FanCraze

Founded Year

2021Stage

Series A | AliveTotal Raised

$117.4MLast Raised

$100M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-62 points in the past 30 days

About FanCraze

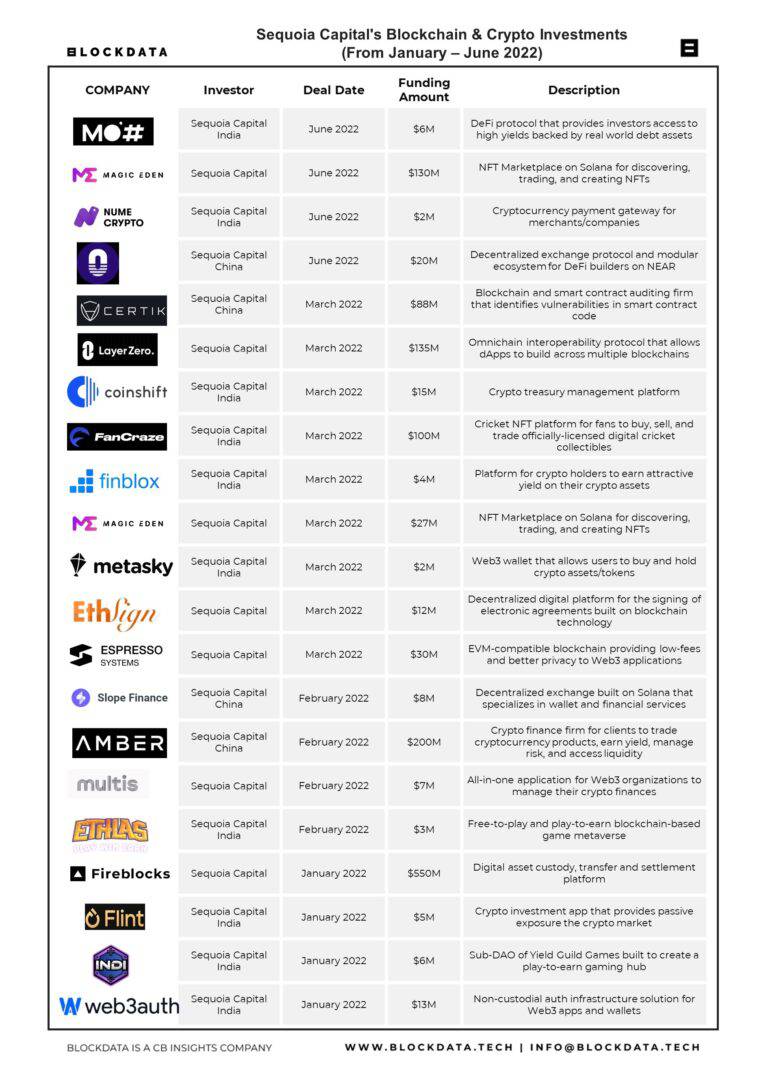

FanCraze is a company specializing in officially licensed cricket digital collectibles within the sports industry. They offer a platform for fans to collect digital player cards and moments, manage virtual cricket clubs, and participate in various interactive experiences. The company primarily caters to cricket enthusiasts and leverages ambassador endorsements to engage its audience. FanCraze was formerly known as Faze Technologies. It was founded in 2021 and is based in Mumbai, India.

Loading...

Loading...

Research containing FanCraze

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned FanCraze in 1 CB Insights research brief, most recently on Aug 17, 2022.

Expert Collections containing FanCraze

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

FanCraze is included in 1 Expert Collection, including Blockchain.

