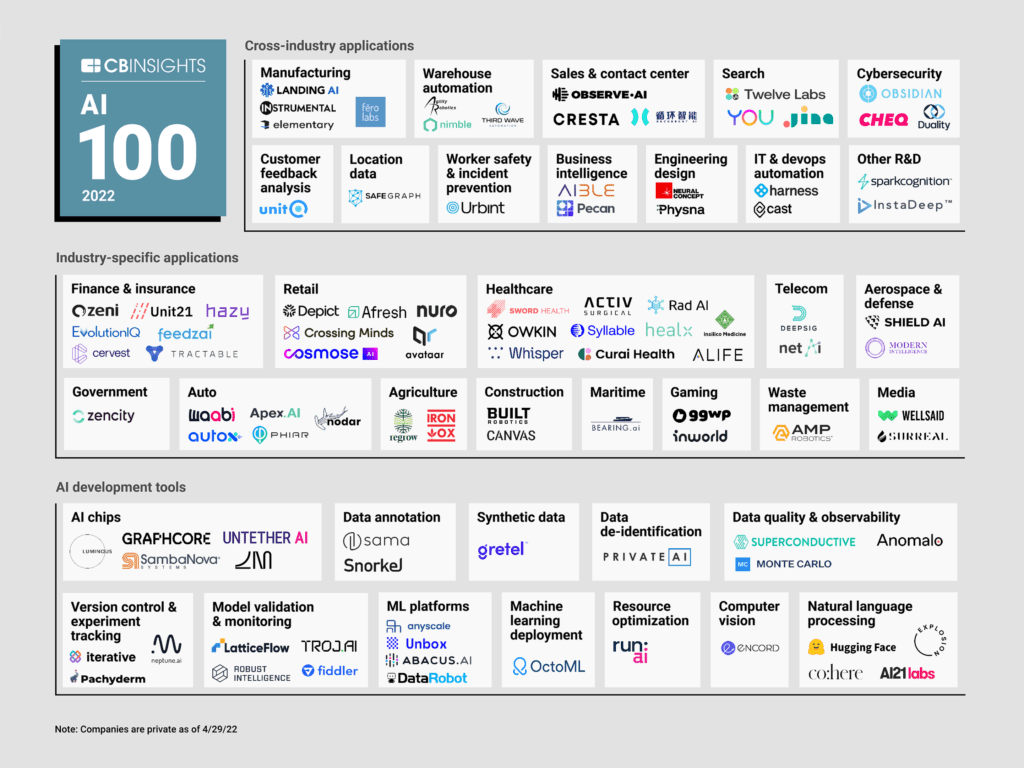

]]>The post AI 100: The most promising artificial intelligence startups of 2022 appeared first on CB Insights Research.

]]>Some of this year’s winners are advancing the development and use of artificial intelligence (AI) across specific industries — such as healthcare, gaming, and agriculture. On the other hand, some are developing applications to support sales, engineering design, cybersecurity, and other functions across a wide range of industries.

Additionally, a sizable portion of the companies in this cohort are developing tools, like machine learning (ML) platforms, to support AI development.

Using the CB Insights platform, our research team picked these 100 private market vendors from a pool of over 7K companies, including applicants and nominees. They were chosen based on factors including R&D activity, proprietary Mosaic scores, market potential, business relationships, investor profile, news sentiment analysis, competitive landscape, team strength, and tech novelty. The research team also reviewed thousands of Analyst Briefings submitted by applicants.

Clients can access the entire AI 100 list and interactive Expert Collection here. (If you don’t have a CB Insights login, create one here.)

Want to be considered for future rankings? Fill out this initial application form (it’ll take no more than a few minutes). If selected, you’ll be asked to complete our Analyst Briefing Survey so that our analysts can better understand your products, customers, and market traction.

Companies are categorized by their primary focus area and client base. Categories in the market map are not mutually exclusive.

Please click to enlarge.

Table of contents

- Top AI companies 2022: AI 100 cohort highlights

- The AI 100 Class of 2021: Where are they now?

Top Ai companies 2022: AI 100 cohort highlights

We split this year’s cohort into 3 broad categories:

- AI development tools: Nearly one-third of the companies in this year’s cohort are working on solutions to support the management of various stages of the AI lifecycle, from data annotation to model training to model monitoring for algorithmic bias.

