Bestow

Founded Year

2017Stage

Series C | AliveTotal Raised

$138.1MLast Raised

$70M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-76 points in the past 30 days

About Bestow

Bestow operates as an insurance technology company and develops products and software for insurance companies. It provides an application programming interface (API) enabling partners to offer life insurance coverage to customers. The company was formerly known as Coverlife. It was founded in 2017 and is based in Dallas, Texas.

Loading...

Bestow's Product Videos

ESPs containing Bestow

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The embedded insurance infrastructure market consists of tech vendors that offer products to enable insurance sales on third-party platforms via APIs (application programming interfaces). These companies sell their products to insurance providers or third-party platforms. Some embedded insurance infrastructure providers may also provide insurance (as a licensed carrier, managing general agent, or …

Bestow named as Challenger among 15 other companies, including Igloo, Cover Genius, and Qover.

Bestow's Products & Differentiators

Enrollment

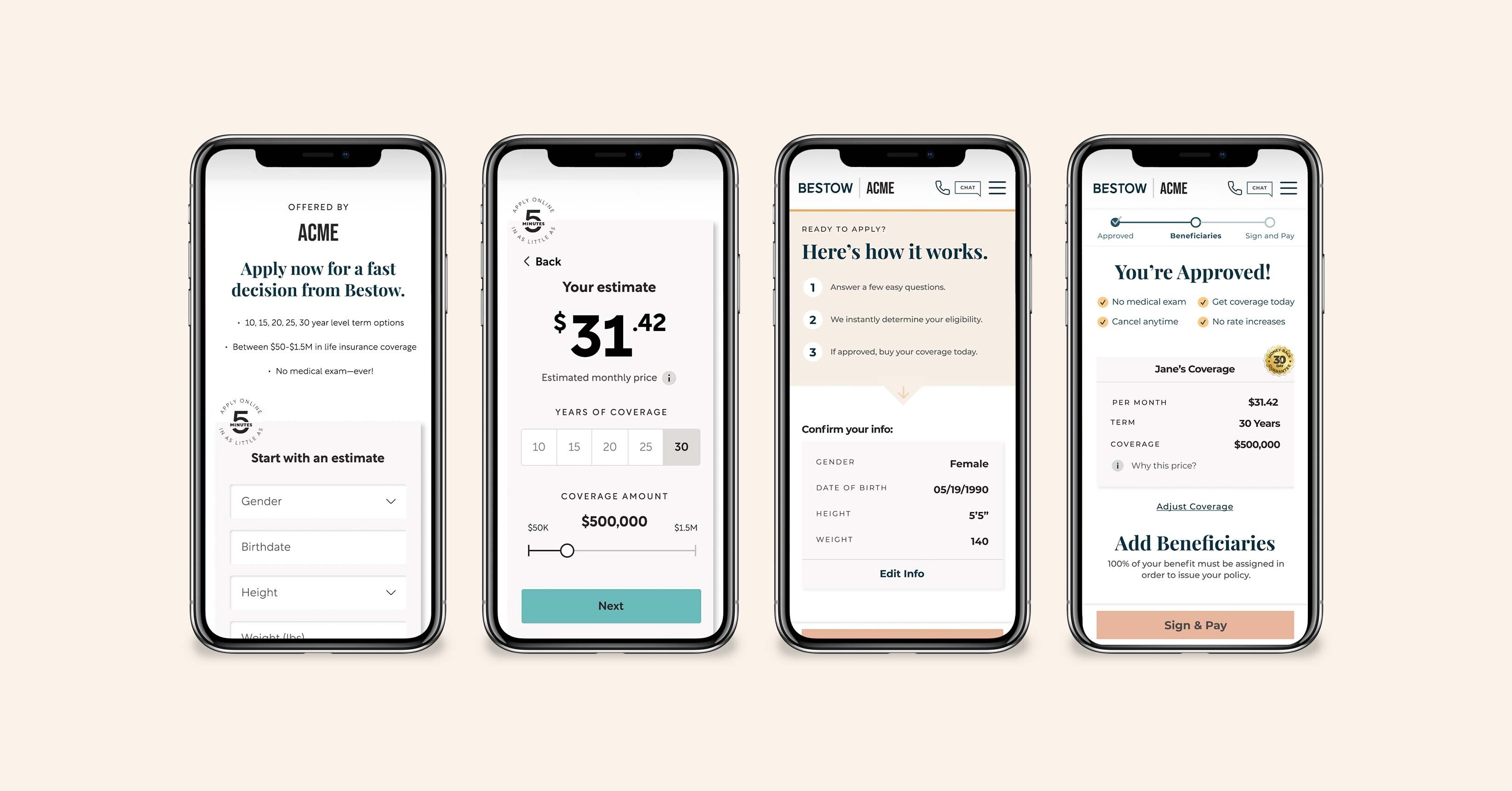

