More than any previous generation, millennials are embracing new and alternative ways of managing their money. We break down how millennial sensibilities are shaping innovation in personal finance across 5 core areas and how startups & incumbents are responding.

Millennials have come a long way from the industry-destroying, avocado-toast-eating stereotype of the 2010s.

With the oldest members of this disruptive generation now in their early 40s and the youngest in their mid-20s, their financial goals are changing.

A 2020 survey by Bank of America found that millennials’ top financial priorities include saving for retirement (75%) and building an emergency fund (51%). Meanwhile, saving for “life milestones and future goals” (73%) has grown 10 percentage points compared to 2018.

But millennials face significant headwinds in making those financial dreams a reality. Having come of age during the Great Recession and its climate of wage stagnation, and being burdened by unprecedented levels of student debt, millennials have been called “the brokest generation.”

However, millennials are proving to be a fiscally conscientious generation, saving more and earlier than previous generations did at their age.

As millennials head deeper into adulthood and make more money, the personal finance space is adapting to their unique money management attitudes in a few key ways:

- From in-person to online. Millennials are partial to digital banking. According to a 2021 Capco report, 78% are using mobile banking — the highest among any generational group — while 75% also rely on online banking services. Finance companies are aligning their services to reflect these preferences.

- From big banks to challenger banks. One fourth of millennials now have their primary checking accounts in digital-only banks, according to a 2021 study by Cornerstone Advisors. In addition, 77% say they are likely to move their bank account to a digital-only bank, according to Galileo Financial Technologies. This openness to banking alternatives presents opportunities for fintech startups looking to innovate in financial services from the outside.

- From “the way it is” to “the way it could be.” In 2013, 70% of millennials believed that the way that people purchase things would be totally different in 5 years, and 33% believed that one day they wouldn’t need a bank at all. Eight years later, millennials are even more comfortable with the idea of alternative financial systems, and this has opened the door to a variety of innovations, from alternative investment vehicles like cryptocurrency to point-of-sale lending alternatives.

Incumbent financial institutions are feeling the effects of millennials’ disruptive attitudes, with the share of primary bank customers dropping by nearly 7 percentage points in 2020 at banks such as Wells Fargo and Bank of America.

Meanwhile, digital-first banks are hitting user growth milestones. Chime, for instance, has reached 12M customers in 2021 — a 50% increase year-over-year (YoY). UK-based Revolut boasts 16M users globally, while Nubank takes the top spot among challengers with 40M users across Latin America.

But legacy institutions are fighting back, cherry-picking the best financial innovations that their younger competitors develop — investment robo-advisors, AI-based budgeting, and expense monitoring — and incorporating them into their services.

There have been some high-profile failures, such as JPMorgan’s short-lived mobile bank app Finn. But incumbent banks are also at the forefront of some of the most promising innovations in personal finance today, such as virtual banking assistants powered by artificial intelligence and voice control.

In this report, we’ll look at how millennial money sensibilities are shaping innovation in personal finance across 5 core areas and how startups & incumbents are responding.

How millennials think about money

To understand where these millennial money behaviors come from, it’s important to understand 3 socio-economic forces that have shaped the generation: the Great Recession, the student loan crisis, and the Covid-19 pandemic.

Millennials were almost four times as likely as other generations to find themselves unemployed during the recession, and households headed by millennials born in the 1980s actually lost net worth between 2010 and 2016.

Meanwhile, 1 in 3 millennials has student loan debt, according to the Education Data Initiative. And out of 45.4M Americans who owe on student loans, millennials make up 14.8M — more than any other generational group.

Finally, the Covid-19 pandemic accelerated digital transformation trends that were already underway, such as the shift from in-person to digital banking services. Online banking usage increased by 35% during the pandemic, according to Deloitte.

From 2015 to 2020, branch usage had already decreased by 35% across all age groups. Branch usage dropped the most among the youngest age groups, with a 48% decrease among 18- to 24-year-olds and a 44% decrease among 35- to 49-year-olds. What’s more, a poor mobile banking experience is now the biggest attrition driver — not fees or customer service.

With their unique financial pressures and their digital-first backgrounds, millennials are looking for new ways to manage their incomes, debt, and future savings. Below, we analyze how millennials are approaching personal finance across:

- Banking: Brick-and-mortar is out; digital and mobile-first are in

- Budgeting & Saving: Millennials go mobile and embrace automation

- Investing: Robo-advisors and micro-investing lower barriers to entry

- Payments: Mobile is replacing cash

- Borrowing: Credit-shy millennials embrace PoS lending

1. Banking: Brick-and-mortar is out; digital and mobile-first are in

Traditional banks like Chase and Bank of America are increasingly battling for market share with a new class of competitor: challenger banks. These digital-first banking alternatives are well-funded, adding customers rapidly, and ready to compete with the traditional banks for market share. And millennial preferences are leading the way.

Compared to other generations, millennials are the least loyal to their current financial institution. Thirty-seven percent are likely to switch banks in the next year, and 33% already switched in the past 2 years, according to a 2021 Morning Consult survey. While 64% of young customers would endorse their bank’s products, 56% would still switch to an Apple or Google banking solution if it became available, per Oracle.

