Cigna Healthcare

Founded Year

1982Market Cap

88.78BStock Price

316.85Revenue

$0000About Cigna Healthcare

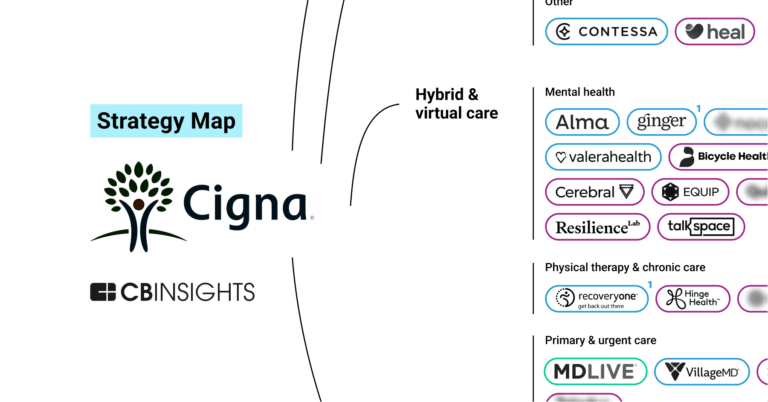

Cigna Healthcare offers a range of insurance plans and products across various sectors of the healthcare industry. The company provides medical and dental insurance plans, Medicare coverage, supplemental health insurance, and pharmacy benefits, designed to support individuals and families through all stages of life. Cigna Healthcare's services are tailored to meet the evolving health needs of its customers, offering plans that include virtual care, preventive services, and emergency support. It was founded in 1982 and is based in Bloomfield, Connecticut.

Loading...

Loading...

Research containing Cigna Healthcare

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Cigna Healthcare in 6 CB Insights research briefs, most recently on Jul 19, 2024.

Expert Collections containing Cigna Healthcare

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Cigna Healthcare is included in 1 Expert Collection, including Fortune 500 Investor list.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Cigna Healthcare Patents

Cigna Healthcare has filed 78 patents.

The 3 most popular patent topics include:

- data management

- machine learning

- computer network security

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/20/2023 | 10/15/2024 | Machine learning, Numerical climate and weather models, Statistical forecasting, Regression analysis, Meteorological data and networks | Grant |

Application Date | 7/20/2023 |

|---|---|

Grant Date | 10/15/2024 |

Title | |

Related Topics | Machine learning, Numerical climate and weather models, Statistical forecasting, Regression analysis, Meteorological data and networks |

Status | Grant |

Latest Cigna Healthcare News

Oct 25, 2024

MultiPlan, which denies the allegations, has been sued dozens of times over concerns the company is conspiring with health insurers to underpay doctors for out-of-network care. Published Oct. 25, 2024 Listen to the article 4 min This audio is auto-generated. Please let us know if you have feedback . Dive Brief: Cost management company MultiPlan is facing yet another lawsuit for allegedly conspiring to underpay providers — this time, from the largest physician association in the United States. The American Medical Association’s complaint, filed Thursday in an Illinois district court, accuses MultiPlan of colluding with major health insurers to set artificially low reimbursement rates for out-of-network care, forcing providers to accept payments that often don’t cover their operating costs. The litigation, which asks the judge for an injunction requiring MultiPlan to halt the illegal practices, is the latest in a long string of suits against the company. Congress is also scrutinizing MultiPlan, which denies the allegations. Dive Insight: The 127-page complaint accuses MultiPlan of working with the nation’s largest health insurers, including UnitedHealth and Cigna, to create a multifaceted conspiracy that stifled competition for out-of-network services and caused provider reimbursement to flatline. At issue is MultiPlan’s business model. Instead of determining their own out-of-network rates, insurers can outsource that function to MultiPlan, which promises to save them money on those claims. In many cases, MultiPlan uses an algorithm-based tool to recommend a payment level — and receives a portion of the difference between the recommendation and the original out-of-network bill, giving the company a financial incentive to recommend lower rates. The majority of U.S. insurers, including the 15 largest in the country, use MultiPlan to determine out-of-network payments. The arrangement is a “smokescreen for traditional price-fixing,” the AMA’s suit argues. According to the complaint, MultiPlan’s algorithms are based on arbitrarily low data and include rate caps from its insurer members, artificially depressing rates. Payments based on MultiPlan’s repricing system can be 1.5 to 49 times lower than payments calculated using a traditional method, according to a 2020 investigation by the Office of the New York State Comptroller cited in the AMA’s suit. “These dynamics have forced many practices, particularly smaller ones, to shut their doors, cease offering certain services, or join massive hospital conglomerates, leaving patients with fewer and fewer healthcare options,” the AMA’s suit argues. Overall, more than two dozen lawsuits have been filed against MultiPlan over the alleged conspiracy, including by Florida-based system AdventHealth , Louisiana-based system Allegiance Health Management and Community Health Systems , one of the largest hospital operators in the country. Those lawsuits were centralized this summer in the same Illinois federal court handling the AMA’s litigation. Another lawsuit filed in California by the liquidating trust for health system Verity Health was dismissed in August after a judge determined reimbursement rates are not prices that can be fixed. A spokesperson for MultiPlan called the AMA’s litigation a “copycat” of other suits. “We have consistently stated that these lawsuits are without merit and would ultimately increase prices for patients and employers,” the spokesperson said in an emailed statement. It’s not the AMA’s first time squaring up against the alleged MultiPlan cartel in the courts. In 2022, the physician association joined class action litigation against Cigna for allegedly underpaying providers in its MultiPlan network. MultiPlan’s stock has taken a hit among the scrutiny, with its value dropping more than 82% since the beginning of this year. The company’s finances are also pressured, with MultiPlan posted a $577 million net loss in the second quarter — mostly due to a large goodwill impairment charge — compared to a net loss of $36.4 million same time last year. During an August call with investors, CEO Travis Dalton called the results not “consistent, predictable or good enough,” adding that “the overhang of media scrutiny has been an ongoing challenge.” Recommended Reading

