Amount

Founded Year

2014Stage

Series E | AliveTotal Raised

$253.2MLast Raised

$30M | 3 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+89 points in the past 30 days

About Amount

Amount develops digital banking and financial technology solutions. The company offers a suite of products and services that enable financial institutions to provide mobile banking experiences, including swift loan approval, automated account origination, and flexible payment solutions. Its primary customers are financial institutions and their merchant partners. It was founded in 2014 and is based in Chicago, Illinois.

Loading...

ESPs containing Amount

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The lending APIs & infrastructure market provides end-to-end solutions for lending operations, including loan management systems, risk management tools, and compliance management capabilities. The market for lending APIs and infrastructure is driven by factors such as increasing demand for digital lending platforms, the need for improved efficiency and automation in lending operations, and the gro…

Amount named as Challenger among 15 other companies, including Mambu, Plaid, and Q2.

Amount's Products & Differentiators

Retail Banking

Amount empowers financial institutions to rapidly and securely create high-value digital solutions so customers can bank when, where and how they want. Amount’s fully integrated and flexible platform is underpinned by enterprise bank-grade infrastructure and compliance, ensuring safe and reliable banking experiences across e-commerce and brick-and-mortar channels. Amount technology delivers: Ø White-label application to tailor and optimize cross-channel consumer experiences. Ø API toolkit that enables seamless integrations to originate and manage loans. Ø Proprietary decisioning engine and fraud prevention framework that delivers instant customer approvals and greater conversions without increasing overall risk. Ø Flexible reporting and analytics tools Ø Solutions that work and thrive with existing infrastructure

Loading...

Research containing Amount

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Amount in 6 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market map

Mar 30, 2022

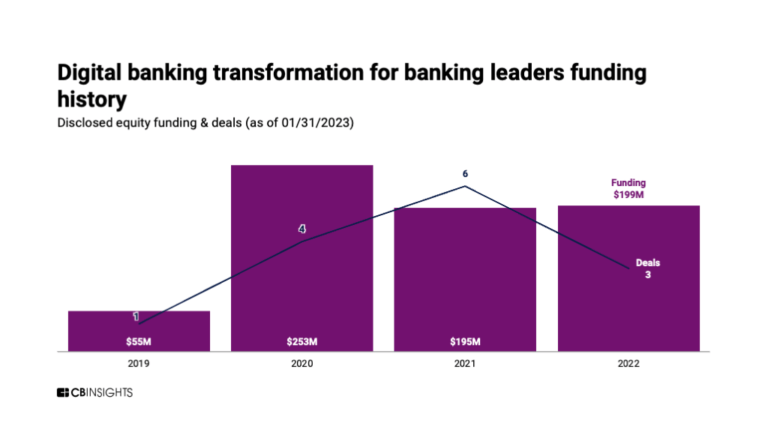

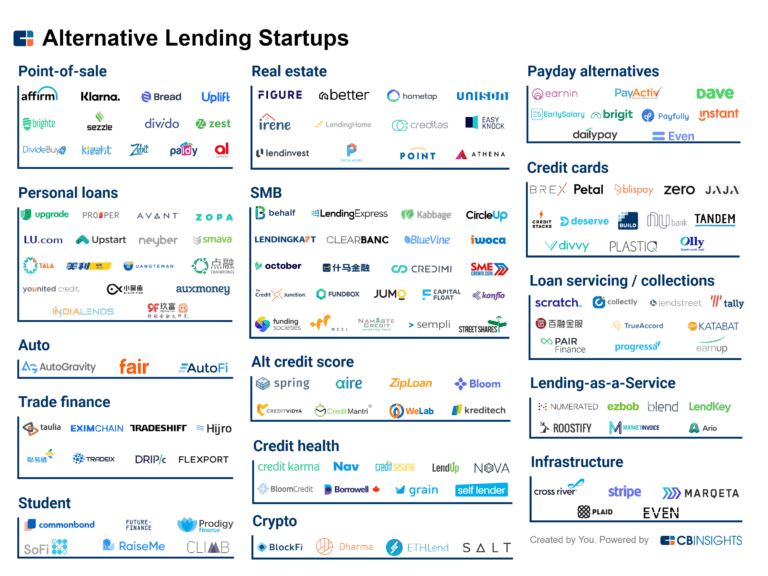

140+ startups shaping the digital lending spaceExpert Collections containing Amount

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Amount is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,249 items

Digital Lending

2,665 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

9,304 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

979 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Amount Patents

Amount has filed 2 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/14/2015 | 9/13/2016 | GPS navigation devices, Videotelephony, Mobile computers, Windows administration, Personal computers | Grant |

Application Date | 10/14/2015 |

|---|---|

Grant Date | 9/13/2016 |

Title | |

Related Topics | GPS navigation devices, Videotelephony, Mobile computers, Windows administration, Personal computers |