- Industry-specific applications: Forty-three of the winners are focused on applying AI to use cases specific to different industries, such as gaming, healthcare, and construction.

- Cross-industry applications: Vendors here are developing solutions that can be utilized across multiple industries, including warehouse & logistics robots, sales & contact center tech, and engineering design tools.

Below are a few highlights from the AI 100 Class of 2022.

Overall funding & valuation trends: The AI 100 includes a mix of companies at different stages of maturity, product development, and funding.

Overall, the cohort has raised $12B+ from 650 investors, across 300+ equity deals, since 2017 (as of 5/10/22). This year’s list includes 16 unicorns with a $1B+ valuation. (Note: Neither unicorn status nor the total amount of funding raised were included among the selection criteria for this year’s list.)

Global reach: This year’s winners represent 10 different countries across the globe. Seventy-three of the selected companies are headquartered in the US. The UK came in second with 8 winners, and Canada followed closely with 5.

Other countries home to a winner/winners on this year’s list include India, Sweden, China, and Germany. (Note: This geographical breakdown does not account for companies with multiple global headquarters.)

Early-stage innovation: Thirty-nine of our winners are seed/angel or Series A companies with promising product ideas.

To highlight a couple, GGWP, which was co-founded by former professional gamer Dennis Fong, is combating toxicity in online gaming. You.com has brought together a team of research scientists with experience at Salesforce and Stanford in order to develop a search engine that enables users to compare and sort results.

Most-represented categories: Among the core industries highlighted on this map, healthcare holds the largest share of our winning cohort. The 10 companies featured in this category are focused on surgical tech (ACTIV Surgical), drug discovery for rare diseases (Healx), and more. Finance & insurance came in second with 7 winners, including vendors working on visual damage appraisal for cars (Tractable) and synthetic & anonymized financial datasets (Hazy).

Novel applications: A number of companies on this year’s list are working on niche applications where the use of AI is not commonplace yet.

To name a few, Whisper is developing sound separation tech to improve hearing aid performance. Notably, the company’s head of hardware engineering was previously a hardware engineer for Apple AirPods. Canvas Construction — founded by individuals with experience at Boston Dynamics and the MIT Lincoln Laboratory — is focused on AI-driven robotics for drywall finishing in the construction industry. Agility Robotics, on the other hand, is developing humanoid robots for warehouse and logistics use cases.

AI 100 (2022)

Track the 100 most promising private AI companies to watch in 2022.

the AI 100 class of 2021: where are they now?

The 2021 AI 100 winners have accomplished a great deal since April 2021. Together, they have seen:

- Over $6B in equity funding across 70+ deals

- 20 mega-rounds (deals worth $100M+), including a $600M round to an AI chip developer

- 9 exits, with some winners being acquired by tech leaders like Meta and Nvidia

- 6 new entrants to the $1B+ unicorn club

- A plethora of new partnerships with industry leaders like Geico, Cisco, and Snowflake

If you want to learn more about the AI 100 Class of 2021, check out the full list of previous winners.

The post AI 100: The most promising artificial intelligence startups of 2022 appeared first on CB Insights Research.

