EvolutionIQ

Founded Year

2019Stage

Series C | AliveTotal Raised

$60.35MLast Raised

$20.15M | 3 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+12 points in the past 30 days

About EvolutionIQ

EvolutionIQ focuses on artificial intelligence in the insurance industry. The company offers an AI-powered claims guidance system that helps insurers handle claims effectively, guiding claimants onto the right recovery path early on. The company primarily serves the insurance industry. EvolutionIQ was formerly known as DeepFraud AI. It was founded in 2019 and is based in New York, New York.

Loading...

ESPs containing EvolutionIQ

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The fraud, waste, and abuse (FWA) detection platforms market refers to the use of technology to identify instances of fraud, waste, and abuse in the healthcare industry. These platforms use artificial intelligence to detect patterns that may indicate fraudulent activity. This can include billing for services that were not actually provided or billing for unnecessary services. The goal is to identi…

EvolutionIQ named as Leader among 7 other companies, including Shift Technology, 4L Data Intelligence, and Leapstack.

EvolutionIQ's Products & Differentiators

IQInvestigate

Focused on monitoring Disability Claims in real time to identify which claims no longer meet the definition of disabled so examiners can focus on claims that can be resolved and reduce investment on low priority claims

Loading...

Research containing EvolutionIQ

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned EvolutionIQ in 6 CB Insights research briefs, most recently on Oct 11, 2024.