The generation’s disenchantment with traditional banking institutions is evident in their unwillingness to talk to bank employees. Only 1 in 5 customers between the ages of 21 and 40 say they prefer to talk to a bank employee to get informed, according to Cornerstone Advisors.

Fees are another factor driving budget-conscious millennials away from traditional banks. When asked about the most important credit card feature, for example, “no annual fees” came in third place for millennials according to a 2021 survey from The Ascent. No-annual-fee credit cards are also the second-most popular type of credit card among millennials, with cash back cards holding the top spot.

Then there’s the mobility aspect, which became even more important in the wake of the pandemic. The share of millennials using mobile banking jumped from 45% to 55% during the pandemic, while branch use decreased from 13% to 5%, according to American Bankers Association. Fifty-five percent of millennials use a banking app on a daily basis, per a Plaid report.

THE RISE OF Challenger Banks

These factors have created an opportunity for challenger banks to take on incumbents for financial dominance. Digital-first banks such as Chime and Current have risen to prominence with a no-fee, digital-first experience targeted directly at millennials.

Their message appears to be resonating: Chime is expected to surpass the 13M client mark this year, cementing its status as the largest US-based challenger. Current trails with 4M users but is poised for more expansion as target groups like Gen Z and Generation Alpha come of age. In fact, half of its clients are first-time account holders.

But the growing popularity and accessibility of digital banking services can prove to be costly for young consumers. Forty-six percent of millennials with 2 or more checking accounts were charged overdraft fees in 2020, compared to just 35% in 2018, according to Cornerstone Advisors. The cause? Forty-one percent say they lost track of their balance.

Recognizing consumers’ need to avoid unnecessary fees, banking app Dave launched in 2017 with budgeting and overdraft protection tools. If a user is about to overdraft their account, they can get a $100 advance to avoid incurring fees. Four years after launching, the app boasts 10M users who have collectively saved almost $200M in fees so far.

Describing itself as “banking for humans,” the company now offers a fee-free debit card, a banking app, as well as a tool for job seekers called Side Hustle. In June 2021, Dave announced it’s going public at a $4B valuation.

Spotting opportunity in the US market, several international challenger banks are setting their sights on the US, including the UK’s Revolut.

In March 2020, Revolut launched in the US through a partnership with Metropolitan Commercial Bank. The app offers a budgeting tool, allows users to send and request payments, get their paycheck 2 days in advance, and more. As of September 2021, the company has attracted 300,000 clients in the US — a modest number compared to its 16M users globally. In March 2021, the challenger applied for a US banking charter — if approved, it could see accelerated growth in the market.

Revolut’s global userbase doesn’t even come close to that of Brazil-based Nubank, the world’s biggest challenger bank with 40M customers in Colombia, Brazil, and Mexico. The company’s first product was a fee-free credit card, a welcome alternative to the high credit card fees of Brazil’s traditional banks. Today, it offers life insurance, personal loans, digital accounts, and money transferring. In October 2021, the company filed to go public in the US, seeking a $50.6B valuation.

Not all challenger banks have been successful in their global pursuits. Monzo, another UK-based challenger bank, applied for a US banking license in 2020, only to withdraw its application in October 2021 following difficulties working with regulators.

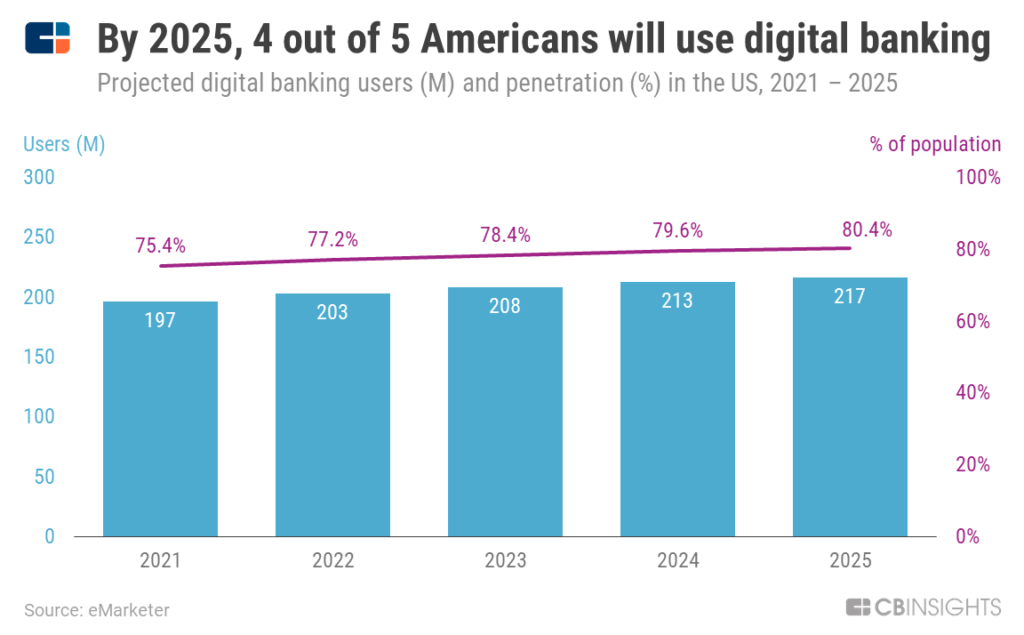

The strength of the challenger bank value proposition rests on its digital-first focus. The vast majority of US consumers use mobile banking, with most relying on it as the number one access method to their bank account. The number of digital banking users is expected to continue growing each year, reaching 80% of all US consumers by 2025, per eMarketer.