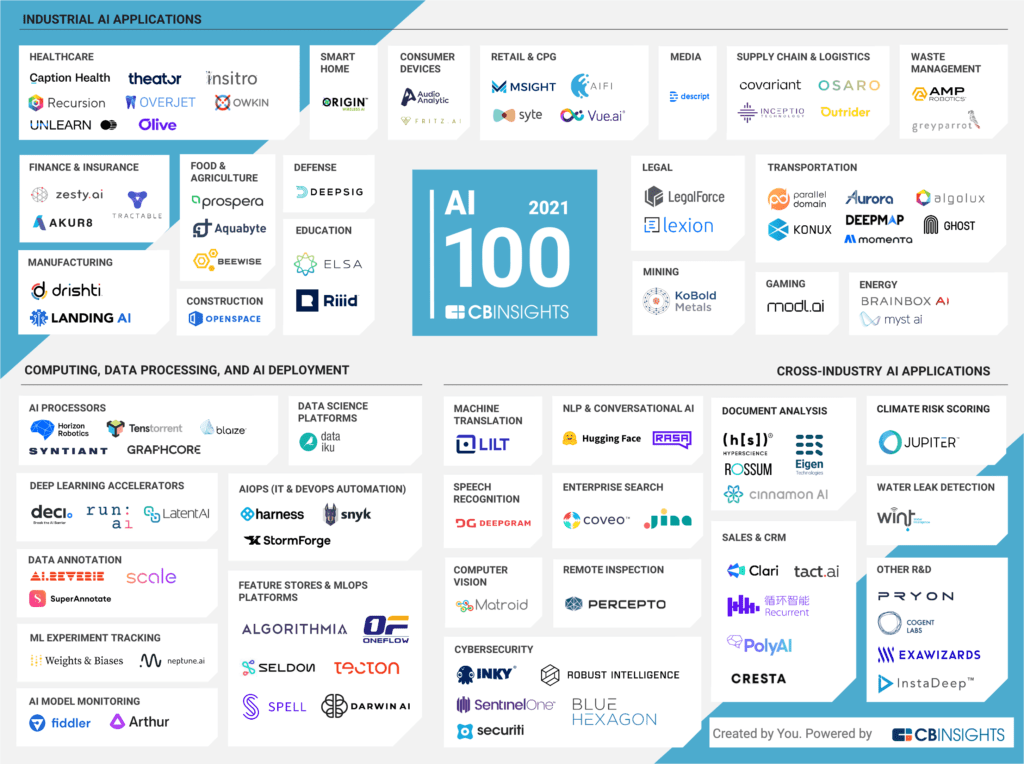

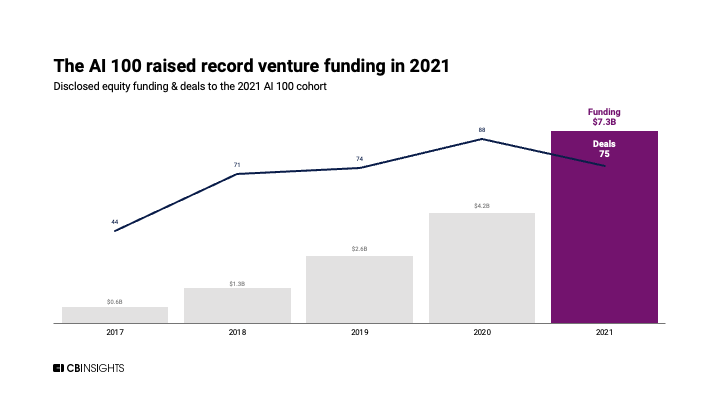

]]>The post The top 100 AI startups of 2021: Where are they now? appeared first on CB Insights Research.

]]>The winning cohort worked on a wide array of applications, from drug R&D and hospital revenue cycle management to autonomous beekeeping and municipal waste sortation — highlighting the breadth and depth of AI’s impact across industries.

FREE DOWNLOAD: THE COMPLETE AI 100 LIST

Get an excel file with the entire AI 100 list including each company’s total funding, focus area, and more.

Since then, the AI 100 2021 cohort has gone on to do big things.

Here’s what they’ve achieved since April 2021:

- Nearly $6B in equity funding across 60+ deals — with an average deal size more than 5x that of the broader venture market

- 18 mega-rounds (deals worth $100M+), including a $600M round to an AI chip developer

- 9 exits, with winners being acquired by tech leaders like Meta and Nvidia

- 5 new entrants to the $1B+ unicorn club

- A plethora of new partnerships with industry leaders like Geico, Cisco, and Snowflake

Below, we look at how the 2021 cohort has fared since being selected to the AI 100.

FUNDING

Since April 2021, 50% of the winning startups disclosed equity rounds, amounting to $5.8B raised across 64 deals. During that time:

- Average deal size has clocked in at $108M, more than 5x the average deal size across venture in Q1’22.

- 17 startups have raised a total of 18 $100M+ mega-rounds, for a combined total of nearly $4.5B.

- The largest deal went to Horizon Robotics, which raised a $600M Series C at a $5B valuation.