Oct 11, 2024

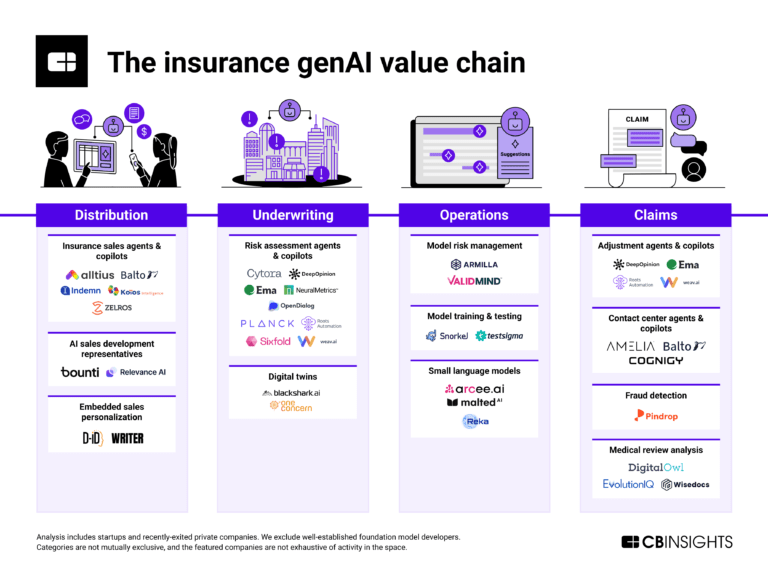

How genAI is reshaping the insurance value chain

Dec 18, 2023

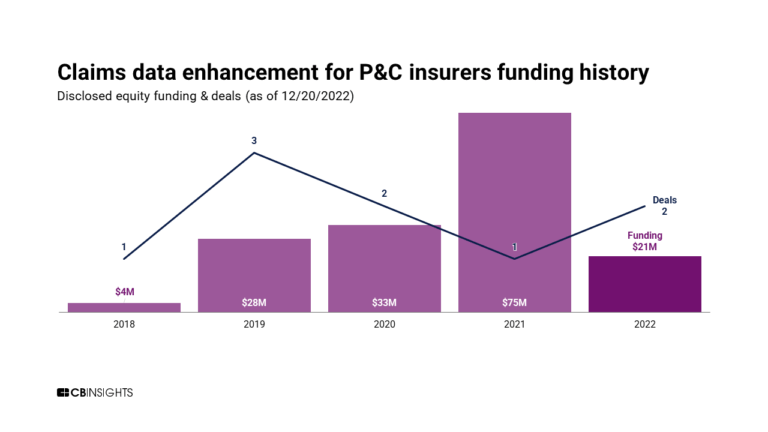

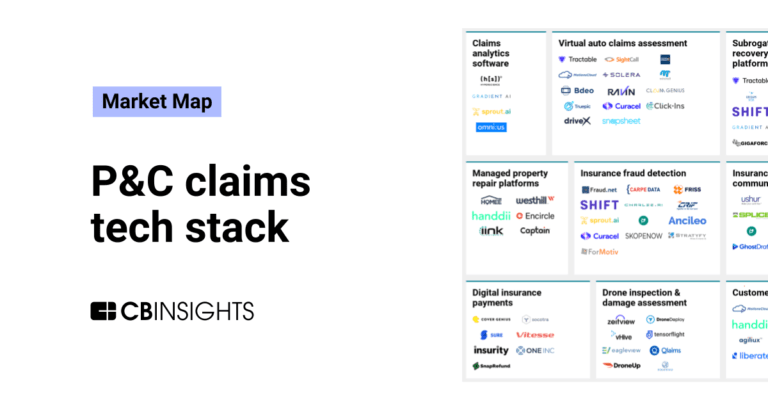

The P&C claims tech stack market map

Jun 15, 2022 report

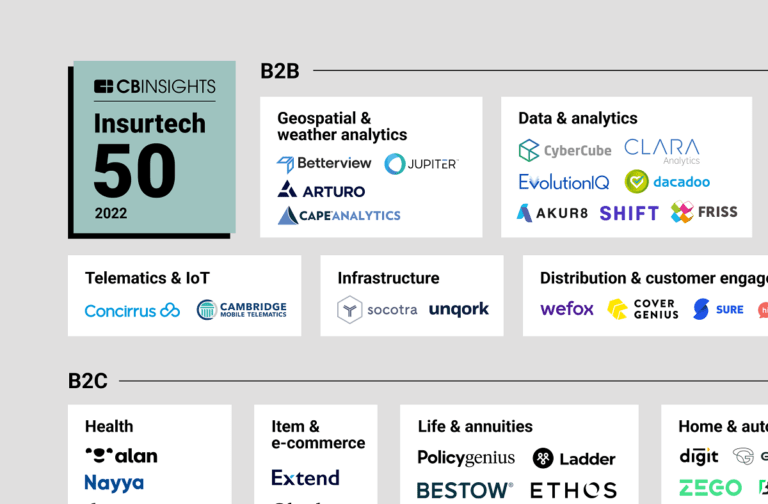

Insurtech 50: The most promising insurtech startups of 2022Expert Collections containing EvolutionIQ

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

EvolutionIQ is included in 8 Expert Collections, including Insurtech.

Insurtech

4,363 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,304 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

100 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

AI 100

100 items

AI 100 (2024)

100 items

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Latest EvolutionIQ News

Oct 14, 2024

News provided by Share this article MedHub provides comprehensive medical synthesis that enables faster, smarter claims handling across lines of insurance NEW YORK, Oct. 14, 2024 /PRNewswire/ -- EvolutionIQ, the market-leading Claims Guidance platform, today announced the expansion of MedHub to all life, health, accident, and casualty lines of insurance. MedHub is the only active medical summarization solution that transforms medical data into a competitive advantage by engaging claims professionals with holistic, tactical insights. Challenges in Existing Medical Summarization Tools For every claim, claims handlers spend an average of 12.5 hours reviewing complex medical data from various sources, while managing increasingly overwhelming caseload volume. Claims professionals can spend days trying to decipher the case documents for a single claim, and medically-driven claims are only getting more complex. Unfortunately, most medical summarization tools meant to ease this challenge rely on passive summary generation and rote risk reviews which, when overused, can erode claim professional proficiency. EvolutionIQ's MedHub leverages EvolutionIQ's market-leading technology advantages in Claims Guidance and five years of experience putting tactical recommendations directly into the front lines of complex claim handling. EvolutionIQ's advanced capabilities make medical insights highly interactive for claim professionals. With MedHub's adjuster-in-the-loop structure, the product ensures exceptionally useful summaries, clear claim synthesis, insights, and assessments while building claim handler proficiency. This approach fosters critical thinking, deepens medical understanding, and leads to more informed decisions. "MedHub enhances our claims professionals' ability to deeply understand their claimants' medical circumstances, and be a partner on their return to health journey. Using it inside our existing EvolutionIQ environment makes it a seamless expansion of our capabilities to better serve our claimants," said Amanda Staples , Vice President, Head of Group Insurance Claims, Prudential . The MedHub Solution MedHub seamlessly ingests, processes, and extracts data from hundreds of records, transforming dense, varied types of raw medical data and documentation into tactical insights. EvolutionIQ's solution enables claims professionals to make faster critical decisions through an adjuster-in-the-loop approach. Claims professionals using MedHub explore medical timelines, uncover hidden connections, and engage with the raw medical data in a way that fosters true understanding and continues building medical proficiency. MedHub enables users to directly understand the records that generated the medical insights, with EvolutionIQ's Click for Evidence functionality taking users from synthesis to evidence with a click. Carriers using MedHub benefit from: Accelerated Reviews: Quickly extract critical information from hundreds of pages of medical records. Enhanced Expertise: Engage your team with a deeper understanding of medical conditions and their impact on claims. Exceptional Outcomes: Claims handlers make faster, more informed decisions, leading to improved customer experiences and reduced operational costs. "The risk with any passive medical summary tool is it invites a copy/paste approach to time savings, and can potentially hurt claims outcomes," said Benjamin Berry, Chief Product Officer at EvolutionIQ. "MedHub is entirely different, actively engaging claims professionals in the medical synthesis itself with access to essential data, context, and a timeline for informed decision-making. MedHub's focus on expert engagement is a pivotal component in EvolutionIQ's vision to become the #1 trusted source of medical insights and analysis in the insurance industry." With a lightweight design and configurable interface, MedHub can be enabled and operational for any insurance carrier within two weeks, post data onboarding. About EvolutionIQ EvolutionIQ pioneered Claims Guidance in 2019. Its explainable AI guides insurance claims professionals to their highest potential impact on claims, including specific Next Best Action guidance. EvolutionIQ improves the claimant experience and delivers better claim outcomes to claimants, carriers and their customers. EvolutionIQ serves the group disability, individual disability and workers' compensation markets worldwide. EvolutionIQ's AI native products have been adopted by 70% of the top 15 U.S. disability carriers and a growing list of workers' compensation carriers. The New York-based company employs almost 200 staff across the United States, Europe and Australia. For more information, visit evolutioniq.com and follow the company on LinkedIn . Media Contact