But the road to the digital-only future hasn’t always been smooth. Simple, an early contender founded in 2009, floundered following its 2011 launch before ultimately being bought by Spanish banking giant BBVA in 2014. It finally shut down in January 2021.

Incumbents have responded to challenger banks’ disruptive presence by introducing digital-first offerings of their own. Bank of America, Capital One, Chase, PNC, and Wells Fargo all offer digital and mobile banking options.

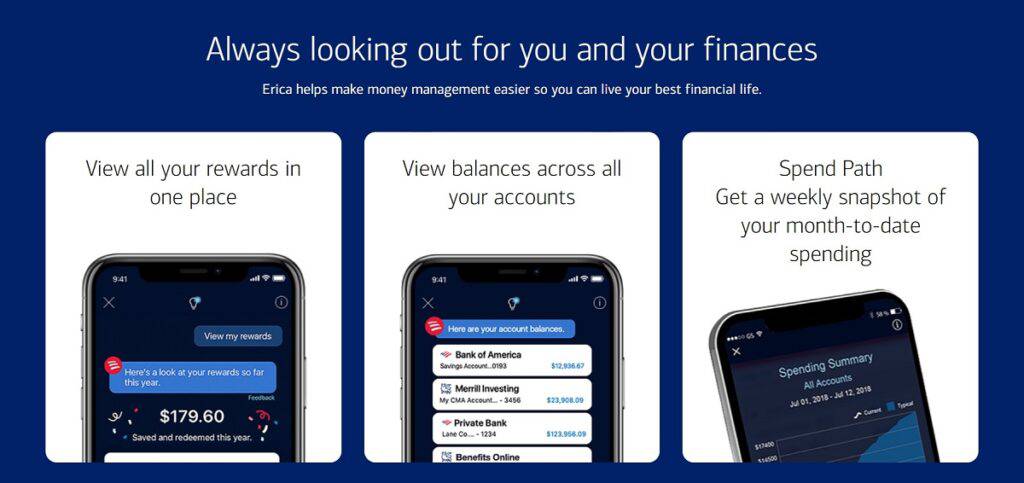

For example, Bank of America’s mobile banking app includes a virtual assistant called Erica. Among many useful features, Erica allows users to get reminders about upcoming bills and credit score changes and warns them about overdrafting their accounts. In Q1’21, 19.5M Bank of America customers were using the tool compared to 12.2M in Q1’20 — a nearly 60% increase year-over-year.

Bank of America uses phrases such as “live your best financial life” to appeal to younger generations. Source: Bank of America

Wells Fargo plans on expanding its mobile banking services by launching Fargo, an AI-powered virtual assistant, in 2022. With the help of Fargo, customers will be able to get budgeting tips, pay bills, make payments, and more. The bank is also updating its mobile app, which currently has 27M users.

Wells Fargo, Capital One, and Bank of America are also looking to chatbots as a way to provide more responsive, real-time digital services for customers.

2. Budgeting & Saving: Millennials go mobile and embrace automation

Between retirement savings, house savings, emergency fund savings, and student loan debt — not to mention day-to-day expenses like housing, groceries, and healthcare — millennials have more demands on their financial attention than any previous generation.

But contrary to the stereotypes about their whimsical spending habits, millennials are just as budget-conscious as other generations — they just budget and save differently.

Specifically, millennials are embracing the automation and machine-learning capabilities of fintech companies to help them advance toward their savings goals without having to think about it.

TAKING BUDGETING TO THE NEXT LEVEL

The millennial age group has played a significant role in popularizing budgeting apps. Only 4% of baby boomers use mobile banking apps for budgeting, compared to 17.5% of millennials, as shown in a Chase Digital Banking Attitudes Study.

Mint, one of the first personal budgeting tools to break through, launched in 2007. It acquired 1.5M users in under 2 years on its way to being acquired by Intuit in 2009 for $170M. Today, Mint has tools to help the millennial money manager tackle spending as well as credit cards and loans.

Budgeting app Mint has expanded its purview to cover credit scores and investing. Source: Mint

But Mint is far from the only player in the budgeting app space:

- You Need a Budget (YNAB), which claims its users save an average of more than $6,000 in their first year, offers new users a one-month free trial after which they can opt for a monthly or yearly subscription plan.

- Personal Capital offers free budgeting and net worth tracking as a customer acquisition strategy for its financial advising services. It has 2.5M users and was acquired by Empower Retirement for $1B in 2020.