We deliver a clean, seamless, and fully integrated buying experience for agents and customers, allowing their brand to shine with a white-labeled look and feel. Includes rates and pricing, quoting, a branded website or embedded solution, a branded digital application, checkout, and e-delivery supporting multiple sales channels and multiple life insurance products.

Loading...

Research containing Bestow

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Bestow in 2 CB Insights research briefs, most recently on Feb 23, 2024.

Feb 23, 2024

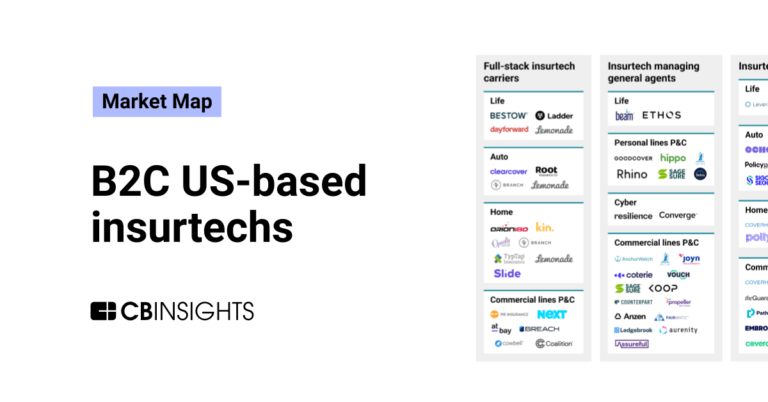

The B2C US insurtech market mapExpert Collections containing Bestow

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Bestow is included in 6 Expert Collections, including Insurtech.

Insurtech

3,188 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,304 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

500 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Artificial Intelligence

6,888 items

Bestow Patents

Bestow has filed 3 patents.

The 3 most popular patent topics include:

- artificial intelligence

- enterprise application integration

- workflow technology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/22/2022 | Artificial intelligence, Enterprise application integration, Workflow technology, IPad, Multi-agent systems | Application |

Application Date | 12/22/2022 |

|---|---|

Grant Date | |

Title | |

Related Topics | Artificial intelligence, Enterprise application integration, Workflow technology, IPad, Multi-agent systems |