Blockchain

12,836 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Latest FanCraze News

Apr 16, 2023

Synopsis This NFT — a digital certificate of ownership that is traceable on a blockchain — was one of the five exclusive tokens released by Malhotra on the WazirX NFT marketplace, which was launched with much hype about two years ago. Gopal, 38, has over 500 NFTs. ETtech In October 2021, Bengaluru-based blockchain developer Ramesh Gopal aka Mike Blue bought Illuminous Showstopper, a non-fungible token ( NFT ) linked to a sketch by designer Manish Malhotra of a couture piece he had made for actor Kareena Kapoor Khan. It cost Gopal over 3,000 WRX, the native token of the cryptocurrency exchange WazirX, which came to about `2.2 lakh then. It was like owning a piece of history, says Gopal. “It was probably the first fashion-themed NFT drop in India,” he recalls. This NFT — a digital certificate of ownership that is traceable on a blockchain — was one of the five exclusive tokens released by Malhotra on the WazirX NFT marketplace, which was launched with much hype about two years ago. Gopal, 38, has over 500 NFTs . He picked up an NFT of a Deewar poster of Amitabh Bachchan from a marketplace called BeyondLife.club and a trump card of cricketer Jasprit Bumrah from a cricket NFT platform called Fancraze . But there was something about Illuminous Showstopper. It came with bragging rights and new investment opportunities, he thought. He was wrong. The fall in WRX’s value has meant Gopal’s Manish Malhotra NFT is now worth just `42,000 — about 19% of what he had paid. The value of his overall NFT portfolio has also eroded by 80% from its peak. Malhotra’s team declined to respond to a query from ET on whether the designer planned to add utilities such as access to exclusive content for his NFT holders. ETtech These could have propped up the value of his NFTs and Gopal would have had something more to show with his Illuminous Showstopper. Even as the value of NFTs plummeted in the middle of a global crypto crisis, India’s NFT investors were faced with a double whammy. WazirX shut down its marketplace in February amid falling transaction volumes. Discover the stories of your interest The boom NFTs rose from obscurity to mainstream popularity in 2021 after an NFT-backed artwork Everydays: The First 5000 Days by the American digital artist Mike Winkelmann aka Beeple sold for $69 million at a Christie’s auction. NFT sales volume soared to $24.9 billion that year, according to market tracker DappRadar. An NFT craze ensued in India as well. There was a deluge of celebrity projects. The number of NFT users in the country at the peak of the cycle in 2021 was pegged at around 1.5 million, according to Statista Digital Economy Compass 2022. The crash The crypto ecosystem began to feel the heat in the summer of 2021 itself. Cryptocurrency Luna collapsed on May 9. Then crypto lender Celsius went bankrupt. By the winter of 2022, Sam BankmanFried, founder of one of the biggest crypto exchanges, FTX, was arrested on charges of fraud. Pranav Sharma, founding partner of Woodstock Fund, a Web 3.0 investment firm, says after the US Federal Reserve hiked interest rates, liquidity evaporated from marketplaces. “A lot of speculative applications (of NFTs) without clear, longterm utility and value simply collapsed,” he says. “That led to the closure of marketplaces that had mushroomed in euphoric times. Many of them had focused on wash trading and non-compliance to attract volumes. This was unsustainable. This is a natural cycle of contraction of marketplaces which will turn around once two fundamental things are addressed: longterm utility of NFT use cases and liquidity in markets.” He adds that NFTs are valuable containers of data and value, with wide-ranging use cases in consumer and financial services. In India, at least five NFT trading platforms have shut shop, run out of money, or pivoted to other models such as using NFTs as ingame assets. Indian edition India’s first NFT marketplace Kalamint, which was launched in February 2021 and climbed to the top 20 in seven months, ran out of funds in December last year amid falling trading volumes, according to an employee of the company. Says its founder Sandeep Sangli: “We had to let go of the team and have been running it with an operational expenditure that we can manage via loans and personal funds until we figure out what’s next. We did not raise enough initially, and when the market turned to what it is, it became harder to raise additional rounds. That affected our growth trajectory.” ETtech When WazirX platform shut down, it said monthly transactions had dropped to $112.24 and it had made just about $6 in fees while server expenses ran into thousands of dollars. NFTs was tipped as the future of the art world, the token that would revolutionise how art works are bought, sold and collected. In India, a bunch of entrepreneurs launched film and cricket memorabilia that had zero utility. These projects soon lost steam. In September 2021, Colexion, a digital market place for NFTs, launched with much fanfare and partnerships with musicians