- Goodbudget provides tools for couples who want to manage their budgets together.

- Mvelopes takes the popular “envelope” method of budgeting digital by letting users allocate money to different categories directly through the app.

- Moneydance provides numerous features for users who want an in-depth overview of their spending, saving, and investing.

- EveryDollar utilizes the zero-based budgeting method in which a user’s entire income goes toward paying off debts, other expenses, and savings, with nothing left over. Free and premium versions are available.

Another millennial-driven trend in the budgeting and saving space is AI-powered virtual spending services:

- Apps like Cleo and Olivia use AI to analyze users’ bank account balances and spending patterns, set budgets, and save money automatically.

- Digit syncs with users’ bank accounts, analyzes their spending patterns, and siphons unused cash into a separate Digit account. The app is also notable for its SMS-based user interface, which lets users manage their Digit account via text. As of June 2021, the company offers a banking service called Direct that includes a debit card. Digit was acquired by Oportun for $213M in November 2021.

- Qapital lets users set rules for when to save money. Users can also set group savings goals — a useful feature for millennials working toward long-term financial goals with a partner, family, or friends. Originally launched in 2015, Qapital has raised $52M in funding to date and gained more than 2M users.

However, apps that focus primarily on automated savings may be at a disadvantage, as the feature is relatively easy to replicate. In 2018, robo-advisor Betterment, for example, rolled out a “Smart Saver” product that directly mimics Digit’s set-and-forget approach, and paired it with a 2% monthly interest rate (Digit offers 1% every 3 months).

In an effort to make saving money more exciting, prize-linked savings apps such as PrizePool and Yotta give users the opportunity to win cash prizes. To enter a drawing, the user simply deposits money in their savings account.

PrizePool, for example, holds a weekly drawing where users can win thousands of prizes, with $25,000 being the biggest prize. There’s also a referral program that allows users to get 10% of a prize won by a user they referred to the app. In June 2021, it raised $10M in a Series A funding round with plans to grow its team and issue debit cards.

Yotta also raised a Series A funding round in early 2021 worth $13M. The app works by issuing a ticket for every $25 the user deposits, which is then connected to 7 random or hand-picked numbers. Every day for a week, the app draws a random number, and if it’s a match, the user wins a prize. If all 7 numbers match, they’ll win $10M. The company has also launched a debit card with a special feature that gives users a chance to win a prize every time they swipe their card.

Incumbents have taken note of consumers’ appetite for money management and saving solutions. Barclays has introduced budgeting features into its mobile apps, including the ability to control spending in major categories like groceries, restaurants, bars, gas, and phone.

But not all efforts to integrate these features have been successful. Chase’s digital-first app Finn mirrored Qapital’s automated rule-setting model, but after less than a year the big bank announced plans to shutter the service and move its customers to its main Chase Mobile app product.

3. Investing: Robo-advisors and micro-investing lower barriers to entry

The Great Recession’s impact on millennials’ financial lives is most pronounced in investing. After watching others’ savings take a hit in the downturn, millennials grew highly skeptical of investing.

Millennials also have fewer assets to invest than previous generations, as more “immediate” financial pressures like housing, healthcare, and student loan repayment consume most of their resources.

Now, tech firms are taking on the challenge of helping cash-strapped millennials invest in their financial futures across 4 key areas: retirement, active investing, passive investing, and alternative investing.

Thanks to fintech firms making investing more accessible, a growing number of millennials are entering this space, making up 14% percent of investors in 2020 compared to only 9% in 2017, according to a Broadridge Financial Solutions study.

Retirement

Millennials will likely need more retirement savings than previous generations, as they are expected to live longer and receive less from Social Security and other programs. The median millennial has $23,000 in their retirement savings account, according to a 2020 Transamerica Institute study, while 12% of millennials have no retirement savings.

Cost has been a significant barrier to accessing retirement services. Legacy financial advisors typically require balances of at least $100,000 to access their services, a bar that few millennials can enter considering they own only around 5% of the wealth in the US.

Enter the robo-advisor, which uses software to automate much of the manual work of giving financial advice or managing investments. Robo-advisors rose to prominence on the strength of 2 core promises: lower fees and low starting investments.

Betterment, one of the first robo-advisors on the scene, has a distinctly millennial story. Jon Stein, a millennial himself, founded the company in 2008. By 2018, the average Betterment user was 35, and about two-thirds of the company’s customers were millennials. Betterment has also introduced a socially conscious portfolio option, which seems custom-built to appeal to millennials’ values-driven sensibilities.

Betterment made its name on the promise of personalized, professional-grade financial advice without the professional-grade fees.

Other contenders in the robo-advising space include:

- Wealthfront offers a wider range of investing products than Betterment, including 529 savings accounts and alternative asset classes, such as natural resources and real estate. It also offers a digital financial planning tool called Path, which helps users adjust their long-term goals of saving money as their financial situation changes with things like new jobs, children, and home buying.

- Wealthsimple has higher management fees than either Betterment or Wealthfront at .40%-.50%, compared with the flat .25% per year charged by Wealthfront and Betterment. Like Betterment, Wealthsimple offers a range of socially responsible investment (SRI) options to appeal to values-driven millennial investors.