EvolutionIQ Frequently Asked Questions (FAQ)

When was EvolutionIQ founded?

EvolutionIQ was founded in 2019.

Where is EvolutionIQ's headquarters?

EvolutionIQ's headquarters is located at 250 Hudson Street, New York.

What is EvolutionIQ's latest funding round?

EvolutionIQ's latest funding round is Series C.

How much did EvolutionIQ raise?

EvolutionIQ raised a total of $60.35M.

Who are the investors of EvolutionIQ?

Investors of EvolutionIQ include First Round Capital, Amasia, Guidewire Software, Foundation Capital, FirstMark Capital and 14 more.

Who are EvolutionIQ's competitors?

Competitors of EvolutionIQ include Gradient AI, Sprout.ai, Charlee.ai, CLARA Analytics, Riskcovry and 7 more.

What products does EvolutionIQ offer?

EvolutionIQ's products include IQInvestigate and 1 more.

Who are EvolutionIQ's customers?

Customers of EvolutionIQ include Reliance Standard and Argo Group.

Loading...

Compare EvolutionIQ to Competitors

Shift Technology specializes in AI decision-making solutions for the insurance industry. The company offers a suite of products that automate and optimize decisions in areas such as fraud detection, claims processing, and underwriting risk assessment. Its AI-driven tools are designed to enhance operational efficiency and improve the policyholder experience. It was founded in 2014 and is based in Paris, France.

Charlee.ai specializes in artificial intelligence and predictive analytics within the insurance sector. The company offers solutions that analyze claims and predict litigation and severity, utilizing natural language processing to enhance claims workflows and manage reserves effectively. Charlee.ai's predictive analytics solutions are tailored to the insurance industry, including personal, commercial, and workers' compensation sectors. Charlee.ai was formerly known as Infinilytics. It was founded in 2016 and is based in Pleasanton, California.

FRISS is a company focused on risk assessment automation for property and casualty (P&C) insurance carriers. The company offers a platform that provides real-time analytics to understand and evaluate the inherent risks in customer interactions, aiming to enhance trust and efficiency in insurance processes. FRISS's solutions enable insurers to automate underwriting, accelerate claims processing, and conduct structured investigations into suspicious activities. It was founded in 2006 and is based in Mason, Ohio.

InsurAnalytics is a data analytics company focused on the insurance sector, specializing in data analysis. The company provides AI and machine learning solutions for claims processing and predictive analytics. InsurAnalytics serves the insurance industry with its cloud-based solutions. It was founded in 2018 and is based in Mountain View, California.

CLARA Analytics provides insurance services. It develops artificial intelligence (AI) technology for insurance claims optimization in front of their workers’ compensation claims. It helps predictive insights from the claims data to provide key signals to the claims team for claim outcomes. It was founded in 2017 and is based in Sunnyvale, California.

Gradient AI specializes in artificial intelligence solutions for the insurance sector. The company offers a software-as-a-service platform that utilizes AI to enhance underwriting results, minimize claim costs, and boost operational efficiency. Gradient AI primarily serves the insurance industry, including carriers, MGAs, TPAs, and other related entities. It was formerly known as Milliman - Gradient A.I. It was founded in 2012 and is based in Boston, Massachusetts.

Loading...