Status | Application |

Latest Bestow News

Sep 19, 2024

Some news from the US market for you; Transamerica has announced the introduction of a new final expense insurance offering that provides applicants with an easy, digital experience — from quote to policy delivery — in as little as 10 minutes. The new Transamerica FE Express Solution℠ (FE Express) provides guaranteed level premiums and permanent lifetime protection, up to $50,000 for qualified applicants. “Everyday Americans deserve protection that is designed to be quick and easy to apply for at affordable prices,” said Andrew DeMarco, head of life solutions at Transamerica. “That’s why Transamerica created FE Express to provide peace of mind at a budget-friendly price point. The intuitively designed digital platform gives agents and customers access to manage their policy when it works for them.” FE Express comes with with an optional Funeral Concierge Rider provided by Everest Funeral Concierge , at no additional premium cost. Staffed round-the-clock, families have access to trained professionals who specialize in funeral planning, offering support to clients before, during, and after the loss of a loved one. The service also provides legacy planning tools to create a will, healthcare directive and other customized legal documents, and then stores them for convenient access. The FE Express integrated, online platform streamlines the application process to identify options and premiums to fit the consumer. Text and email signatures and electronic policy delivery make the buying process simple, while online policy management lets the consumer stay on top of their policy 24/7. Powered by Bestow, a leading life insurance technology company, consumers and agents benefit from the specialized technology platform and self-service options offered by FE Express. The interactive dashboard gives a snapshot of application status and current policies, helping agents understand and manage their business. “Through their dedication to our customers, agents see first-hand how Transamerica products and services help clients, often when they need it most,” said DeMarco. “FE Express, with the ease-of-application and unique benefits, will assist our agents build even stronger relationships and connect with new customers in underserved markets.” FE Express is the latest addition to Transamerica’s final expense suite of products, which include Immediate Solution, 10-Pay Solution and Easy Solution . Share this:

Bestow Frequently Asked Questions (FAQ)

When was Bestow founded?

Bestow was founded in 2017.

Where is Bestow's headquarters?

Bestow's headquarters is located at 2700 Commerce Street, Dallas.

What is Bestow's latest funding round?

Bestow's latest funding round is Series C.

How much did Bestow raise?

Bestow raised a total of $138.1M.

Who are the investors of Bestow?

Investors of Bestow include New Enterprise Associates, Core Innovation Capital, Morpheus Ventures, 8VC, Valar Ventures and 5 more.

Who are Bestow's competitors?

Competitors of Bestow include Plum Life, Amplify, Pendella, PolicyGenius, Everyday Life Insurance and 7 more.

What products does Bestow offer?

Bestow's products include Enrollment and 3 more.

Who are Bestow's customers?

Customers of Bestow include Equitable, https://www.nationwide.com/ and https://www.sammonsfinancialgroup.com/.

Loading...

Compare Bestow to Competitors

Ethos provides life insurance solutions. It offers predictive analytics and data science technologies for life insurance policies. It covers expenses such as a home mortgage, debt, college tuition, and more. It was founded in 2016 and is based in Austin, Texas.

Ladder is a company that specializes in providing term life insurance through a digital platform within the insurtech industry. The company offers affordable term life insurance policies with the flexibility to adjust coverage as the policyholder's life circumstances change. Ladder's services are designed to be accessible online, with a paperless application process and tools like an insurance calculator to help customers determine their coverage needs. It was founded in 2015 and is based in Menlo Park, California.

New York Life Insurance Company operates as a financial services firm in the insurance and investment sectors. The company offers a range of insurance products including term life, whole life, universal life, and long-term care insurance, as well as individual disability insurance. Additionally, it provides investment services such as mutual funds, exchange-traded funds, and annuities, along with retirement and wealth management advisory services. It was founded in 1845 and is based in New York, New York.

Asteya specializes in providing income insurance policies within the insurance sector. The company offers financial security through earnings replacement and disability coverage, with services that include monthly benefits and lump-sum payments for individuals unable to work due to illness or injury. Asteya's platform caters to a diverse clientele seeking to safeguard their income. It was founded in 2020 and is based in Miami, Florida.

Everyday Life Insurance specializes in providing term and whole life insurance policies within the insurance industry. The company offers an online platform for individuals to apply for life insurance, featuring a simple application process, personalized policy recommendations, and the option for no medical exam insurance. Everyday Life Insurance primarily serves individuals and families seeking financial security through life insurance. It was founded in 2018 and is based in Boston, Massachusetts.

Mutual of Omaha operates in the insurance and financial services industry. The company offers a range of insurance products, including life insurance, Medicare supplement insurance, and various other types of coverage, as well as financial services such as investments and mortgages. Its primary customer base includes individuals, businesses, and groups across various sectors of the economy. Mutual of Omaha was formerly known as Mutual Benefit Health & Accident. It was founded in 1909 and is based in Omaha, Nebraska.

Loading...