- Ellevest seeks to differentiate itself in the crowded robo-advisor market by targeting its services specifically at women. The company says that it designs its products to account for the unique financial needs that women have, such as longer lifespans and covering child and eldercare obligations; however, the range of accounts supported by Ellevest is limited, and the platform doesn’t include more sophisticated financial features, like tax-loss harvesting, which other robo-advisors provide.

Betterment is the largest among these robo-advisors, with $26.8B under management from 615,000 accounts, as of September 2021. Wealthfront, meanwhile, has 307,000 accounts and a reported $21.4B under management.

But incumbents aren’t simply surrendering the retirement space to robo-advising startups. In February 2021, Goldman Sachs launched its robo-advising platform, Marcus Invest, allowing anyone with a minimum of $1,000 and access to a smartphone to open an account.

Other major investment companies that have entered the robo-advising space include Vanguard and Charles Schwab, requiring a minimum investment of $3,000 and $5,000, respectively.

But there’s still plenty of territory to be claimed: robo-advising is estimated to be a multi-trillion-dollar market, per CB Insights’ Industry Analyst Consensus.

Passive investing

While robo-advisors have focused primarily on making retirement and other long-term investing goals more accessible to millennials, another group of companies has set its sights on opening up retail investing.

As with robo-advisors, the rise of micro-investing apps is closely tied to millennials’ financial coming-of-age. One of the most prominent examples, Acorns, launched in 2014 and specifically targeted college students, offering them a low-friction entry into investing by rounding up their credit card purchases and investing the difference in a dedicated Acorns account.

Acorns has grown with its original target audience and now offers 5 product packages. As of early 2021, the company has surpassed the 9M user mark, managing $4.3B in assets.

Another micro-investing app, Stash, built its platform around the promise of empowering users to invest in portfolios that align with their values. This seems built to appeal to millennials, who are 2X more likely than other investors overall to make impact investments.

Ninety-nine percent of millennials have expressed interest in the idea of sustainable investing, and 88% are interested in investing in solutions to combat climate change, according to a 2021 Morgan Stanley survey. Launched in 2015, Stash has 5M clients as of 2021, with an average age of 30 — squarely in the center of the millennial generation.

Active investing

While robo-advisors and micro-investing apps focus primarily on helping millennial investors grow their money passively, another group of young companies is developing services for those who want to be more hands-on with their money.

Robinhood, for example, is deeply intertwined with the millennial story. The app, which lets users invest in individual publicly traded companies and funds without paying commission, launched in 2013 with the goal of making investing accessible to people with smaller bank accounts in the wake of the recession. By 2015, 80% of Robinhood’s user base was made up of millennials, with an average user age of 26.

When Robinhood launched, no major brokerage offered zero-commission trading. The company remained an outlier in this regard until October 2019, when Charles Schwab, E-Trade, and TD Ameritrade all announced they would no longer levy commissions on ETF, options, and stock trading. Robinhood had effectively disrupted this long-standing brokerage practice — in turn lifting a major barrier for first-time investors.

The company has had its fair share of controversy. In early 2021, for instance, it limited purchases of GameStop and other “meme stocks,” reportedly to ensure it continued to meet its clearinghouse deposit requirements. In response, the company received harsh blowback from the public and left many account-holders wondering whether they should close their accounts.

Nevertheless, by July 2021, Robinhood rebounded enough to garner a valuation of $32B in its IPO. For more on Robinhood’s strategy and controversial business model, check out our report on How Robinhood Makes Money.

Source: Robinhood

M1 Finance launched a year after Robinhood with a similar commission-free stock trading model. Unlike Robinhood’s platform at the time, M1 offered fractional shares, meaning users could invest all of the funds they transfer to the platform rather than leaving cash on the table. (Robinhood now also offers fractional share trading.) M1 also offers Roth IRA, Traditional IRA, and SEP IRA accounts in addition to its commission-free taxable investment accounts.

Another no-fee investment platform, Zecco, was acquired by Ally Bank in 2016 and became part of the company’s investment product, Ally Invest. The platform offers users the choice between managed portfolios and self-directed trading, charging $4.95 for stock and ETF trades and $0.65 per contract on options trades.

Alternative investing

Millennials are also shaking up alternative investment categories, such as real estate funds, and other non-traditional investments. Thirty-two percent of affluent millennial investors are currently using alternative investments, while 60% see future opportunity to invest, according to a 2021 EY Global Wealth Research Report.

In the real estate sector, New York-based Cadre lets high-net-worth individuals and institutional investors buy and sell commercial and family real estate at lower fees than private equity funds. The company was valued at $801M in its Series C in 2017.

Fundrise also lets users invest in real estate portfolios, touting annual returns between 8% after 1 year and 66% after 6 years. The company manages $2.5B worth of real estate and has approximately $500M in equity assets under management.

Cryptocurrency is becoming a more popular investment category among millennials, with 49% saying they’re somewhat or very comfortable investing in crypto, according to a 2021 Bankrate survey. Twelve percent believe this is the best way to invest in the next 10+ years.