Across all of 2021, the AI 100 cohort raised a record 7.3B, up 74% YoY.

EXITS

Nine AI 100 winners have exited in the past year, including both public exits and acquisitions. Since April 2021:

- 4 startups have been acquired by companies ranging from Meta to Nvidia to DataRobot. For instance, Facebook parent Meta acquired AI 100 winner AI.Reverie, which generates synthetic data, in October 2021. This is the third year in a row Meta has purchased an AI 100 winner.

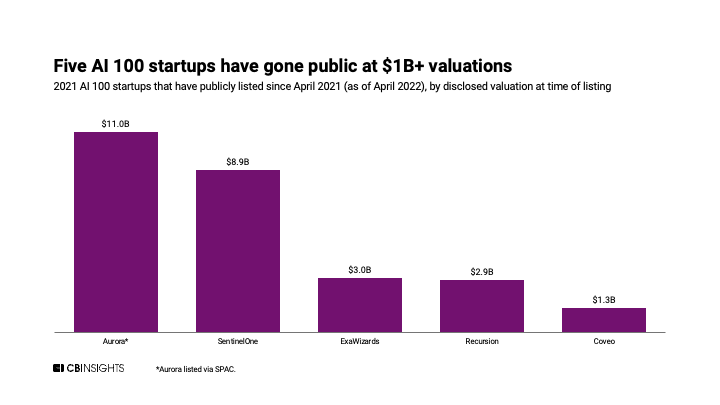

- 4 startups IPO’d. The largest was SentinelOne, which debuted at an $8.9B valuation.

- Autonomous driving company Aurora went public via SPAC at an $11B valuation.

FREE DOWNLOAD: THE COMPLETE AI 100 LIST

Get an excel file with the entire AI 100 list including each company’s total funding, focus area, and more.

UNICORNS

On top of the existing 12 unicorns in the AI 100, five more startups became billion-dollars companies:

- Cresta, which uses speech recognition and AI to monitor call center conversations and guide agents. In March 2022, Cresta raised an $80M Series C at a $1.6B valuation from investors such as Andreessen Horowitz and Tiger Global, as well as contact center software companies Five9 and Genesys.

- TensTorrent, which develops chips and hardware to run deep learning systems. In May 2021, it raised a $200M Series B led by Fidelity at a $1B valuation.

- Owkin, which uses federated learning, a privacy-preserving technique, to build and train AI models that predict how patients will respond to treatments. The startup raised a $180M Series B from Sanofi Ventures at a $1B valuation in November 2021.

- Weights & Biases, which offers a platform for developers to more efficiently build machine learning models. In October 2021, Weights & Biases raised a $135M Series C from at a $1B valuation from Coatue Management, Insight Partners, and Felicis, among others.

- Tractable, which uses computer vision to rapidly appraise pictures of vehicle or home damage for insurance claims. It raised a $60M Series D co-led by Insight Partners and Georgian Partners at a $1B valuation.

Partnerships

Many of the winning companies have forged new strategic partnerships or client relationships since being selected to the AI 100. For example:

- Tractable added clients like Geico, Root Insurance, Covea, and Duck Creek Technologies, among others.

- Cresta added 2 major partners: Genesys and Five9, both of which backed its Series C.

- KoBold Metals, which uses machine learning to analyze geological data and predict promising mining sites, partnered with mining incumbents BHP and Bluejay Mining.

- AI-powered cybersecurity startup Securiti added Cisco and Snowflake as partners. The startup is helping both businesses protect against vulnerabilities in the cloud.

The post The top 100 AI startups of 2021: Where are they now? appeared first on CB Insights Research.