Salim-Sulaiman, actor Suniel Shetty and singer Mika Singh. “That time we had a muted response and that is why we did not release NFTs. People did not know what to do with them and what could be their use,” says Abhay Aggarwal, founder, Colexion. Aggarwal says they have wound up the entertainment division and the company is now focused on selling player card NFTs that can be utilised in an online cricket game and give holders access to signed merchandise. The platform has about 2,000 daily active users and 50,000 registered users from India. “NFTs of celebrities did not go big because celebrities were not well-informed about it. A lot of projects had no utility,” he says. The very approach of some of the celeb projects was wrong, says Abhishek Sistla, cofounder of OmniFlix Network, a peer-topeer network for creators and communities to mint, manage and monetise NFTs. “They were successful in generating hype if that was the objective. Several projects were focused on selling celeb NFTs instead of building a community. Since those projects could not be sustained, people lost confidence in those NFTs,” he says. Experts whom ET spoke to say a lot of NFT projects were looking to capitalise on the hype, make a quick buck and exit, as it happens in any bull cycle. In December 2021, BollyCoin, an NFT platform founded by Atul Agnihotri, entered the market by dropping a pixellated image of Chulbul Pandey, his brother-inlaw Salman Khan’s character from Dabangg. Now, BollyCoin is shifting its focus from trading platform to a new product called BollyShot, which allows users to fund content using tokens, according to a company spokesperson. “The marketplace is not shut, however, our focus is on BollyShot at the moment,” says the spokesperson, adding that the Dabangg NFTs have “iconic value”. Diginoor, another celebrity NFT project backed by Polygon Fund and Cred’s founder Kunal Shah, was founded by two teenage entrepreneurs Shaamil Karim and Yash Rathod. In 2021, it sold Rajinikanth NFTs. Now, the marketplace has shut operations according to sources aware of the matter. According to Rathod’s LinkedIn profile, he has “successfully exited” the venture and Karim has moved on to work in an investment fund. ET tried to reach the founders on Twitter and LinkedIn but did not get a response. “For those who have invested, there is always the possibility of these NFTs finding retrospective value as the earliest mints but it’s a long shot,” says Cyber Shakti, an NFT collector, artist and advisor to multiple projects. Next chapter A few NFT platforms have survived the bear market and are seeing consistent user growth. Tiger Global Capital-backed Fancraze and Dream Capitalfunded Rario are trying to tap the cricket fan base. Rario, a cricket NFT platform, says it has sold more than 1.5 million player cards and has over 700,000 users. “A lot of people in this space took a technology-first approach and not a user-first approach,” says Ankit Wadhwa, cofounder, Rario. “For us the whole idea was to build a cricket fan club. We knew that the level of engagement in the sport is not commensurate to the fan base it has.” ETtech Wadhwa says their target market is 150-200 million cricket fans who engage in apps related to cricket. Jump.trade, launched by Kalaari Capitalbacked GuardianLink, is another NFT marketplace focused on cricket and racing games. Its tokens can be used in online games. It has about 60,000 active users in India, says Kameshwaran Elangovan, cofounder of GuardianLink. Future NFT projects will be community focused, say experts, and could look beyond the arts. Dhruv Saxena, chief strategy officer of Singapore-based Vistas Media Capital, which had launched celebrity NFTs on Fantico, defines this shift: “When this chaos phase gets over, we will bring to the market NFTs with utility, maybe even financial utility. The community-building aspect is also very clear.” Some startups are using the technology to grant memberships or bundle software. Like Pune-based StackOS, which intends to load NFTs with software. In 2022, Zostel launched over 700 NFTs which allowed users to get their trips planned for free by the company. Early this year, it set up Zo House, a membership-only club in Bengaluru for their NFT holders. It is a place to incubate and launch NFT artists in the Web 3 space. Says cofounder Chetan Singh: “Our plan is to increase the value of NFTs for our users.” He says holders of Zo House NFTs have seen the value jump 10x as of date. “Our strength is in building a consumer business. That’s what we know,” he says. “But everyone has their own thesis and NFTs operate on a broad spectrum so use cases will evolve.” Don’t miss out on ET Prime stories! Get your daily dose of business updates on WhatsApp. click here! Saturday, 15 Apr, 2023 The Canada Pension Plan Investment Board (CPPIB) and the Ontario Municipal Employees Retirement System (OMERS) are planning to invest more than ₹4,300 crore ($526 million) in IndInfravit, an infrastructure investment trust (InvIT) that owns and operates Indian road assets and is majority owned by the two investors, said two persons aware of the development.