Coinbase is the most popular consumer-facing cryptoasset exchange in the United States. In recent years, it has expanded beyond its original core service as a bitcoin wallet and retail exchange to offer services including cryptocurrency custody and professional and institutional trading platforms. In April 2021, the company went public at a $65.3B valuation.

Source: Coinbase

Meanwhile, Circle bills itself as “a new kind of global financial services company,” allowing individuals, institutions, and entrepreneurs to use, trade, invest, and raise capital with open crypto technologies. The company’s Poloniex exchange lets users trade more than 60 cryptoassets, while Circle Pay promises to let users send money “like a text,” free of charge. In July 2021, Circle announced its plans to go public by the end of the year at a $4.5B valuation. So far, the site has had almost 10M retail customers and facilitated more than 100M transactions.

Millennials are also showing an interest in non-fungible tokens (NFTs), which are unique, non-replaceable data units stored on a blockchain. An NFT can be anything from a piece of writing to a domain name. In March 2021, the artist Beeple sold a digital drawing for $69M, an amount that turned more than a few heads and brought NFTs to mainstream attention. Millennials made up 58% of the bidders for the piece.

While digital collectibles pose an innovative investment opportunity, only 12% of the general population has invested in NFTs, according to a 2021 Adweek survey. But millennials are considerably more open to purchasing NFTs, with 27% having made an investment.

Collecting NFTs goes beyond art. France-based Sorare is behind a fast-growing digital soccer platform where users can buy and sell cards of their favorite players in the form of NFTs. Since its founding in 2019, the company has grown to 600,000 users and recently raised a $680M Series B at a $4.3B valuation.

It’s planning to branch out into other sports, where it faces strong competition from other NFT platforms in the sports collectibles space — such as Candy Digital, a partner of Major League Baseball that raised a $100M Series A in October 2021.

4. Payments: Mobile is replacing cash

You won’t find many millennials pulling up to an ATM to withdraw cash for spending. Instead, millennials are more frequently managing their payments on their smartphones — and cash is becoming increasingly irrelevant as a result. Fintechs are facilitating the shift, building out new mobile-first payment options that make giving and receiving money as simple as the swipe of a smartphone screen.

Forty-six percent of millennials are using digital or mobile wallets to make payments, while only 22% of baby boomers are doing the same, according to a 2020 Savanta survey.

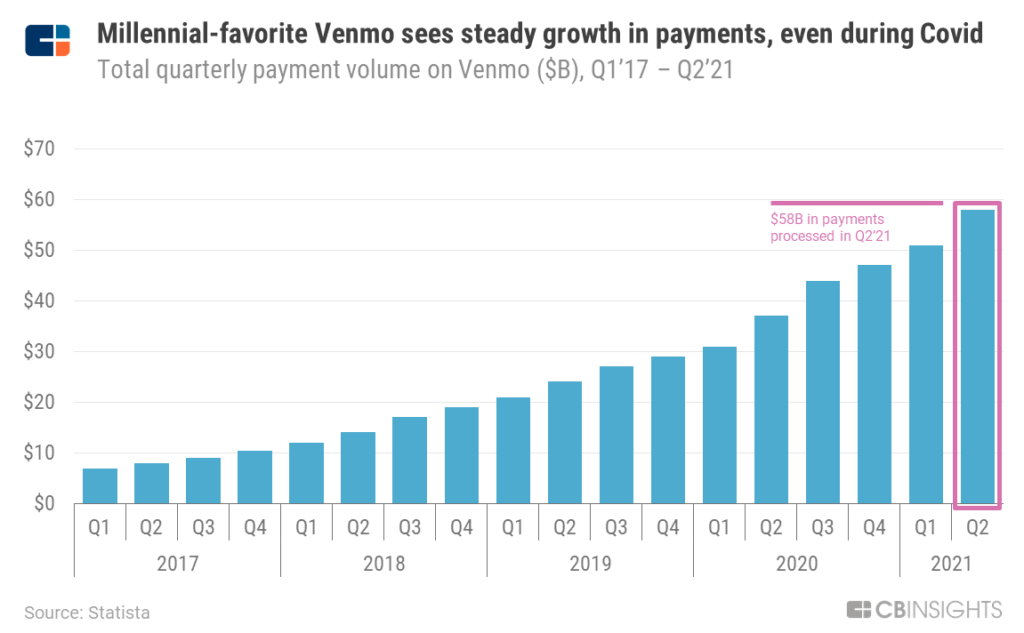

One mobile payments company that’s closely connected to millennials is PayPal-owned Venmo, an app that provides a convenient way to split bills and pay back cash borrowed from friends. In Q2’21, it processed $58B in total payment volume — more than double the $24B processed during the same period in 2019.

Banking incumbents aren’t ceding the payments space to the tech giants and startups without a fight. Venmo competitor Zelle is owned by Bank of America, BB&T, Capital One, JPMorgan Chase, PNC Bank, US Bank, Citibank, and Wells Fargo. According to company reports, Zelle processed $307B in payments in 2020, almost double Venmo’s $159B. Recently, however, a growing number of Zelle users have fallen victim to scams, losing thousands of dollars, which has raised questions around security and fraud protection.