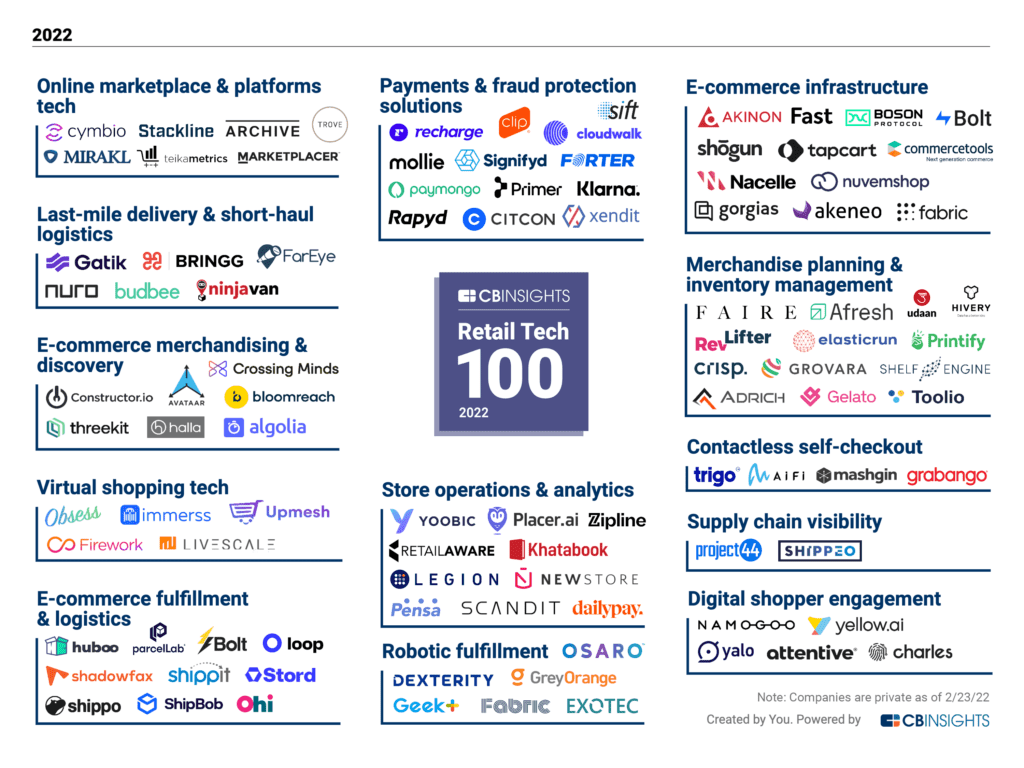

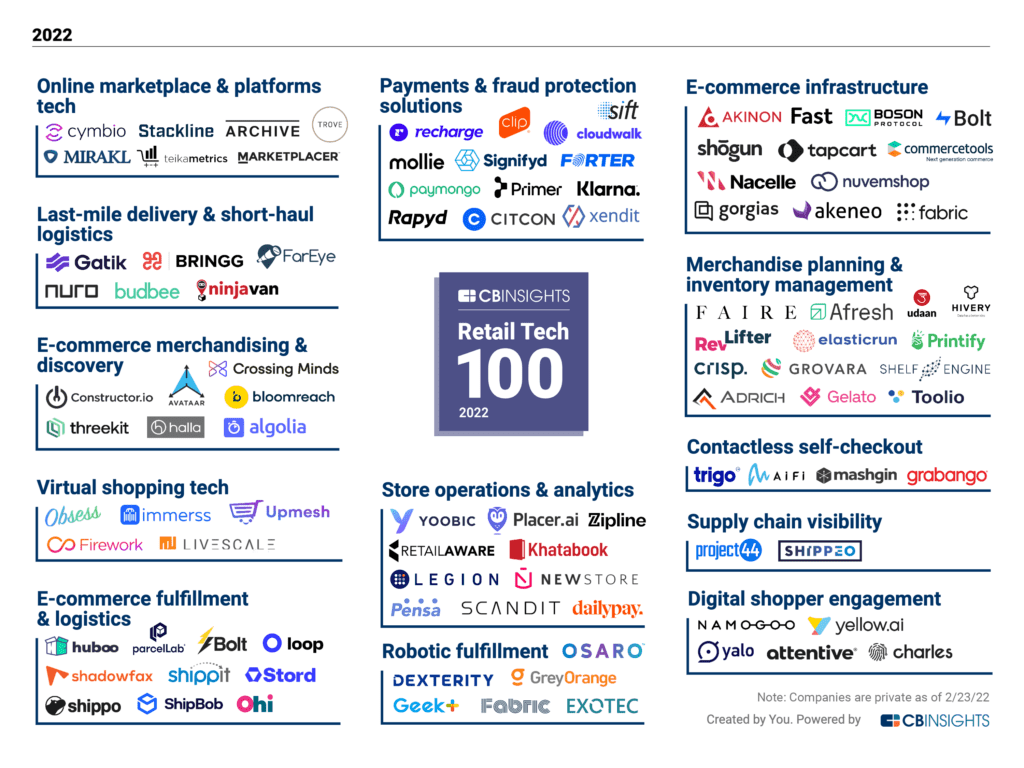

]]>The post The Retail Tech 100: The top retail tech companies of 2022 appeared first on CB Insights Research.