Status | Grant |

Latest Amount News

Oct 24, 2024

By PYMNTS | October 24, 2024 | Credit underwriting strategy can be an untapped competitive advantage for lenders. It turns out analytics can be used to automate and improve that too. To help financial institutions of all sizes customize their credit, pricing and fraud policies, the consumer and small business deposit and loan origination software solutions provider Amount has launched an AI Policy Optimizer, the company said in a press release Thursday (Oct. 24). With this tool, lenders can leverage AI to simulate scenarios based on specific data and strategic goals selected from a range of predefined targets that align with organizational strategies. The report said the AI Policy Optimizer generates tailored recommendations using the lender’s application and performance data. According to Amount, this capability can reduce the time and resources required for credit policy optimization, assist in increasing approval rates and offer acceptances, reduce fraud incidents, improve credit performance and enable credit teams to analyze and implement changes. The report noted that the AI Policy Optimizer’s recommendations must go through established review processes before implementation and that optimized policies can be published within Amount’s Unified Account Opening and Lending Platform. The resulting automation of tasks traditionally managed by analysts or data scientists is intended to shift the focus of credit teams from manual data modeling to strategic, data-driven decision-making. Amount said the results are a streamlined policy optimization process that stays compliant with regulatory requirements. A survey finding by Cornerstone Advisors indicates there could be a market for tools like Amount’s Policy Optimizer. The percentage of banks planning to invest in or deploy generative AI is expected to increase from 6% to 14% this year. “Amount is dedicated to pushing the boundaries of innovation in the lending industry. Our AI Policy Optimizer exemplifies our commitment to providing lenders with state-of-the-art tools that enhance their decision-making processes, optimize their operations, and ultimately, drive their success. The tool enhances the efficiency of our clients’ existing teams, enabling them to optimize existing programs to balance scale and compliance with profitability and succeed in a highly competitive marketplace,” Amount CEO Adam Hughes said in the report.

Amount Frequently Asked Questions (FAQ)

When was Amount founded?

Amount was founded in 2014.

Where is Amount's headquarters?

Amount's headquarters is located at 222 North LaSalle Street, Chicago.

What is Amount's latest funding round?

Amount's latest funding round is Series E.

How much did Amount raise?

Amount raised a total of $253.2M.

Who are the investors of Amount?

Investors of Amount include Hanaco Ventures, WestCap, QED Investors, Goldman Sachs, Curql and 11 more.

Who are Amount's competitors?

Competitors of Amount include Lendflow, VeendHQ, SplitIt, Figure, Avant and 7 more.

What products does Amount offer?

Amount's products include Retail Banking and 1 more.

Loading...

Compare Amount to Competitors

Klarna specializes in providing payment solutions and services within the e-commerce sector. The company offers a platform for online shopping that includes price comparisons, deals, and various payment options to facilitate purchases for consumers. Klarna primarily serves the e-commerce industry by enabling a seamless shopping experience through its payment and financing services. It was founded in 2005 and is based in Stockholm, Sweden.

Best Egg operates as a consumer financial technology platform in the fintech sector. The company offers a digital financial platform that provides personal loans, credit cards, and financial health resources to help individuals manage their everyday finances. It primarily serves the personal finance management sector. Best Egg was formerly known as Marlette Holdings. It was founded in 2014 and is based in Wilmington, Delaware.

ChargeAfter focuses on providing embedded financing and consumer finance solutions. The company offers a platform that enables merchants and financial institutions to provide personalized financing options to their customers at the point of sale, both in-store and online. The platform connects customers with multiple lenders, streamlining the lending process and managing compliance requirements, underwriting processes, and regulations. It was founded in 2017 and is based in New York, New York.

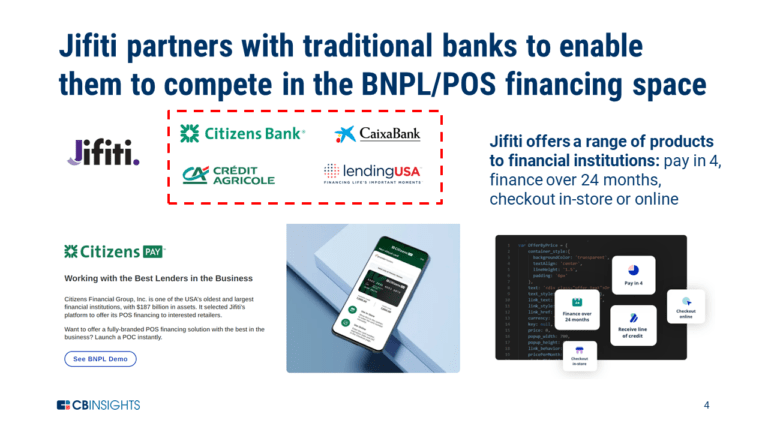

Jifiti is a fintech company that operates in the financial services industry. The company provides white-labeled embedded lending solutions for banks, lenders, and merchants, enabling them to deploy and scale consumer and business financing programs at any point of sale. These services primarily cater to the retail finance and consumer finance sectors. It was founded in 2011 and is based in Columbus, Ohio.

Ezbob is a company that focuses on embedded banking and finance technology in the financial services industry. The company offers digital finance solutions that enable financial institutions and payment companies to provide services such as term loans, account opening, line of credit, overdraft, asset finance, and credit cards. Ezbob primarily serves the banking and payment companies sector. It was founded in 2011 and is based in London, England.

Achieve offers digital financial solutions. Its services include home equity loans, personal loans and debt resolution, and financial education. It caters to individuals and families. Achieve was formerly known as Freedom Financial Network. It was founded in 2002 and is based in Scottsdale, Arizona.

Loading...