While bank transfer was the number one method for peer-to-peer transactions just a few years ago, this is no longer the case. Forty-three percent of consumers now rely on direct money transfer services like Venmo or Square‘s Cash App to send payments, compared to 34% who use banks, according to a 2021 Global Consumer Survey.

The shift to mobile impacts more than just peer-to-peer payments. The number of mobile payment users at in-store points of sale is expected to increase from 92.3M in 2020 to 125M in 2025, according to eMarketer, with millennials making up 4 out of 10 users of digital wallets.

Phone companies have played a significant role in the shift to mobile payments. Apple launched its mobile payments platform, Apple Pay, in the fall of 2014. Google followed Apple’s lead with Google Pay for Android users in 2015. Samsung Pay also came out in 2015.

Seven years later, Apple Pay accounts for 92% of all mobile wallet transactions, according to a Pulse Debit Issuer study, leaving only 5% for Samsung Pay and 3% for Google Pay.

Another trend taking shape in the payments space is the rise of virtual credit and debit cards. With online data security becoming a growing concern, virtual cards provide an added layer of security by generating unique card numbers for each individual transaction, thereby limiting the chance of fraud.

Virtual cards are one area of financial innovation where incumbent banks are on the forward edge of innovation. Citibank allows its clients to generate fee-free virtual account numbers and set spending and time limits for each number, while Capital One offers virtual cards through its online assistant, Eno. Eno works as a browser plug-in and generates virtual card numbers at checkout when users click the button on their browser.

As cryptocurrencies slowly become mainstream, a growing number of companies are accepting it as payment, including Starbucks and Microsoft. With 49% of millennials already owning cryptocurrencies, it’s no surprise that more than half of millennials are open to making payments using crypto, according to a 2021 Piplsay survey.

A final innovation in payments with a strong millennial tie is loyalty programs. While cashback programs have historically been associated primarily with credit cards (which millennials have been slower to adopt than previous generations), a handful of startups have emerged that bring this perk to debit users as well.

For example, Dosh is a loyalty shopping app that links with users’ credit or debit card and gives them cash back on purchases made at over 10,000 stores and restaurants. Once a user earns $25, they can transfer it to their account or donate it to charity. Meanwhile, platforms like Lolli and Pei offer users cash back in bitcoin for purchases made at stores ranging from Starbucks and Panera to GameStop and Sephora.

5. Borrowing: Credit-shy millennials embrace PoS lending

Debt is one of the defining details of the millennial generation. The typical millennial now carries $87K in debt, according to a 2020 Experian study. Fintech companies are turning that number into an opportunity, developing new tech-forward options for millennials to manage the debt they have — and to help them make better borrowing decisions for new big-ticket items, such as homes.

With a growing ecosystem of startups focused on disrupting lending, an Experian study found that fintech firms issued 39.9% of personal loans in 2020. What’s more, millennials and Gen Z accounted for only 28% of bank-issued personal loans — a clear indicator younger generations are turning away from traditional lenders.

Incumbent banks arguably have more to lose in the lending category than anywhere else, given how central profits from loan interest are to the traditional banking business model.

Realizing this, a growing number of traditional banks are getting into the digital lending business, primarily as investors. For instance, in 2021 alone, Citibank has invested in alternative lending platforms Clerkie, Octane, and Splash Financial.

Among the rising group of fintech lenders, SoFi hit the scene in 2011 with the goal of providing a more affordable option for financing education. The company says it saves its members an average of nearly $19,000 when they refinance student loans.

SoFi has since expanded its portfolio to include other forms of lending, such as mortgages and personal loans. The company makes money primarily via securitizations and whole loan sales. As of Q2’21, SoFi has 2.6M users — a 100% increase YoY.

Another fintech company taking aim at student loans is Credible, which claims to have helped over 55,000 clients save money on loans in 2021 so far, including saving them $92M in interest.