FanCraze Frequently Asked Questions (FAQ)

When was FanCraze founded?

FanCraze was founded in 2021.

Where is FanCraze's headquarters?

FanCraze's headquarters is located at HD-090 WeWork Enam Sambhav, Mumbai.

What is FanCraze's latest funding round?

FanCraze's latest funding round is Series A.

How much did FanCraze raise?

FanCraze raised a total of $117.4M.

Who are the investors of FanCraze?

Investors of FanCraze include Peak XV Partners, Courtside Ventures, Tiger Global Management, Coatue, Insight Partners and 9 more.

Who are FanCraze's competitors?

Competitors of FanCraze include Cric Studio and 7 more.

Loading...

Compare FanCraze to Competitors

Dibbs is a company specializing in the tokenization of physical collectibles, operating within the blockchain and NFT sectors. They provide a platform for brands and intellectual property holders to create and manage asset-backed NFTs, offering services such as regulated custody, proprietary 3D imaging, and minting of digital tokens. Dibbs primarily serves sectors that deal with consumer products in sports, music, entertainment, toys, and luxury goods. It was founded in 2020 and is based in El Segundo, California.

Sorare is a company focused on the intersection of digital collectibles and fantasy sports within the gaming and sports industry. The company offers a platform where users can collect, play, and win with officially licensed digital cards featuring professional athletes from football, the National Basketball Association (NBA), and Major League Baseball (MLB). The platform primarily caters to sports enthusiasts and gamers. It was founded in 2018 and is based in Saint Mande, France.

Sanspareils Greenlands specializes in manufacturing cricket equipment and is a prominent player in the sports gear industry. The company offers a wide range of products including cricket bats, balls, protective gear, apparel, and accessories designed for both professional and amateur players. Sanspareils Greenlands also provides a lifestyle clothing line that complements its core offerings in the sports domain. It was founded in 1931 and is based in Meerut, India.

Hitwicket focuses on the development of cricket gaming experiences. The company offers a cricket strategy game that aims to provide cricket fans and is expanding into football, NFTs, and blockchain gaming. It was founded in 2012 and is based in Hyderabad, India.

Bitso is a financial services company specializing in cryptocurrency transactions and borderless payments. The company offers a platform for buying, selling, and trading a variety of cryptocurrencies, as well as facilitating crypto-based international transfers. Bitso primarily serves individuals and businesses looking to utilize cryptocurrencies for investment, trading, and payment solutions. It was founded in 2014 and is based in Mexico City, Mexico.

DappRadar is a decentralized application store. The company offers a platform for managing crypto wallets, tokens, and non-fungible tokens (NFTs), as well as providing insights into the market with smart tools. DappRadar serves as a hub for dapp discovery and a distribution channel for developers to reach consumers, while also incorporating community governance through its decentralized autonomous organization (DAO). It was founded in 2018 and is based in Klaipeda, Lithuania.

Loading...