Cigna Healthcare Frequently Asked Questions (FAQ)

When was Cigna Healthcare founded?

Cigna Healthcare was founded in 1982.

Where is Cigna Healthcare's headquarters?

Cigna Healthcare's headquarters is located at 900 Cottage Grove Road, Bloomfield.

Who are Cigna Healthcare's competitors?

Competitors of Cigna Healthcare include Intermountain Health, Truveris, Advocate Aurora Health, Excela Health, Magellan Health and 7 more.

Loading...

Compare Cigna Healthcare to Competitors

Blue Cross Blue Shield is a national federation of independent, community-based and locally operated companies focused on providing health care coverage. The company offers a range of health insurance products and services designed to ensure access to safe, quality, and affordable healthcare. Blue Cross Blue Shield also provides insights and reports on healthcare trends and maintains a comprehensive provider network. It was founded in 1929 and is based in Chicago, Illinois.

Alignment Health operates as a health insurance provider focused on offering Medicare plans. The company provides on-demand access to healthcare services, including in-person, in-home, and mobile device consultations, along with a range of all-inclusive benefits for its members. The company primarily serves the Medicare beneficiaries sector. It was founded in 2013 and is based in Orange, California.

RxBenefits is a technology-enabled pharmacy benefits optimizer operating in the healthcare sector. The company offers services to optimize pharmacy benefit plans, aiming to provide savings and protect member health and safety. It primarily serves mid-market employers, hospitals and health systems, and third-party administrators. It was founded in 1995 and is based in Birmingham, Alabama.

Flipt is a healthcare technology and services company that operates in the pharmacy benefits management sector. The company offers full-service pharmacy benefit management services and Software as a Service pharmacy benefit administration services, which include enterprise benefit administration, claims adjudication, and consumer engagement platforms. Flipt primarily sells to the healthcare industry. It is based in Jersey City, New Jersey.

Carelon is a healthcare services company focused on delivering whole-person care across various domains within the healthcare industry. The company offers integrated care models, digital tools, and services that address physical, mental, social, and economic health factors, aiming to simplify healthcare experiences, improve outcomes, and manage costs. Carelon's solutions are designed to support individuals with complex health conditions, provide behavioral health management, and facilitate primary and palliative care, alongside pharmacy services and medical benefits management. It was founded in 2017 and is based in Morristown, New Jersey.

Prime Therapeutics is a company that focuses on pharmacy benefit management in the healthcare industry. The company offers services that help people get the medicine they need, including core pharmacy benefit management services, benefit design implementation, clinical and specialty programs, formulary and networks. It primarily serves health plans, employers, and consultants. It was founded in 1987 and is based in Eagan, Minnesota.

Loading...