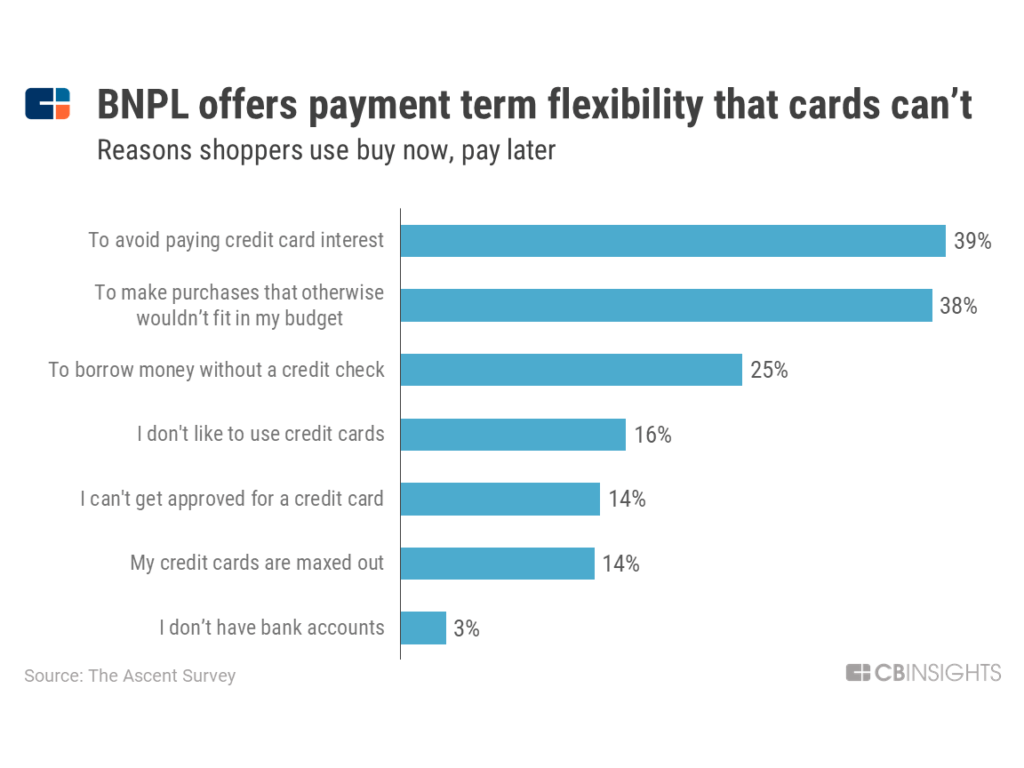

In recent years, “buy now, pay later” (BNPL) companies like Affirm and Klarna have seen considerable adoption among younger generations, having shaped their lending offerings around millennials’ skepticism toward credit cards. Compared to credit cards, they charge less interest and fewer fees. For instance, 98% of transactions made with Klarna are free of interest.

Instead of relying on fees, BNPL providers earn money by charging the retailers who aim to attract more shoppers with convenient payment plans.

The retailers’ gamble seems to be paying off. In 2021, 41% of millennials have used a BNPL provider, compared to only 17% in 2019, according to Cornerstone Advisors. Klarna now has 20M customers in the US alone, with an average customer age of 33. By 2024, the BNPL market size in the US is expected to reach a value of $114B, according to Mercator Advisory Group.

Seeing the potential of BNPL apps, big tech players are looking for ways to get their piece of the pie. In August 2021, Amazon announced a partnership with Affirm, allowing shoppers to create a payment plan for items over $50. The companies expanded the partnership in November, making Affirm the exclusive BNPL provider for Amazon.

Apple and Goldman Sachs are also working on a BNPL offering called “Apple Pay Later,” while Google Pay has partnered with Afterpay and Klarna to provide BNPL services for in-store shopping.

However, considering that most shoppers rely on BNPL apps to buy small-ticket items such as clothing and accessories — non-essentials they simply wouldn’t have bought before — this raises concerns that young customers will be driven to reckless spending and incur large amounts of debt.

MILLENNIALS AND THE HIDDEN RISK OF FInancial Education

Fintech tools are more accessible today than ever before, but there is still a long way to go to achieving widespread financial literacy.

A 2021 TIAA Institute study found only 18% of millennials answered most questions measuring financial literacy correctly, while 24% were considered to have poor financial literacy. However, millennials who received some form of financial education answered more questions correctly than those who did not, illustrating the importance of learning about money management.

Pervasive financial illiteracy among the younger generation doesn’t mean that they aren’t eager to learn about managing their finances. Financial influencers, or “finfluencers,” have been gaining more prominence on platforms like TikTok, where they share investment and savings tips in bite-sized videos. Robo-advising companies like Betterment and Wealthfront have even partnered with finfluencers to promote their platforms.

But social media is often rife with misinformation, making it necessary for young investors to do their research before following financial advice they receive on TikTok or Instagram. As the dissemination of financial education becomes more decentralized, it could become harder to separate valuable advice from misleading claims.

The future of personal finance

From banking to budgeting to saving to investing, the money behaviors of millennials have had an indelible impact on the way personal finance has taken shape in the 21st century. But millennials are now facing competition for the attention of startups and financial incumbents from a new source — Generation Z.

Born roughly between 1997 and 2015, Gen Z has never known a time without the internet. While they were alive during the Great Recession, they are too young to remember it or have felt its impact directly. But they saw the effect of both the recession and student loan debt on their parents and their millennial peers, and they’re already working proactively to set themselves up for financial stability.

Seventy percent of Gen Z deposited money in their savings over the last year, and 26% made investments, according to a 2021 Bank of America survey. Forty-six percent of Gen Z also have a secondary source of income or “side hustle,” according to a 2020 LendingTree survey.

All of these factors and more will likely contribute to a very different financial landscape and a different set of financial priorities as Gen Z enters adulthood and takes the reins on their finances. Finance firms will need to watch carefully — and be ready to meet them where they are.

If you aren’t already a client, sign up for a free trial to learn more about our platform.