EcoVadis

Founded Year

2007Stage

Secondary Market | AliveTotal Raised

$732MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-19 points in the past 30 days

About EcoVadis

EcoVadis provides business sustainability ratings. The company offers services such as risk and compliance management, sustainable finance, and sustainability performance improvement. Their main products include evidence-based ratings and actionable scorecards that provide benchmarks, insights, and a guided improvement journey for businesses. EcoVadis primarily sells to sectors such as global supply chains, financial institutions, and public organizations. It was founded in 2007 and is based in Paris, France.

Loading...

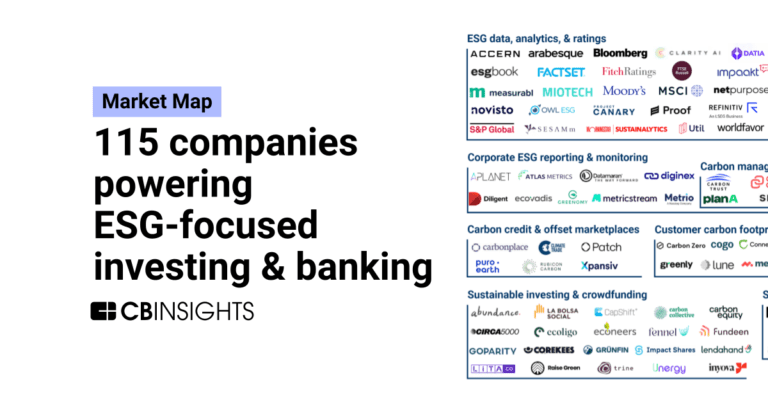

ESPs containing EcoVadis

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The ESG reporting, monitoring, & data analysis market helps companies manage and report on their sustainability performance. These solutions enable organizations to collect, aggregate, and analyze ESG data from various sources, assess their ESG performance against industry benchmarks or frameworks, identify areas for improvement, communicate their ESG efforts to stakeholders, and engage portfolio …

EcoVadis named as Leader among 15 other companies, including Cority, Sphera, and Novata.

EcoVadis's Products & Differentiators

Enterprise sustainable procurement and portfolio management

Engage and manage a portfolio of rated companies, to engage and drive improvements

Loading...

Research containing EcoVadis

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned EcoVadis in 4 CB Insights research briefs, most recently on May 24, 2023.

Expert Collections containing EcoVadis

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

EcoVadis is included in 4 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

4,049 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,249 items

Decarbonization Tech

2,372 items

Companies in the Decarbonization & ESG space, including those working on enterprise and cross-industry decarbonization and emissions monitoring solutions, as well as ESG monitoring and carbon accounting.

Regtech

200 items

Latest EcoVadis News

Oct 25, 2024

HSBC's head office in Dubai. (Credit: Supplied) Banking giant HSBC has launched a new sustainable finance product designed to drive sustainability improvements for mid-sized corporates in the UAE, Egypt, Qatar and Bahrain. On Monday, the bank officially launched its Sustainability Improvement Loan in the UAE. The facility links the interest rates of loans to a company’s environmental, social, and governance (ESG) performance. The interest rate for Sustainability Improvement Loan is linked to changes in borrowers’ sustainability assessments and ratings from EcoVadis, one of the world’s largest providers of business sustainability intelligence and ratings. Borrowers of Sustainability Improvement Loans are required to complete an annual sustainability assessment throughout the duration of the facility. Those whose scores improve may benefit from a reduced interest margin. Similarly, the interest margin may increase if the borrowers’ scores decline. According to HSBC, this new offering aims to simplify the path to sustainable finance for corporates. “The availability of this product will help an even greater number of organisations take demonstrable steps towards their sustainable goals,” said Patricia Gomes, Regional Head of Commercial Banking, HSBC MENAT. “We wanted to create a product that makes sustainability accessible to all of our clients, regardless of where they are on their transition journey.” Who is EcoVadis? EcoVadis is a global leader in business sustainability ratings, providing detailed assessments of companies’ environmental, social, and governance (ESG) performance. With a network spanning over 100,000 businesses across 200 industries and 175 countries, EcoVadis evaluates companies based on a comprehensive set of criteria, helping them understand their sustainability impact. These ratings are instrumental in enabling organizations to improve transparency, reduce risk, and drive positive environmental and social change within their operations. HSBC’s partnership with EcoVadis underscores its commitment to offering clients reliable and globally recognised assessments for sustainability improvement. Focusing on Three Pillars The launch of this new solution highlights HSBCs broader sustainability strategy, which focuses on three key pillars: transitioning existing clients, financing the new economy, and supporting sustainable supply chains. Transitioning clients: HSBC aims to help companies of all sizes, shift to more sustainable business practices. The Sustainability Improvement Loan is part of this effort, allowing even our smaller clients to participate. Financing the new economy: HSBC is also committed to funding innovative climate technologies and large-scale infrastructure projects like solar parks and wind farms, which are critical to decarbonisation. Supporting supply chains: As the world’s largest trade bank, HSBC is focused on helping companies decarbonise their supply chains, not just their own operations. This includes offering financing options like Sustainable Supply Chain Finance. Client Experiences Clients who have already taken advantage of the loan have expressed enthusiasm about its simplicity and impact. “For us, it was an obvious choice,” said Martin Bradley, Group CFO at Dulsco Group. “The Sustainability Improvement Loan allows us to lower our cost of capital while we continue working on our ESG goals. It’s simple to achieve because it aligns perfectly with what we’re already doing to improve our sustainability practices.” Another client, Zulfiker Hasis, Founder and CEO of Delight Investment Group, highlighted the financial and reputational benefits. “We were already on the path of improving our sustainability score, but the fact that HSBC offers a financial incentive made it even more compelling,” he said. “It’s not just about reducing costs. We can now proudly use this loan as part of our brand when we communicate with clients, showing that we are committed to sustainability.” The product is already live and available to HSBC clients in the UAE, Qatar, Egypt, and Bahrain. How the Loan Works The Sustainability Improvement Loan is designed to encourage mid-sized companies to make real, measurable changes to their sustainability practices. Companies with an EcoVadis rating can link their loan interest rates to their ESG score. If their score improves, their interest rate will decrease. If it declines, the rate will rise. The loan operates on a straightforward principle: better sustainability performance leads to better financial outcomes. For example, if a company demonstrates improvements in its ESG performance, as measured by its EcoVadis rating, it will benefit from a lower interest rate. On the other hand, if the company’s sustainability rating worsens, the interest rate will increase. This financial incentive structure not only encourages companies to enhance their sustainability practices but also integrates sustainability into their long-term financial planning. Jennifer Chammas, Regional Head of Sustainability and Sustainable Finance, Commercial Banking HSBC MENAT explained, “The loan structure is straightforward: as your ESG score improves, your interest rate margin goes down. If it deteriorates, you’ll pay a little more. This incentivises companies to actively work on their sustainability strategies and improve their ESG ratings.” Early-Stage Sustainability Support The introduction of the Sustainability Improvement Loan is specifically focused on supporting corporates that may be earlier on in their sustainability journey. The bank has already completed several transactions using this new solution, with more in the pipeline. HSBC sees this new product as a key step in helping businesses transition toward more sustainable operations. Jennifer Chammas added, “These new instruments enable HSBC to further engage with customers on their sustainability objectives and provide sustainable finance instruments that are suitable for customers based on where they are in their ESG journey.” The new loan is part of HSBC’s broader strategy to grow its sustainable finance portfolio in the region. HSBC hopes that the product will encourage more companies to begin or accelerate their sustainability journeys. “We’ve made a complex product far more straightforward,” said Jennifer Chammas. “Now, all of our clients can take real steps toward sustainability while benefiting financially.” To learn more about this offering in its respective markets, click on the links below:

EcoVadis Frequently Asked Questions (FAQ)

When was EcoVadis founded?

EcoVadis was founded in 2007.

Where is EcoVadis's headquarters?

EcoVadis's headquarters is located at 43/47, avenue de la Grande Armée, Paris.

What is EcoVadis's latest funding round?

EcoVadis's latest funding round is Secondary Market.

How much did EcoVadis raise?

EcoVadis raised a total of $732M.

Who are the investors of EcoVadis?

Investors of EcoVadis include BlackRock, GP BullHound Sidecar, GIC, Princeville Capital, BeyondNetZero and 6 more.

Who are EcoVadis's competitors?

Competitors of EcoVadis include Briink, SupplyShift, Impaakt, Sedex, Turnkey and 7 more.

What products does EcoVadis offer?

EcoVadis's products include Enterprise sustainable procurement and portfolio management and 3 more.

Loading...

Compare EcoVadis to Competitors

RepRisk is a leading company in the ESG (Environmental, Social, and Governance) technology sector. The company's main services include the systematic analysis of public information to identify material ESG risks, leveraging a combination of artificial intelligence, machine learning, and human intelligence. RepRisk primarily serves sectors such as banking, insurance, asset management, and government, among others. It is based in Zurich, Switzerland.

Impak Analytics operates as an independent impact rating agency. The company helps investors and lenders make more sustainable decisions by providing them with assessments that go beyond environmental, social, and corporate governance (ESG) and include both the negative and positive impacts of their assets. It was founded in 2016 and is based in Montreal, Canada.

Sphera is the leading provider of enterprise sustainability management software, data, and consulting services, focusing on EHS&S, Operational Risk Management, Product Stewardship, and Supply Chain Risk Management. The company offers a comprehensive platform that enables organizations to manage environmental, health, safety, and sustainability challenges, optimize workflows, and comply with global regulations. Sphera's solutions cater to a diverse range of industries, including Chemicals, Oil & Gas, Industrials, Consumer Packaged Goods, Financial Services, and Retail. Sphera was formerly known as IHS - Operational Excellence & Risk Management Business. It was founded in 2016 and is based in Chicago, Illinois.

Worldfavor is a company focused on sustainability management and reporting in the supply chain, investment portfolios, and corporate sectors. The company offers an ESG platform that helps investors, supply chains, and corporations manage data and drive sustainability, simplifying the process of improving ESG performance. The company primarily sells to sectors such as the investment industry, supply chain management industry, and corporate sector. It was founded in 2010 and is based in Stockholm, Sweden.

Turnkey is a company that focuses on providing ESG sustainability solutions, operating within the corporate and financial sectors. The company offers a platform that helps businesses meet ESG requirements by monitoring and making sense of key data, thereby enabling them to improve their overall business performance. Turnkey primarily serves the financial sector, supply chains, corporate sustainability, and investment funds. It was founded in 2015 and is based in Singapore.

S Factor specializes in data analytics and insights for social impact within the investment and technology sectors. The company offers a suite of products that analyze and score social impact factors for businesses, providing benchmarks and risk ratings to inform investment decisions. S Factor primarily serves the sustainable, responsible, and impact investing (SRI) market, with a focus on enhancing environmental, social, and corporate governance (ESG) criteria. It was founded in 2009 and is based in Toronto, Ontario.

Loading...