]]>The 2022 Retail Tech 100 cohort has raised approximately $25.4B in equity funding across 373 deals since 2017. The list includes startups at different investment stages of development, from early-stage companies to well-funded unicorns.

The companies were selected by CB Insights’ Intelligence Unit from a pool of over 7,000 companies, including applicants and nominees.

They were chosen based on several factors, including data submitted by the companies, company business models and momentum in the market, and Mosaic scores, CB Insights’ proprietary algorithm that measures the overall health and growth potential of private companies.

Clients can access the entire Retail Tech 100 list and interactive Collection here. (If you don’t have a CB Insights login, create one here.)

Want to be considered for future rankings? Fill out this initial application form (it’ll take no more than a few minutes). If selected, you’ll be asked to complete our Analyst Briefing Survey so that our analysts can better understand your products, customers, and market traction.

The market map above categorizes the Retail Tech 100 companies based on core area of focus. Categories are not mutually exclusive. Companies are private as of 2/23/22.

Table of contents

- Top retail tech companies 2022: Retail Tech 100 investment trends

- Category highlights

- Categories & most well-funded startups

- The Retail Tech 100 Class of 2020: Where are they now?

TOP RETAIL TECH COMPANIES 2022: RETAIL TECH 100 INVESTMENT TRENDS

- Funding trends: In 2021, these 100 private companies raised $13.1B in equity funding across 109 deals, triple the amount raised in 2020. So far in 2022, they have raised $2.3B across 15 deals (as of 3/8/22).

- Future market leaders: Nearly two-thirds of the companies on the list are early- or mid-stage companies. There are 20 early-stage companies (seed/angel and Series A) and 43 mid-stage firms (Series B or Series C) in this year’s cohort. The early-stage grouping includes Immerss and Obsess, which power virtual shopping experiences via video chat and virtual stores, as well as Halla and Constructor.io, which both make tech focused on hyper-personalizing online shopping.

- Global reach: 40% of the 2022 Retail Tech 100 is based outside the US. After the US, the UK and India follow with 6 companies each. Overall, this year’s winners span 19 countries, including Singapore, Australia, China, and the Netherlands. Companies from emerging markets where informal retail is still dominant — like India, Indonesia, the Philippines, and Mexico — are notable additions to this year’s list, as their inclusion indicates that tech companies in locations like these are making progress toward digitizing retail operations.

- Unicorns: Thirty-six of the 100 companies (36%) are valued at or above $1B as of their latest funding rounds. Among the most recently crowned are Scandit, which makes mobile computer vision technology for use across store operations; Fabric, which maintains small robotic fulfillment centers that are utilized by Walmart and Instacart; and Singapore-based Ninja Van, a provider of last-mile delivery services for companies in Southeast Asia.

- Top investors: Salesforce Ventures is the most active investor in this year’s Retail Tech 100, having made investments in 10 companies across 19 deals since 2017. Tiger Global Management and Insight Partners, which have both invested in 9 companies on the list, are tied for second. Among Salesforce’s investments is a Series B round for ThreeKit, which makes 3D content for e-commerce sites, in November 2021.

- Most well-funded companies: The biggest rounds of the year went to BNPL giant Klarna, which closed a $1B growth equity deal in March 2021, and online checkout player Mollie, which raised $800M in Series C funding in June 2021. Klarna is also the most well-funded company among the Retail Tech 100, having raised over $3B in funding. Autonomous delivery company Nuro follows with $2.1B in total funding.

Clients can access all 100 companies on the CB Insights platform here.

CATEGORY HIGHLIGHTS